Using capital projects, you can define capital

assets and capture construction-in-process (CIP) and expense costs for assets

you are creating. When you are ready to place assets in service, you can

generate asset lines from the CIP costs and send the lines to Oracle Assets for

posting as fixed assets.

Use capital projects to capture the costs of

capital assets you are building, installing, or acquiring. We can also use

capital projects to create retirement adjustment assets that you associate with

a group asset in Oracle Assets. You use a retirement adjustment asset to

capture the costs of removing, abandoning, or disposing of assets you want to

retire.

You define and build capital assets in capital

projects using information specified in the project work breakdown structure

(WBS). You define asset grouping levels and assign assets to the grouping

levels to summarize the CIP costs for capitalization.

·

Create Capital

Project

·

Define CIP Assets

·

Assign CIP Assets

at the appropriate Grouping Level

·

Collect CIP Costs

for the Project

·

Specify an Actual

Date In Service

·

Generate Asset

Lines

·

Interface Assets

to Fixed Assets

For

capital assets, you must specify whether to capitalize or expense each

transaction charged to a capital project. The Capitalizable classification is

similar to the billable classification for transactions charged to a contract

project. The task and transaction controls you define determine the default

value for this classification.

Setup

Select

a default asset book from the list of values. The value that you select for

this field will be the default value for all project assets that you create.

You can override the default value at the asset level.

1. Enter a name for

Project type.

2. Class : Select

Capital to create a capital project type

3. Enter effective

start date of the project type

4. Service Type:

Select the required service type from the list of values.

5.Work Type: Select

the work type created above in the setup. Click on the Capitalization

Information Tab (Tab gets enabled only when the project class is ‘Capital’).

6.Cost Type: For the project type, specifies whether to capitalize costs

at their burdened or raw cost amount.

7.Require Complete Asset Definition: Specifies whether an asset definition

in Oracle Projects must be complete before you can interface costs to Oracle

Assets. If you select this option, you do not need to enter information for the

imported asset line in the Prepare Mass Additions window in Oracle Assets. The

Asset Interface process places asset lines with complete definitions directly

into the Post queue in Oracle Assets.

8.Override Asset Assignment: This field interacts with the assignment

status of the asset to either call or disregard the Asset Assignment client

extension.

9.Asset Cost Allocation Method: You can select one of several predefined

allocation methods to automatically distribute indirect and common costs across

multiple Assets.

10.Event Processing Method: You can specify a capital event processing

method to control how assets and costs are grouped over time.

11.Grouping Method: Specify how to summarize asset lines.

12.Group Supplier Invoices: Select to consolidate the expenditure items on

a supplier Invoice into one asset line according to the method specified in the

Grouping Method field.

Define

CIP Assets on Project

Navigate to Project Options-->Asset

Information-->Assets

Enter Asset name, Asset Category and the

estimated cost.

Asset book Information defaults from the

setup option and can be overridden

Assign

CIP Assets

Navigate

to Project Options -->Asset Information-->Assets Assignments

You

can change the grouping level type at any time. If you change a grouping level

type from Specific Assets to Common Costs, Oracle Projects deletes existing

asset assignments from the grouping level. Changing the grouping level after

you have interfaced assets does not affect the asset lines previously sent to

Oracle Assets.

Specific

Assets: Select this option to associate assets with the project or task. The

Generate Asset Lines process generates asset lines from the specific assets and

costs you associate with this grouping level.

Common

Costs: Select this option to group projects or tasks that capture costs you

want to allocate to multiple assets.

Collect CIP Costs for the Project: Book expenditure on

the above created project

Placing

an Asset in Service

When

a CIP asset is complete, you place it in service. If your project has more than

one CIP asset, you can place each asset in service as it is completed. You do

not have to complete the entire project to place an asset in service. You place

an asset in service by entering the Actual In-Service Date for the asset. You

will need to run PRC: Update Project Summary Amounts in order to generate Asset

Lines.

Navigate

to the Capitalization--> Capital Projects

Click

on Assets Button.

Now, click on Assets Tab in order to change the

Project Asset Type.

Select As-Built from List of Values and update the

Actual Date as System Default Date and Save your work.

Note:

You cannot send assets to Oracle Assets whose actual date placed in service is

later than the current Oracle Assets period date.

Generating

Asset Lines

The

Generate Asset Lines process creates summarized asset lines for capital assets

. Oracle Projects creates asset lines based on the asset grouping level you

choose within a project and the CIP grouping method you designate for the

corresponding project type. The grouping level represents the WBS level at

which you assign assets or group common costs.

Click on Generate Tab to generate Asset Lines and

interface the Assets to Fixed Assets.

Always update the PA through Date as the Month

Ending Date.

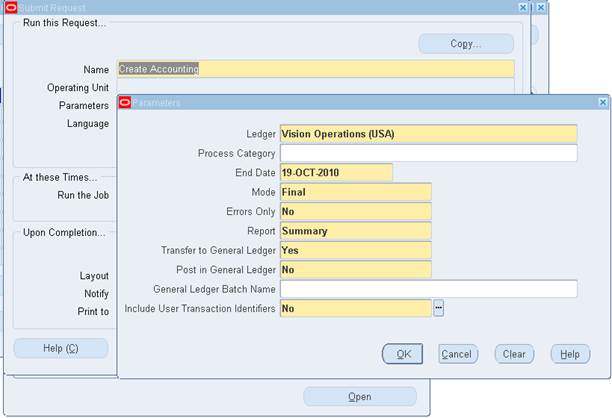

Prior to

Interfacing the Asset Lines to Oracle Assets, you will need to run the Create

Accounting Program to transfer the Payables Invoice to General Ledger in Payables

Responsibility.

Note: Here the source of

the Asset Lines is a Payables Invoice.

Ledger will be your Set of

Books and End Date will be the current system date, thereby ensuring that all

the Payables Invoices will get transferred to GL.

Interface

Assets to Fixed Assets

You

run the Interface Assets process to send asset lines from Oracle Projects to

Oracle Assets. This process merges the asset lines into one mass addition line

for each asset. The mass addition line appears in the Prepare Mass Additions

Summary window in Oracle Assets as a merged parent with a cost amount of zero

and a status of MERGED. The line description is identical to the description of

the expenditure item in Oracle Projects.

Switch Responsibility to

Fixed Assets and Navigate to Mass Additions Screen

Review the Assets Lines

Created

Mass

Additions-->Prepare Mass Additions

Input the Book ID and Project

Number and Click Find.

You will find two lines

Merged and New.

Change the Queue from New to Post, update the

Location and save your record.

Now, run the Post Mass Addition Report, input the

Book Name and click OK and Submit the Report.

Review the Mass Additions Posting Report Output

Now, check for the Asset Status if it has changed

to Capitalized.

Assets-->Assets

Workbench

Input the Asset Number, Book

ID and Project Number and click on Find

The Asset Type has been

changed to Capitalized.

This ends the Capitalization

Process.

Get Flower Effect

Get Flower Effect

3 comments:

Very detailed documentation with the screen print and appreciate the effort

Hello, nice document,was very helpful but i discovered that after interfacing an amount from projects to asset successfully( both item and vat), only the tax line appeared (the transaction originated from AP supplier invoice which was interfaced to oracle projects and the fixed asset). what could be the cause?

Hello Sir,

Really very helpful ,not only this topic.All the information in the blog excellent:)

Post a Comment