General Ledger Activities

The following are demonstrations and activities for Oracle

Fusion General Ledger:

·

Shared Components Demonstration

·

Create Value Sets Demonstration and Activity

·

Create a Chart of Accounts Demonstration

·

Create a Chart of Accounts Structure Activity

·

Create a Chart of Accounts Instance Activity

·

Enter Values Activity

·

Create an Accounting Hierarchy Demonstration

·

Create an Account Combination Activity

·

Define Cross-Validation Rules Demonstration

·

Create a Calendar Activity

·

Create Currencies Demonstration and Activity

·

Create Conversion Rate Types Demonstration and Activity

·

Create a Primary Ledger Demonstration and Activity

·

Ledger Options Demonstration

·

Journal Processing Ledger Options Demonstration

·

Specify Ledger Options Activity

·

Reporting Currencies Demonstration

·

Create a Ledger Set Demonstration

·

Data Access Set Security Demonstration and Activity

·

Create an Allocation Rule Activity

·

Generate an Allocation Activity

·

View a Financial Report in HTML Activity

·

Configure an Account Group Activity

Shared Components Demonstration

BackgroundThe chart of accounts, calendar, and currencies as well as journal source and category are shared across the ledger and related subledgers.

Activity Scope

Perform this demonstration to show the three C's and other shared components in the Create Journal page:

1. Login

the application

2. Select Navigator

> General Accounting > Journals > Create Journals. Make sure your

data access set is the Infusion Data Access Set.

3. Point

out the Accounting Period which is populated from the Calendar.

4. Point

out the Source of Manual which defaults on a manual journal.

5. Point

out the Currency field.

6. Point

out the Category field.

7. Click

the Search and Select Category down arrow to show the various

categories.

8. Select

the Category of Adjustment.

9. Click

the Currency down arrow to show all the enabled currencies.

10. Click

on the Select: Account icon at the end of Line 1 in the Journal

Lines region to show the segments and default values of an accounting

flexfield.

11. Select

the Search: Account drop down arrow in the Account segment.

12. Select 11200

Cash.

13. Click OK

to show how an account combination is displayed.

14. Explain

the segments and the separator.

15. Click

the Cancel button to exit the page.

Create Value Sets Activity

BackgroundValue sets are created as the first step in the chart of accounts configuration. The value sets are then assigned to the chart of accounts instance. Do not create values until after assigning your values sets to the chart of accounts segments because this step is needed to establish which value set attributes should be exposed.

Note: It is strongly recommended that you choose the Value Data Type of Character and Value Subtype of Text. These can never be changed. If you only want to use numbers, just define only numeric values for that value set. If you choose the Value Subtype of Numeric digits only, then you will be stuck with your decision and you will never be able to use characters or letters for your values in the future.

Activity Scope

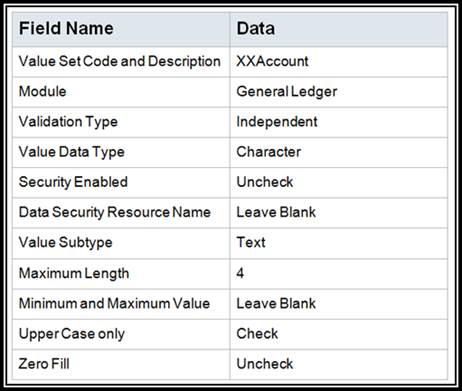

Create one value sets for your chart of accounts: XXAccount replacing XX with your initials.

Note: For the Company and Department segments, we will use existing value sets called Corporate Company and Corporate Cost Center.

1.

From your implementation project, Navigate > Define

Common Applications Configuration > Define Enterprise Structures for

Financials > Define Financial Reporting Structures > Define Chart of

Accounts > Manage Chart of Accounts Value Sets > Go

to Task.

2. Click

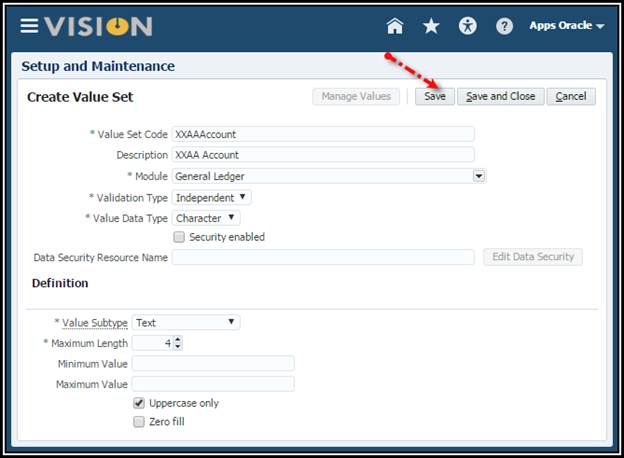

the Create icon to create the following value set.

Note: It is strongly recommended that you choose the Value Data Type of Character and Value Subtype of Text. These can never be changed. If you only want to use numbers, just define numeric values for that value set. If you choose the Value Subtype of Numeric digits only, then you will be stuck with your decision and you will never be able to use characters or letters in the future.

3. Save

and Close.

Note on Table-Validated Value

Sets in the Cloud: Only supported if:

1. The

table or view is already provided by Oracle. (It cannot be a table created by

the customer)

2. Customer

only wants to reference a single table or view. (Cannot join multiple

tables / views)

3. Customer

is okay with not adding any filter conditions. In other words, of the values in

that table are valid values.)

4. The

table or view already contains columns named flex_value_attribute1 through 20

and custom_value_attribute1 through 10.

In other words, table-validated value sets are not really

supported in the cloud.

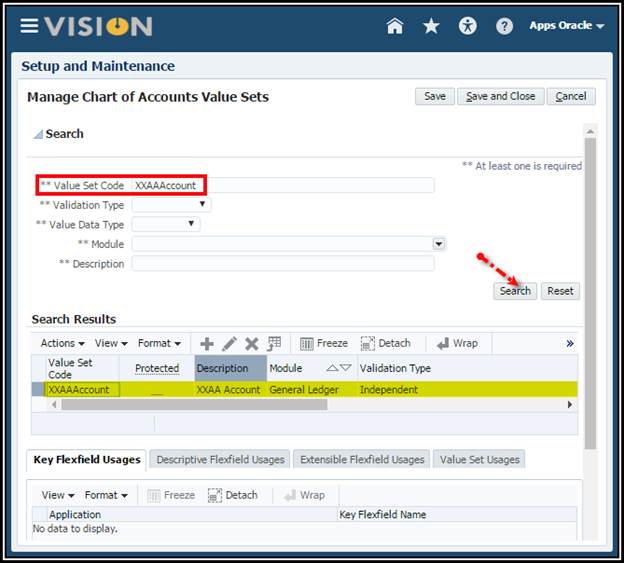

4. In the

Manage Chart of Accounts Value Sets page, search on Value Set Code XX, where

XX are your initials.

5. Click Done

to close the window.

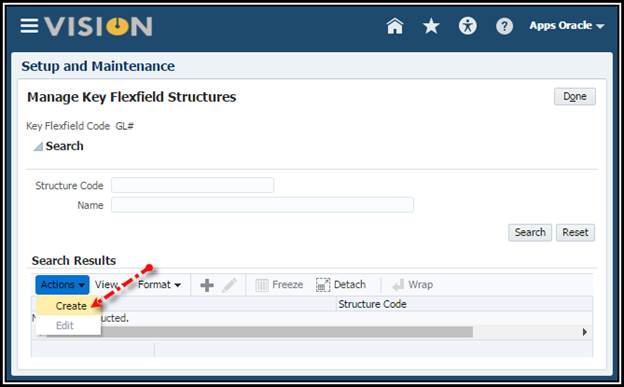

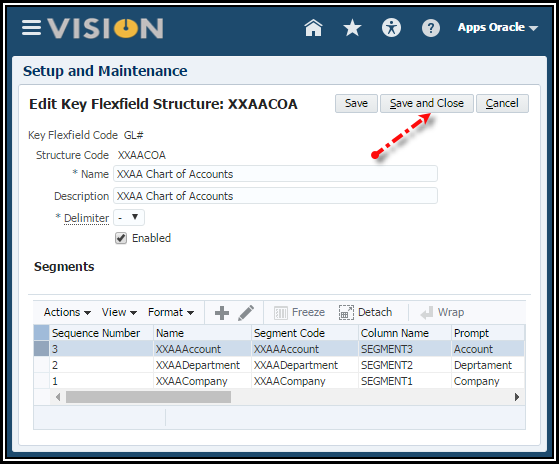

Create a Chart of Accounts Structure Activity

BackgroundChart of accounts structure defines the framework for one or more chart of accounts instances.

Activity Scope

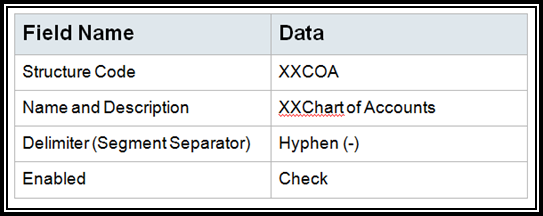

Create your chart of accounts structure called: XXChart of Account replacing XX with your initials.

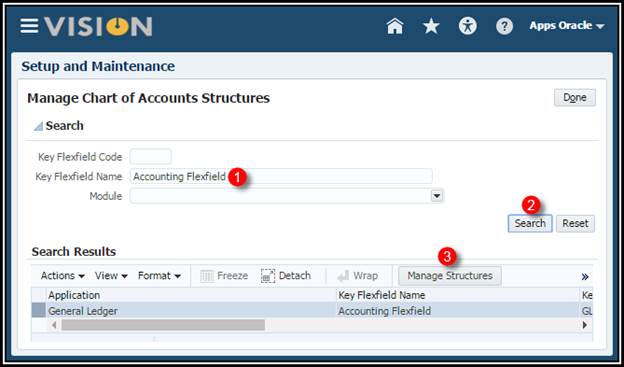

1. From

your implementation project, Navigate > Define Common Applications

Configuration for Financials > Define Enterprise Structures for Financials

> Define Financial Reporting Structures > Define Chart Of Accounts > Manage

Chart of Accounts Structures > Go to Task.

2. Click Search

button.

3. Select Accounting

Flexfield.

4. Click Manage

Structures button.

5. Click Create

icon to create the following structure.

Note: I personally prefer the Period delimiter to use the key pad more

effectively.

6. Save.

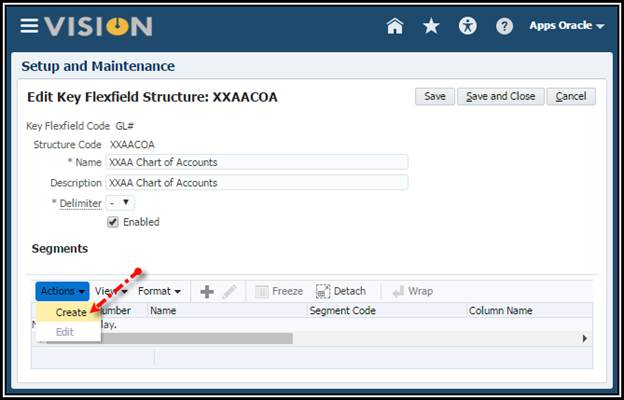

7. Define

the individual segments by clicking the Create icon in the Segments

table. (Note: If you do not save the structure, the Create icon will be

grayed out.)

8. Create

the structure based on the segment information in the following table and check

Enabled on all segments:

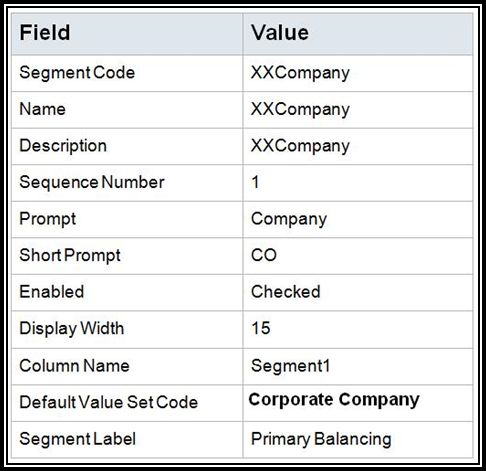

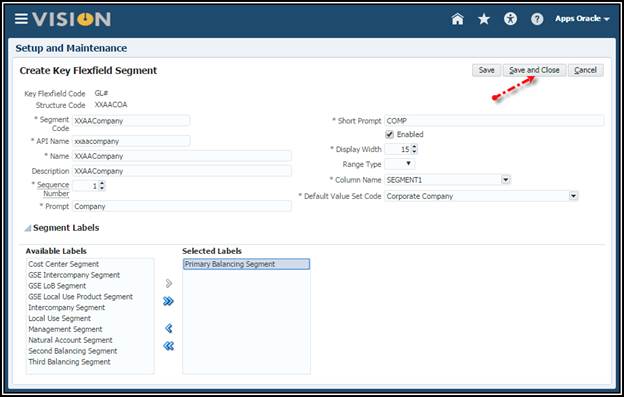

Create the Company Segment:

9. Save

and Close.

10. Click Create

icon in the Segments table to add the next segment.

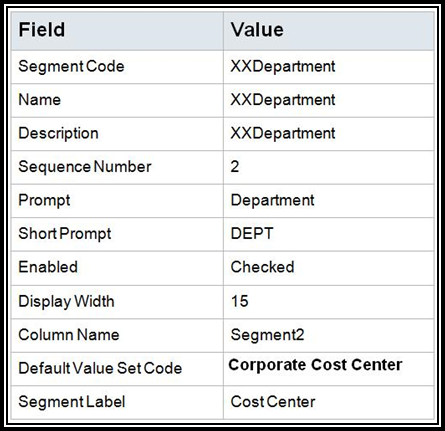

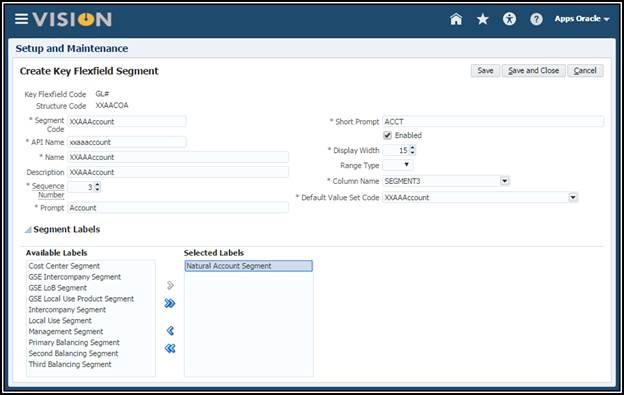

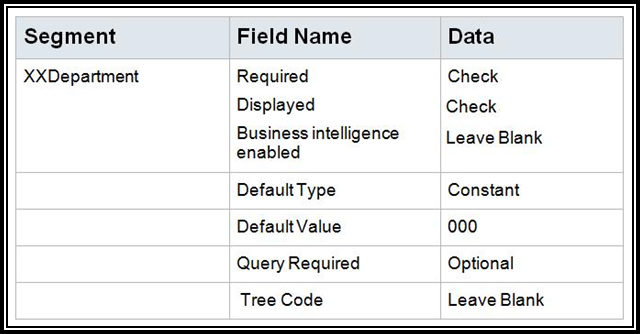

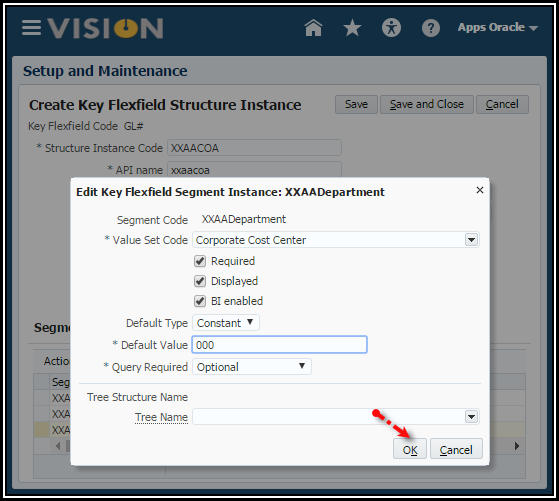

Create the Department Segment:

NOTE: We are reusing a value set already defined.

11. Save

and Close.

12. Click Create

icon in the Segments table to add the next segment

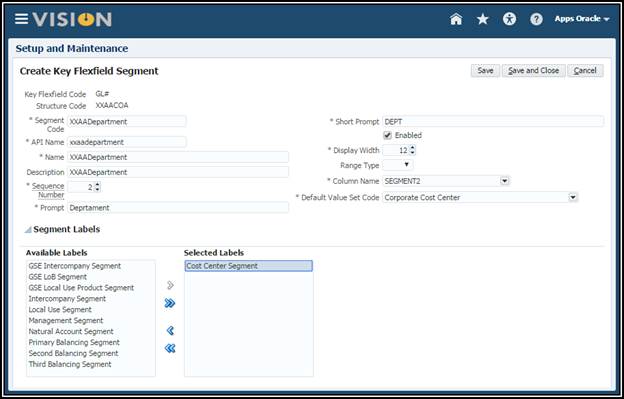

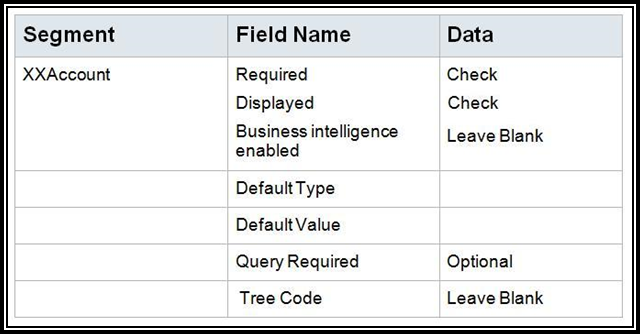

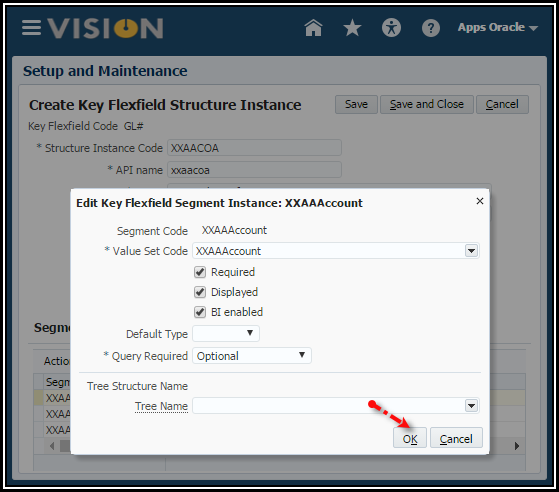

Create the Account Segment:

13. Save

and Close.

You should now see 3 segments in your structure.

14. Save

and Close to close the Create Key Flexfield Structure page.

15. Click Done

to return to the Manage Chart of Accounts Structure page.

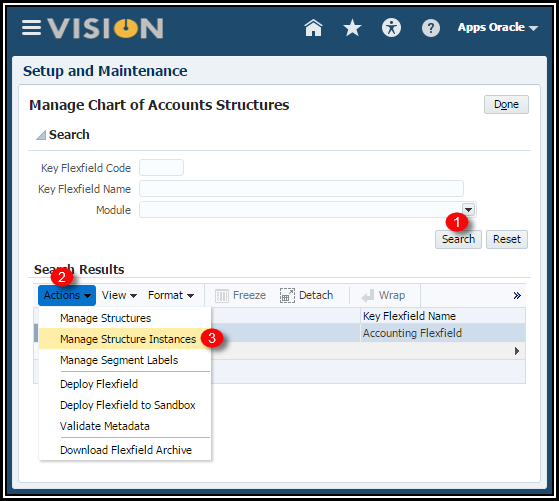

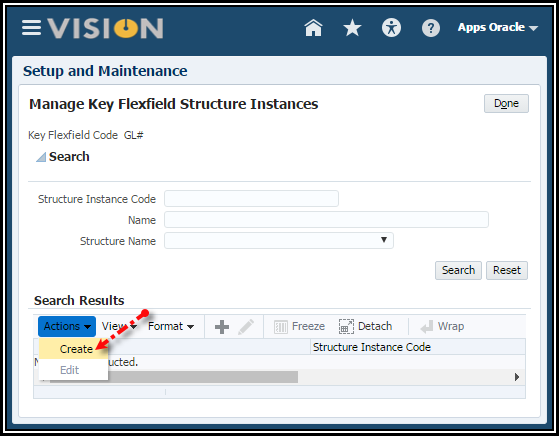

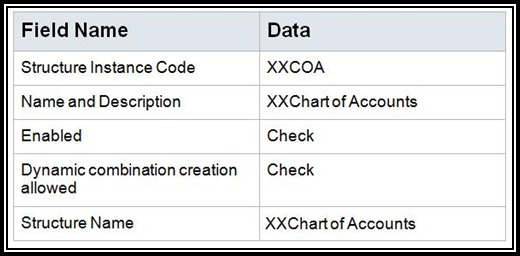

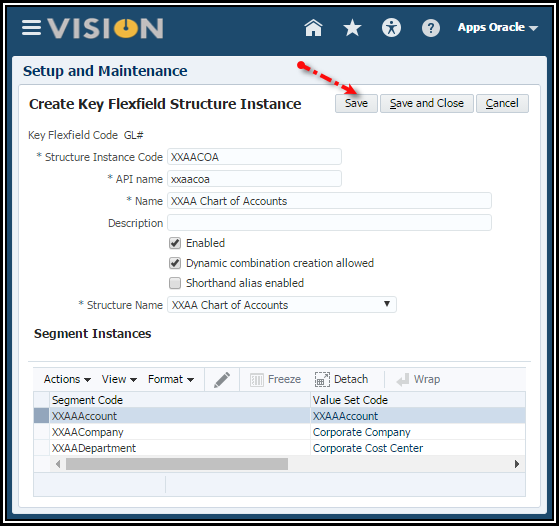

Create a Chart of Accounts Instance Activity

1. From

the Manage Chart of Accounts Structures page,

click Manage Structure Instances button.

2. In the

Manage Key Flexfields Structure Instances page, Click Create icon to

create the instance.

3. Save.

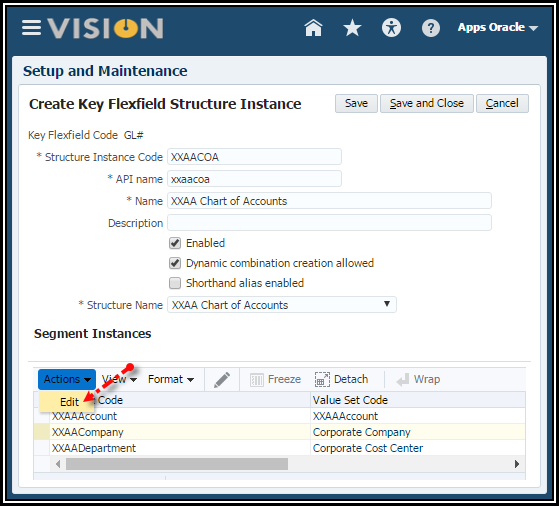

4. Define

the defaults for the individual segments.

5. Click

the Edit icon.

6. Use the

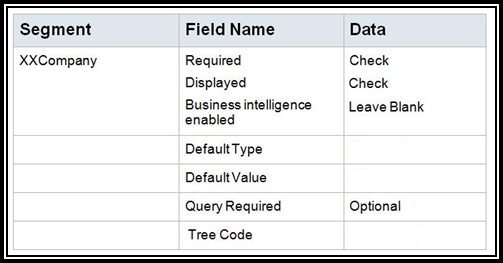

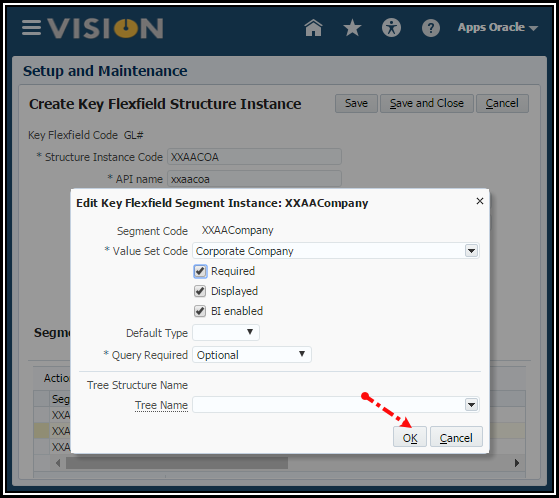

following tables to enter the segment data.

Note: When you enable Business Intelligence for a segment, it tells OTBI that you want to use that segment’s values in OTBI reports to filter reports by specific values. For example, if you want to see all AP invoices by a specific Company Value, you would enable BI for that segment. Out of the box, we always show the entire account combination for transactions because an entire combination is treated as a text string. You would ONLY enable BI if you want to run reports by specific values for that segment, but you will need a System Administrator to perform a RPD to COA Mapping so that OTBI reports don’t break.

Note: You would only assign a Tree Code if you want to use a hierarchy in cross validation rules, chart of accounts mappings, revaluations, data access sets, and segment value security rules. In other words, for things other than reporting or allocations.

7. Click OK.

8. Click

OK.

9. Click OK.

10. Save

and Close.

11. Click Done.

12. In the

Manage Chart of Accounts Structure Instances page, select the General Ledger

Accounting Flexfield and click Deploy Flexfield. This process deploys

(formerly compiles) all chart of account instances on the system.

Wait for the process to complete without errors. (Warnings are OK,

but should be investigated. If you get a warning about analytics, it is

probably because you enabled BI for a segment and the RPD to COA Mapping hasn’t

been done).

13. Click OK.

14. Click Done.

Note: You are not creating account combinations; you are only creating the lists of individual values for each segment.

REMEMBER: You must only define values AFTER values sets have been associated to a chart of accounts instance.

Here's the list of words we should NEVER use for parent nodes:

http://docs.oracle.com/cd/E12825_01/epm.111/esb_dbag/frameset.htm?esb_restricted_names.htm

For example, NEVER use ALL or the name of the segment as a value. You can use “T.”

When naming dimensions, members, and aliases in the database outline, follow these rules:

·

At

the beginning of dimension or member names, do not use the characters listed

below. Essbase will not be able to create cubes successfully if you use special

characters.

Restricted Characters

for Dimension, Member, and Alias Names

Character

|

Description

|

·

Do

not place spaces at the beginning or end of names. Essbase ignores such spaces.

AND

|

ASSIGN

|

|

AVERAGE

|

CALC

|

CALCMBR

|

COPYFORWARD

|

CROSSDIM

|

CURMBRNAME

|

DIM

|

DIMNAME

|

DIV

|

DYNAMIC

|

EMPTYPARM

|

EQ

|

EQOP

|

EXCEPT

|

EXP

|

EXPERROR

|

FLOAT

|

FUNCTION

|

GE

|

GEN

|

GENRANGE

|

GROUP

|

GT

|

ID

|

IDERROR

|

INTEGER

|

LE

|

LEVELRANGE

|

LOOPBLOCK

|

LOOPPARMS

|

LT

|

MBR

|

MBRNAME

|

MBRONLY

|

MINUS

|

MISSING

|

MUL

|

MULOP

|

NE

|

NON

|

NONINPUT

|

NOT

|

OR

|

PAREN

|

PARENPARM

|

PERCENT

|

PLUS

|

RELOP

|

SET

|

SKIPBOTH

|

SKIPMISSING

|

SKIPNONE

|

SKIPZERO

|

TO

|

TOLOCALRATE

|

TRAILMISSING

|

TRAILSUM

|

UMINUS

|

UPPER

|

VARORXMBR

|

XMBRONLY

|

$$$UNIVERSE$$$

|

#MISSING

|

Note: If you enable Dynamic Time Series

members, do not use the associated generation names—History, Year, Season,

Period, Quarter, Month, Week, or Day.

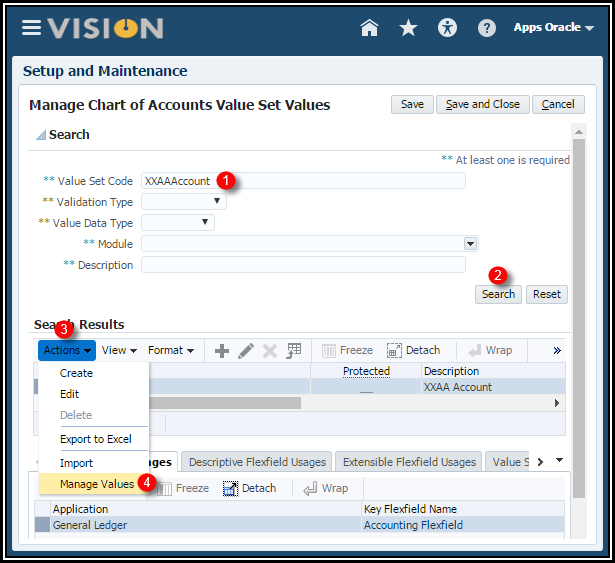

Enter Values

1. Select

the Go to Task icon for Manage Chart of Accounts Value Set Values.

Note: This UI is the exact same UI as Manage Chart of Accounts Value

Set.

2. Find

your XXAccount value set. (Hint: You can query on your initials

in the Value Set Code field).

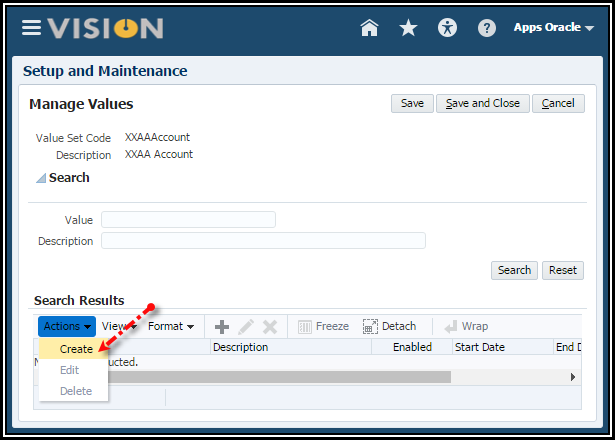

3. Click Manage

Values button.

1. Click Create

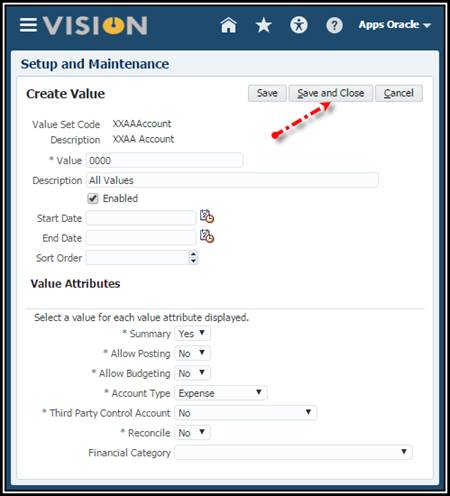

icon to create your values.

Enter the values for XXAA Account segment. Make sure the account type is correct for each account.

Value

|

Description

|

Enabled

|

Summary

|

Allow

Posting and Budgeting

|

Account

Type

|

0000

|

All

Values

|

Yes

|

Yes

|

No,

No

|

Expense

|

1000

|

Total

Assets

|

Yes

|

Yes

|

No,

No

|

Asset

|

1110

|

Cash

|

Yes

|

No

|

Yes,

Yes

|

Asset

|

1210

|

Accounts

Receivable

|

Yes

|

No

|

Yes,

Yes

|

Asset

|

2000

|

Total

Liabilities

|

Yes

|

Yes

|

No,

No

|

Liability

|

2210

|

Accounts

Payable

|

Yes

|

No

|

Yes,

Yes

|

Liability

|

3000

|

Total Owners’ Equity

|

Yes

|

Yes

|

No, No

|

Owner’s Equity

|

3310

|

Retained Earnings

|

Yes

|

No

|

Yes, Yes

|

Owner’s Equity

|

Note: The Reconciliation Flag will not be used as it is not in scope for V1, hence the values are set to No.

Save and Close. and Done

Create an Accounting Hierarchy

BackgroundYour company uses hierarchies in reports, cross validation rules revaluations, segment value security, allocations, and COA Mapping.

Note: Even though you could theoretically use the same tree for all of the above processes, you would typically create at least two different trees: One for reporting and allocations and another for cross-validation rules, segment value security, revaluations and COA Mappings. You need to carefully consider the usage for your trees. If using the tree for reporting and allocations, you need to flatten the rows to be able to use drilldown in Smartview and you must publish the tree to view the hierarchy in the Essbase cubes. If using the tree for other purposes outside of reporting and allocations, then you must flatten the rows, but you do not need to publish the hierarchy. If using the tree for OTBI, you must flatten the columns.

Note about Segment Value Security: It is very common for companies to use segment value security in reports to prevent certain users from being able to view balances for certain cost centers, accounts, etc. If your customer has this requirement, then you should use your reporting hierarchy when defining segment value security rules. If you do not, then segment value security rules will only be applied to transactions.

Note: You should define your hierarchies BEFORE you enter/upload journal entries. If you create hierarchies AFTER you have posted journals, then you must make sure no posted balances have been posted to parent values that were erroneously flagged as a child value. This will cause major issues in creating your Essbase cube if you change a child value to a parent after balances have been posted.

Activity Scope

Create an account hierarchy for your account segment using your value set XXAccount to use for reporting and allocations.

NOTE: Before you begin this, you need to know the exact name of your value set on the natural account segment.

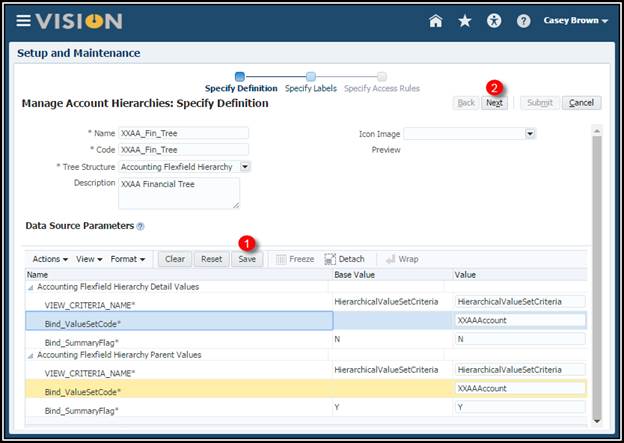

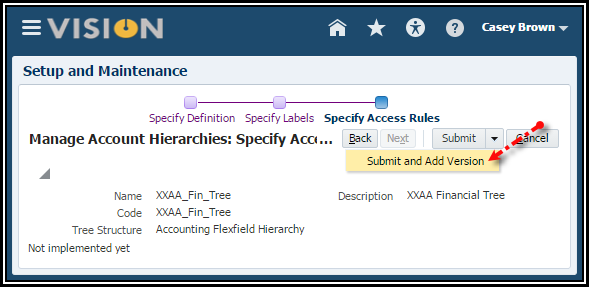

Create a Tree

1. From

your implementation project, Navigate > Define Common Applications

Configuration for Financials > Define Enterprise Structures for Financials

> Define Financial Reporting Structures > Define Chart Of Accounts > Manage

Account Hierarchies > Go to Task.

2. Use the

Manage Account Hierarchies page to search, create, and edit account

hierarchies.

3. Click

the Create Tree icon to open the definition of the tree.

This opens the Manage Account Hierarchies: Specify Definition

page to define the basic details of the tree.

4. Enter

the Name and Code fields: XXAA_Fin_Tree. (No Spaces).

NOTE: Tree names and Tree Version names cannot be more than 30 characters. It will cause problems when inquiring on GL balances.

5. Select

the Tree Structure: Accounting Flexfield Hierarchy.

6. Enter

the Description for the tree: XXAA Financial Tree.

7. In the

Data Source Parameters: Click the Expand button to expand the Accounting

Flexfield Hierarchy Detail Values and Accounting Flexfield Hierarchy

Parent Values rows.

Note: For the Accounting Flexfield Hierarchy Detail Values, how you read it is select the Value Set Code for a value set where the summary flag is N (or No). Then on the Accounting Flexfield Hierarchy Parent Values, you read it as select the Value Set Code for a value set where the summary flag is Y (or Yes).

8. In the Bind_ValueSetCode

field, enter the exact name of your value set (Your initalsAccount).

9. VERY

IMPORANT!!! Click the Save button on the Data Source Parameters

table’s tool bar in the middle of the page. (You will get an error message if

you select Next before saving).

10. A

message confirms that your new values have been updated.

11. Click

the Next button twice to navigate through the next two pages.

12. Click

the Submit and Add Version to save your newly created tree structure and

immediately create a version.

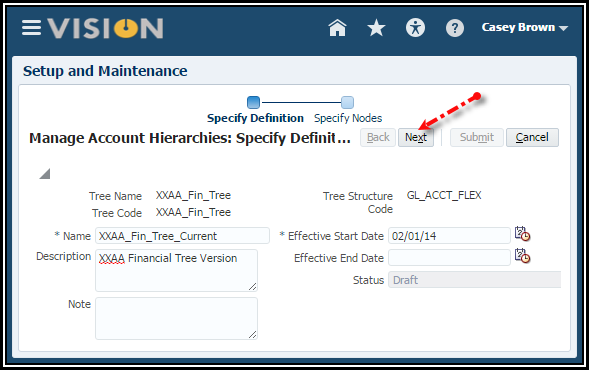

Create a Tree Version

1. Enter

the Name and Description for the tree version

XXAA_Fin_Tree_Current.

NOTE: Tree names and Tree Version names cannot be more than 30 characters. It will cause problems when inquiring on GL balances.

2. Enter

the Effective Start Date. Enter 1/1/14 in the date format suggested in

the UI.

3. Click

the Next button.

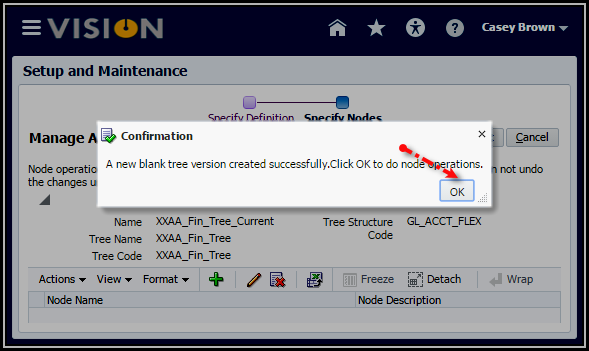

4. Click

the OK button to acknowledge the confirmation of the creation of a new

blank tree version.

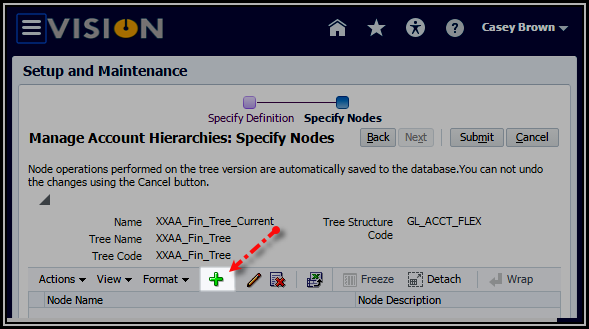

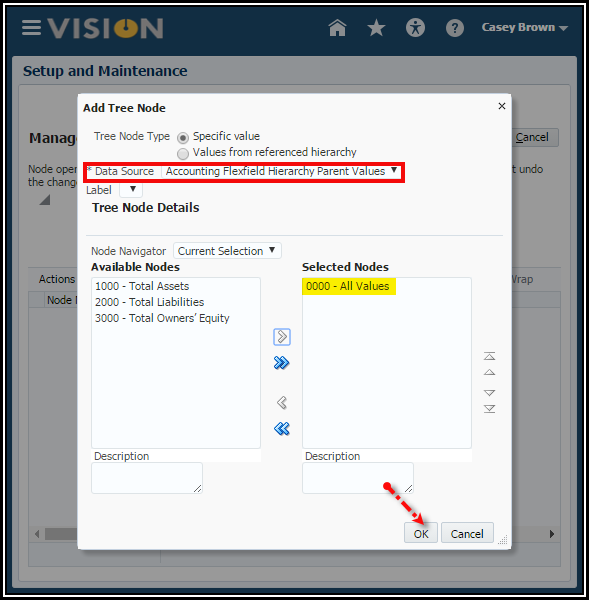

6. With

the Tree Node Type, Specific value selected, select the Data

Source: Accounting Flexfield Hierarchy Parent Values.

7. Select

the 0000 Parent Node. This is the top most root node. You want to

work from the top down. Then move it to the right column. Click OK in the

popup.

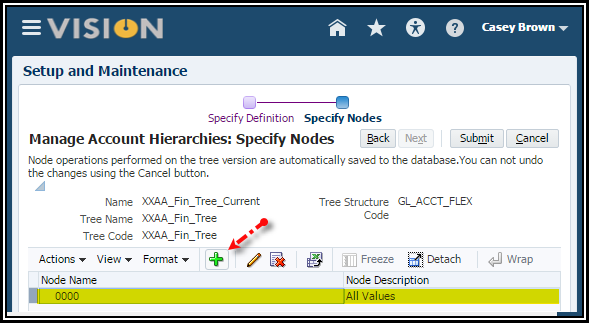

8. Select

the 0000 Value and click the Add icon to start building your hierarchy.

9. Select Accounting

Flexfield Hierarchy Parent Values.

10. Select

all the next level parent values, and move them to the right. Click OK

in the popup.

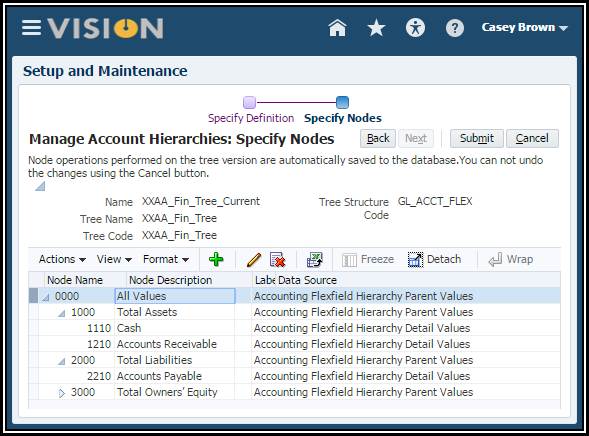

11. Now you

just keep building your hierarchy levels by assigning parents values and child

values where needed.

12. Click

the Expand button on the Parent nodes to see the children.

Your hierarchy should look like this:

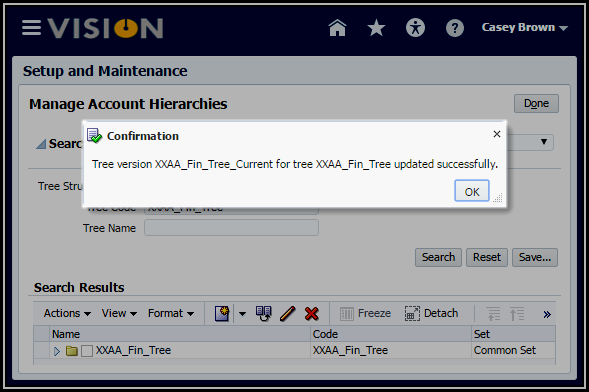

13. Click

the Submit button, then click OK to the message informing you the tree

version was successful.

Complete the Account Hierarchy

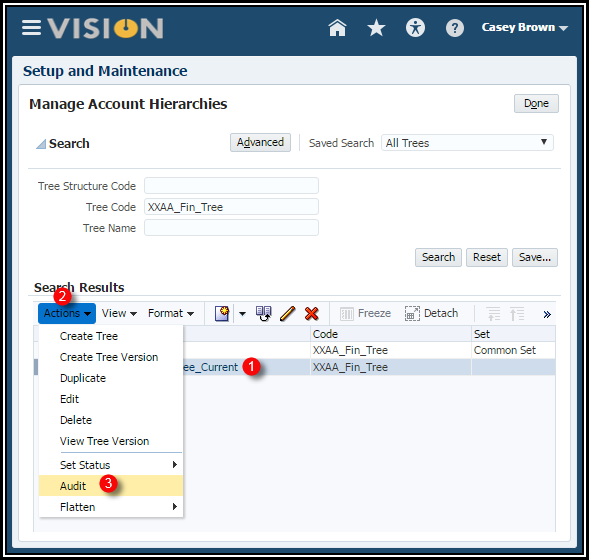

1. Highlight

your tree version. (Note: You need to expand your tree to

select the VERSION.)

2. Click

the Actions menu > Audit

3. Use the

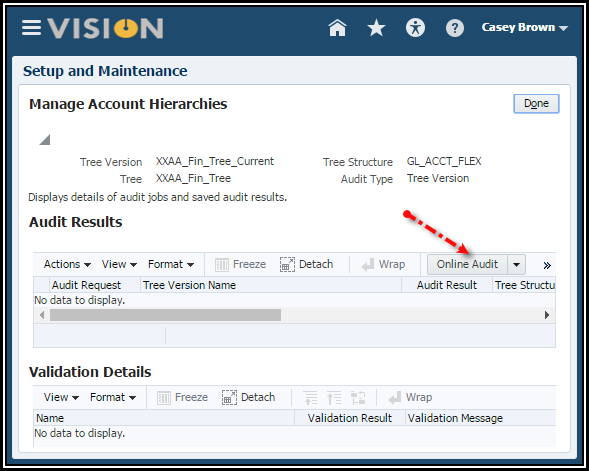

Audit Results region to start the Audit process.

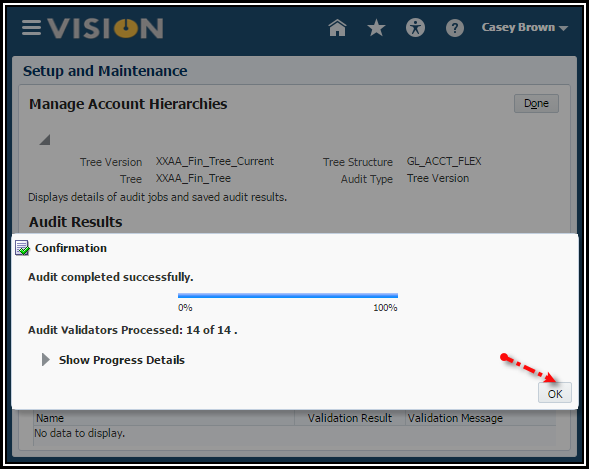

4. Click

the Online Audit button to start the Audit process. Once the

audit is performed, the status of the tree version can be set to active.

5. Click

the Done button.

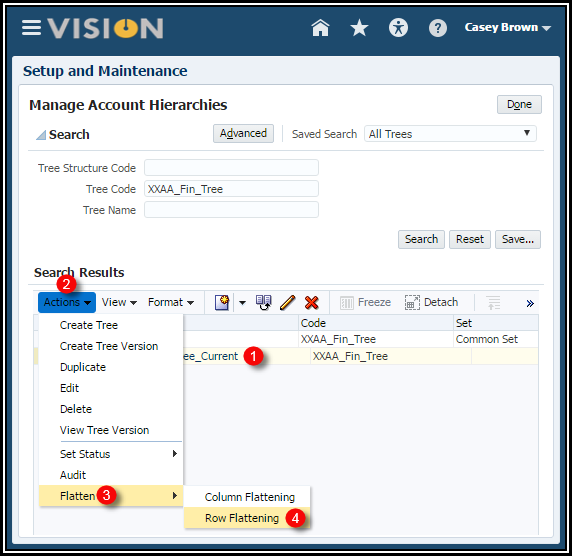

6. Select

your tree version and click Actions > Flatten> Row

Flattening.

Row flattening optimizes parent-child information for run-time performance by storing an additional column in a table for all parents of a child.

Row flattening optimizes parent-child information for run-time performance by storing an additional column in a table for all parents of a child.

Note: You could also flatten the column. It’s only required if using the hierarchy for OTBI reports, but if you just want to flatten rows and columns for all your hierarchies, it will not hurt anything.

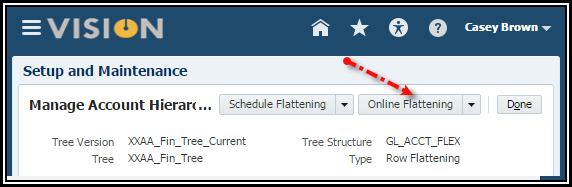

7. Click

the Online Flattening button.

8. Select

the OK button to acknowledge the successful completion message.

9. Click

the Done button.

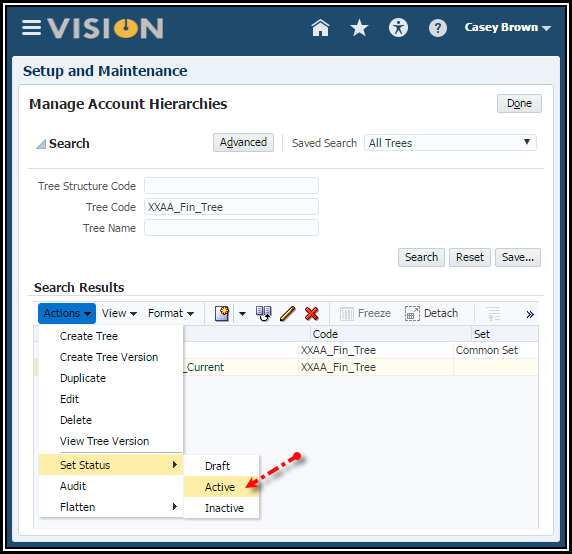

10. Use the

Actions menu > Set Status menu > Active to activate

the tree.

11. Click

Done.

Publishing Accounting Hierarchy

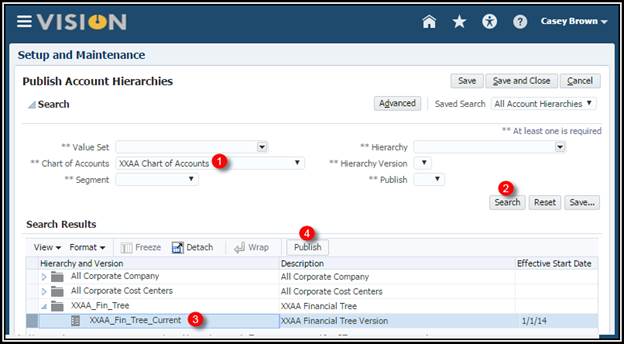

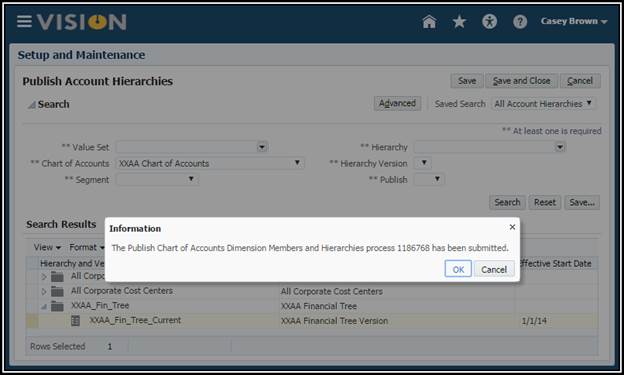

1. For the

next task, Publish Account Hierarchies, select the Go to Task icon.

2. Search

for your tree version using your Chart of Account name.

3. Expand

the XXAA_Fin_Tree_Current.

4. Scroll

all the way to the right and check the Publish check box.

5. Select

the Publish button.

6. Click

Save and Close.

Create a Duplicate of All Accounting

Hierarchies Used for Reporting and Allocations

If

your company uses hierarchies in reports and allocations, be sure you

create a duplicate of the hierarchy. You must also audit, flatten, and publish

this copied hierarchy. This is very important to reduce maintenance overhead of

reports and allocations going forward when a new hierarchy version is later

created. It is recommended you name the current version CURRENT and the copy BASELINE. Please see this white paper https://beehiveonline.oracle.com/content/dav/Oracle/Fusion_ERP_Partner_Implementation_Training_Workspace/Documents/Financials/Implementation%20Training%20for%20Release%207/Best%20Practice%20White%20Papers%20and%20Trouble%20Shooting/General%20Ledger/GL_HierarchiesWhitePaper.pdf for more information.

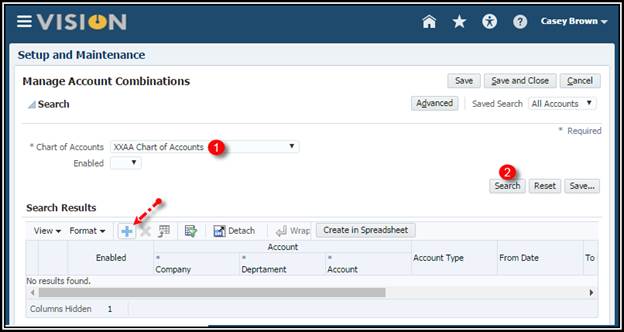

Create an Account Combinations Activity

BackgroundAccount combinations contain a completed set of segment values that uniquely identifies an account in the chart of accounts.

From your implementation project, Navigate > Define Common Applications Configuration > Define Enterprise Structures for Financials > Define Financial Reporting Structures > Define Chart Of Accounts > Manage Account Combinations > Go to Task.

1. Search

by your Chart of Accounts. (There will be no search results).

2. Click

the Add Row icon.

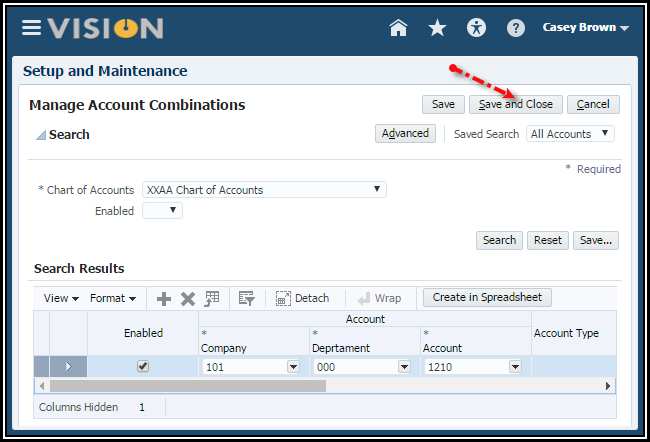

3. Verify

that the Enabled check box is checked.

4. Enter

101-000-1210.

5. Optionally

enter a From Date, To Date and an Alternate Account.

6. Click

the Save and Close button.

Note: If you enabled Dynamic combination creation allowed for your chart of account instances, you do not need to manually create account combinations. The system will automatically create them for you during transaction and journal entry.

Define Cross-Validation Rules Demonstration

BackgroundCreate cross-validation rules to prevent specific combinations of segment values in your account combinations, for example, preventing a particular cost center from being combined with a specific company value. Cross validation rules only affect the creation of new account combinations.

Activity Scope

Enter a new cross validation rule to prevent your InFusion US Chart of Accounts Company value 102 from being combined with your marketing cost center value 139. Let’s assume InFusion US LE 2 BU 2 legal entity does not have a marketing cost center.

1. From

your implementation project, Navigate > Define Common

Applications Configuration > Define Enterprise Structures for Financials

> Define Financial Reporting Structures > Define Chart of Accounts > Manage

Cross-Validation Rules > Go to Task.

2. Select InFusion

US Chart of Accounts.

3. Click

the Add Row icon.

4. Specify

a unique rule Name, NOMAR102, an optional Description: Do not

combine North America Marketing cost center 139 with InFusion America US LE2

BU2 102.

5. Enter

an optional effective From Date of today.

6. Check Enabled.

7. Click

on the Change filter condition on the Condition Filter. Select Add

Fields and select Company. Enter Company Equals 102. The

cross validation rule evaluates if Company 102 was entered and if it is the

defined value, then, the validation process continues to evaluate the rule. Note:

If you do not specify any statement in the condition filter, then the rule is

always evaluated.

8. Click

OK.

9. Click

on the Change filter condition on the Validation Filter. Select Add

Fields.

10. Select Cost

Center Does not equal to 139. Click OK. When the rule is

evaluated, an account combination must contain a cost center other than

139 for company 102 before it can be created.

11. Enter

an Error Message: We do not have a marketing department, select a

different cost center. The message displays in the relevant user interfaces

and processes when an account combination cannot be created because it violates

the rule.

12. Click Save

and Close.

Test:

1. Navigate

> Manage Account Combinations task from within your implementation

project > Go to Task icon.

2. Select InFusion

US Chart of Accounts.

3. Click

the Add Row icon.

4. Enter

102-10-62520-139-000-000.

5. Save. The

error message appears.

Define Cross-Validation Rules Activity

Activity ScopeEnter a new cross validation rule to prevent balance sheet accounts from using any other department besides 000 and 121.

1. From

your implementation project, Navigate > Define Common

Applications Configuration > Define Enterprise Structures for Financials

> Define Financial Reporting Structures > Define Chart of Accounts > Manage

Cross-Validation Rules > Go to Task.

2. Select your

chart of accounts.

3. Click

the Add Row icon.

4. Specify

a Name: “Dept 000 and 121” and Description: “Balance Sheet

Accounts can only be combined with Dept 000 and 121.”

5. Check Enabled.

6. For the

Condition Filter, select the filter icon and select Add Fields

and select Account.

7. Enter Account

Between 1000 – 3000.

8. For the

Validation Filter, enter Department Equals 000 and Department Equals 121.

9. Error

Message: “Use Dept 000 or 121 with balance sheet accounts.”

10. Click

Save and Close.

Test:

1. Navigate

> Manage Account Combinations task from within your implementation

project > Go to Task icon.

2. Select your

Chart of Accounts.

3. Click

the Add Row icon.

4. Enter

101-138-1210.

5. Save. The

error message appears.

Create a new accounting calendar for three years starting January 1, 2013 and ending December 31st each with one adjusting period at the end of the year.

1. From

within your implementation project, Navigate > Define Common

Applications Configuration for Financials > Define Enterprise Structures for

Financials > Define Financial Reporting Structures > Define Calendars

> Manage Accounting Calendars > Go

to Task.

2. Use the

Manage Accounting Calendar page to create and edit calendars.

3. Click

the Create button.

4. Enter

the desired information into the Name and Description field.

Enter XXCalendar.

5. Enter

the desired information into the Start Date field. Enter 1/1/13.

6. Select

Monthly in the Period Frequency field.

7. Accept

the defaults in the Period Name Format.

8. Select

the Once at year end list item in the Adjusting Period

Frequency field.

9. Click

the Next button.

10. Use the

Create Accounting Calendar : Period Details to review the calendar

period data. Only 2013 year has been created.

11. Click Save

and Close button.

12. Click

on the name of your calendar.

13. Click

the Add Year button to add 2014 year. Note: You can only add one year at

a time between saves.

14. Click Save

and Close button.

15. Click

the Done button.

16. You

have successfully created a new accounting calendar.

Your company, InFusion America Inc, has a ledger currency of United States dollars (USD), and is doing business with suppliers in:

·

Canada in Canadian dollars (CAD).

·

Mexico in

Mexican pesos (MXP).

·

Ultraland, a new country which uses Ultraland dollars (ULD).

Activity ScoUltralandpe

Verify that USD, CAD, MXP and GPS are enabled and create currency for Ultraland.

1. From

your implementation, Navigate > Define Common Applications Configuration

> Define Enterprise Structures for Financials > Define Financial

Reporting Structures > Define Currencies > Manage

Currencies > Go to Task.

2. Verifying

that USD, CAD, MXP, and GBP currencies are enabled.

3. Create

a new currency for Ultraland (XXULD) where XX represents your initials.

·

Currency Code: Unique

identifier used to reference the currency in user interfaces. Enter XXULD

replacing XX with your initials.

·

Currency Name: Ultraland

Dollars.

·

Description: Currency

for Ultraland.

·

Enabled: Check box to start

using the currency. Check the box.

·

Start and End Dates: Used

to begin or end use of a currency on a specific date. Start Date default is the

current date. Accept the default date.

4. Click Save.

5. Expand your

currency and accept the defaults in the following fields:

·

Issuing Territory:

Optionally, select among predefined country names per International Standards

Organization (ISO) Standard #3166.

·

Symbol: Optionally, enter the

symbol for the currency.

·

Precision:

Designate the number of digits to the right of the decimal point used in

regular currency transactions. Default is 2.

·

Extended Precision:

Designate the number of digits to the right of the decimal point used in

calculations. Default is 5. You must specify a number greater than or

equal to the number in the Precision field.

·

Minimum Accountable Unit:

Optionally, enter the smallest denomination used.

·

ISO Currency:

Identify ISO currencies. Default is checked.

·

Type: Select Currency or

Statistical to indicate how the currency is used in transactions and journal

entries. Type also determines how the balances are shown. Default is

Currency.

·

Derivation Type: Use

only for the euro and national currencies of the European Monetary Union (EMU)

member states during the transition period. All other currencies do not have

derivation types.

·

Derivation Factor: Enter

a fixed conversion rate by which you multiply one euro to derive the equivalent

EMU currency amount. The euro currency itself does not have a derivation

factor.

·

Derivation Effective Date: Enter

the date on which the relationship between the EMU currency and the euro

begins.

- Click Save and Close

Create Conversion Rate Types Activity

BackgroundYour company, InFusion America Inc, has a ledger currency of United States dollars (USD), and needs different conversion rate types for your payables and receivables transactions with Ultraland, which uses Ultraland dollars (ULD).

·

For receivables, use your corporate conversion rate types.

·

For payables, use a special corporate conversion rate type.

Activity Scope

Create a new conversion rate type for your payables transactions called XXSPCORP (replace XX with your initials).

1. From

within your implementation project, Navigate > Define Common

Applications Configuration > Define Enterprise Structures for Financials

> Define Financial Reporting Structures > Define Currencies > Manage

Conversion Rate Types > Go to Task.

2. Click

the Add row icon.

3. Enter

Name XXSPCORP where XX are your initials. Enter Description

Payables Special Rate Type.

4. Enable Enforce

Inverse Relationship and Enable Cross Rates.

5. Enter

your currency XXULD as the Cross Rate Pivot Currency.

6. Add USD

and CAD as the contra currencies by clicking the Add Row button in the Contra

Currencies region.

7. Click Save

and Close.

Create a Primary Ledger Activity

Activity ScopeCreate a primary ledger using InFusion US Chart of Accounts, AccountingMMYY calendar, USD as the currency, and Standard Accrual as accounting method.

1. From

your implementation project, Navigate > Define Common

Applications Configuration for Financials> Define Ledgers > Define

Accounting Configurations > Manage

Primary Ledgers > Go to Task.

2. Click

the Create icon in the Manage Primary Ledger page.

3. Enter a

unique Name (without any periods) and Description: XXPrimary

Ledger. Your Ledger name will appear on reports so name it correctly.

Note: Do NOT use periods in your Ledger Name, such as ABC Co., Inc.

Essbase will error. Currently, the UI does not validate this.

4. Select Chart

of Accounts: InFusion US Chart of Accounts.

5. Select

your Calendar: XXCalendar.

6. Select Currency:

USD.

7. Select

the Accounting Method: Standard Accrual.

8. Click

the Save and Edit Task List button to save your primary ledger

and return to the Setup and Maintenance work area or your project plan.

9. Select Assign

Legal Entities > Go To Task

10. In the

Select Scope popup, for the Primary Ledger field, select the Select and Add option,

then select the Apply and Go to Task button.

11. Select

your XXPrimary Ledger and then click Save and Close button at the

very bottom of the window.

12. In the

Assign Legal Entities page, select the Add icon and choose your legal entity, XX

Legal Entity, then click Apply, then Done.

13. Click Save and

Close.

14. Your Primary Ledger

name now appears as the Selected Scope across all components of this Accounting

Configuration.

Specify Ledger Options Activity

BackgroundSetting ledger options is one of the most important tasks in configuring your ledgers.

From your implementation project, Navigate > Define Common Applications Configuration for Financials> Define Ledgers > Define Accounting Configurations >

1. Specify

Ledger Options > Go to Task.

Accounting Calendar Options

2. Review

the Accounting Calendar that defaults from your ledger.

3. Select

01-13 as the First Opened Period for your ledger.

4.

Enter 3 for the Number of Future Enterable Periods.

Subledger Accounting Options

5. Review

the Accounting Method from your ledger.

6.

Select US American English as your Journal Language.

Period Close Options

7. Enter Retained

Earnings Account: 101.10.33100.000.000.000.

8.

Enter Cumulative Translation Adjustment Account:

101.10.35000.000.000.000.

Journal Processing Options

Balancing options:

9. Enable Suspense

General Ledger and Subledger Accounting.

10. Default

Suspense Account:101.10.29900.000.000.000.

11. Rounding

Account: 101.10.78550.000.000.000.

12. Entered

Currency Balancing Account: 101.10.29900.000.000.000.

13. Balancing

Threshold Percent: 10.

Enable the following Entry options:

14. Enable

journal approval.

15. Notify

when prior period journal is entered.

16. Allow

mixed statistical and monetary journals.

17. Validate

reference date.

18. Separate

journals by accounting date during journal import.

For Reversal options:

19. Leave

blank. You can select any predefined criteria set from the list of values in

the Journal Reversal Criteria Set at any time.

20. Uncheck

Run AutoReverse after open period. You can return to this page and

enable this option later.

21. For

Intercompany options: Click the Enable intercompany accounting.

22. For

Average Balance Options: Do not enable average balance processing.

Note: Disabling the ADB option will hide this region when you later

update the ledger options.

23. Save

and Close to return to your implementation project.

24. Optionally,

you could assign balancing segment values to legal entities and ledgers and

assign reporting currencies and secondary ledgers.

25. Navigate

> Review and Submit Account Configuration > Go to Task.

26. Click

Submit to create your accounting configuration. This will

automatically create a Data Access Set with full read and write access to your

primary ledger. The system automatically generates data roles for every

data access set.

27. Verify

Data Role Generation for Ledgers > Go to Task

28. Click Search

– Role Templates

29. Enter

Display Name: General Ledger Template for Ledger

30. Click Search

31. Click Open

32. Click Generate

Roles button

33. Click

Summary tab and expand Valid Roles. You should see your General

Ledger data roles that are appended with your ledger name. You assign these

data roles to your users to access those ledgers.

34. Close

the Entitlements Server (a.k.a Access Policy Manager (APM)) window.

35. Provision

Roles to Implementation Users > Go to Task.

This opens Oracle Identity Manager (OIM).

36. Click

the Administration link.

37. Search

for your user.

38. Click

the Roles tab and Assign one of the GL data roles you just created, such as General

Accounting Manager XX Primary Ledger.

39. Close

OIM.

40. The

next step is to open the period. Do not open the period for this exercise.

Reporting Currencies Demonstration

BackgroundA reporting currency is linked to a primary or secondary ledger, and is maintained at one of three data conversion levels.

Activity Scope

Set up reporting currencies tied to your XXPrimary Ledger.

1. From

your implementation project, Navigate > Define Common Applications

Configuration > Define Ledgers > Define Accounting Configurations >

select your XXPrimary Ledger > Manage Reporting Currencies > Go

to Task.

2. Click

the Create icon.

3. Name

and Description: Enter XXReporting Currencies.

4. Currency

Conversion Level: Select Journal.

5. Currency: Enter

GBP.

1. First

Open Period: Enter Jan-11.

2. Rounding

Account: 101.10.78550.000.000.000.

3. Revaluation

Basis: Select Entered currency instead of Primary ledger currency.

4. Enable

journal approval: Click check box.

1. Default

Conversion Rate Type: Corporate.

2. Retain

Transaction Rate Type: Yes

Enter 5 for the Number of Days to Find Last Rate.

1. Retain

Journal Creator from Source Ledger: Yes.

2. Click

the Add icon.

3. Journal

Source: Enter Other.

4. Journal

Category: Enter Other.

5. Convert

Journals to this Reporting Currency: Enter Yes.

6. Click Save

and Close.

Create a Ledger Set Demonstration

BackgroundLedger Sets enable you to group multiple ledgers that share the same chart of accounts and calendar combination.

Activity Scope

Create a ledger set using your XXPrimary Ledger and one of the other student's ledgers.

1. From

within your implementation project, Navigate > Define Common Applications

Configuration > Define General Ledger Options > Manage

Ledger Sets > Go to Task.

2. Click

the Create icon. Name and Description: XXSet

3. Select

your Chart of Accounts: XXChart of Accounts.

4. Select

your Calendar: XXCalendar.

5. Default Ledger:

XXPrimary Ledger.

6. Ledger

or Ledger Set: XXPrimary Ledger (Add one of the student's primary ledger.)

7. Type:

Ledger.

8. Save

and Close.

Data Access Set Security Activity

BackgroundData Access Sets are used to control access to specific ledgers, ledgers sets, or primary balancing segments of ledgers.

Activity Scope

Once you submit the Accounting Configuration, a Data Access Set is automatically created with full read/write access to the Primary Ledger. You only need to create a Data Access Set to grant more granular access to specific balancing segment values or alter the read and write privileges or grant access to multiple ledgers.

1. From

your implementation project, Navigate > Define Common Applications

Configuration for Financials> Define Security for Financials > Define

Data Security for Financials> Manage Data Access Sets > Go

to Task.

2. Click

the Create icon.

3. Enter

unique Name and Description: XXData Access Set, replacing XX is

your initials.

4. Select

the Access Set Type: Full Ledger or Primary Balancing Segment Value.

5. Select

your Chart of Accounts: InFusion US Chart of Accounts.

6. Select

you Accounting Calendar: XXCalendar.

7. Select

the Default Ledger: XXLedger.

8. Click

the Add icon in the Access Set Assignments.

9. Enter

Your Ledger: XXLedger.

10. Select Privilege:

Read and Write.

11. Save.

Note: If you select Access Set Type of Primary Balancing Segment Value, then you have to additionally decide:

1. Check All

Values or leave unchecked to enter one or more primary balancing segment

values.

2. Select Specific

Value: Parent to represent a group of balancing segments or Single Value.

3. If you

select Parent Value, then you must select a Tree Code to indicate the

source of the hierarchy information, a Tree Version Name, and the

primary balancing Segment Value.

Note: You will ONLY be able to select the Tree Code that is

assigned to your segment that was denoted as the Primary Balancing Segment of

your Chart of Accounts Instance.

4. Continue

to add rows to include more than one primary balancing segment value, if

needed.

Segment Value Security Demonstration

BackgroundEnabling Segment Value Security controls what accounting segment values users can see and use throughout the GL UIs.

Functionally, defining and enabling such rules consists of several steps:

1) Enabling Segment Value Security at the value set level

2) Creating a Data Security Condition

3) Creating a Data Security Policy

Before proceeding with these steps, confirm in OIM what roles (as part of the data roles created for each ledger for the respective chart of accounts) are assigned to the users who will be using these ledgers. This is important because as part of the definition of security policies you need to specify what roles are impacted by the policies.

From within your implementation project navigate to

Define Common Applications Configuration for Fusion Accounting Hub > Define Implementation Users > Create Implementation Users > Go to Task.

This opens Identity Manager.

1. Click

on the Administration link on the top right hand corner of the main

page.

2. Search

for your user at the top left corner and click on the Display Name.

3. From

the Roles tab, expand the General Accounting Manager XXPrimary Ledger

role and note it is based on the General Accounting Manager Job Role for

the XXPrimary Ledger Data Access Set.

In case you plan to use tree operators in your policy definitions, review your tree definitions and make sure they are properly set up for the desired security behavior.

Activity Scope

·

Enable security for XXAccount value set associated with your chart

of accounts.

·

Provide the General Accounting Manager XXPrimary Ledger

data role with access to a range of account values.

·

Deny all other users access to all account value set values.

I. Enable Segment Value Security at the value set level.

From within your implementation project navigate to

Define Common Applications Configuration for Fusion Accounting Hub > Define Enterprise Structures for Fusion Accounting Hub > Define Financial Reporting Structures > Define Chart of Accounts > Manage Segment Value Security Rules > Go to Task.

1. Search

for Value Set Code XXAccount and click on Edit.

2. Check

the Security enabled checkbox and click on Edit Data Security

button to proceed with defining a security condition and policy.

II. Create a Data Security Condition.

1. With

the Condition tab selected, click the Create button to begin

creating the policy.

2. Enter XXRestricted

Access for both Name and Displayed name.

3. Click Add

in the Conditions section.

4. Select Column

Name: VALUE, Operator: Between, Value: 1000-7999.

You can use either tree or non-tree operators.

The following non-tree operators are supported:

-

Equal to

-

Not Equal to

-

Between

-

Not Between.

Similarly, the following tree operators are supported:

-

Is a last descendant of

-

Is a descendant of.

5. Once

you have finished defining the desired conditions, click on Save.

III. Create a Data Security Policy.

1. When

you are on the Policy tab, click on the Create button to begin

creating a new policy. Begin by specifying information in the General

Information tab.

2. After

specifying the General Information, proceed to the Role tab and

search for the relevant data role that you desire to be affected by this

policy.

(Note that the search functionality for roles in the Select and

Add popup does not work very well, i.e. it does not like wildcard

characters.)

3. Once

the desired role shows up in the Role tab, click on the Rule tab

in order to associate the condition with the policy.

4. The Row

Set field determines what range of value set values are affected by the

policy. Select Multiple Values.

5. Select

your XXRestricted Access condition that was defined earlier.

6. Click

on the Submit button.

Generate the flexfield (from the Manage Key Flexfields UI).

Get Flower Effect

Get Flower Effect

No comments:

Post a Comment