Bank

Creation

1.

Navigate to Payables Manager àSetup àPayment àBanks

and Bank Branches. Click on Banks tab and then click on Create

button.

(Can

also use Cash Management Responsibility àSetup àBanks

àBanks navigation)

2.

Select the country, enter Bank name & number and other Bank details. Then click on “Save and Next” button.

3.

Click on “Create” button under Address tab and add the address details.

Enter

the address details and click on apply button

Then click on “Save and Next”

button.

4.

Click on “Create Contact” button.

Enter

the details and click on “Apply” button.

5.

Click on “Finish” button and the Bank is created.

Bank

Branch Creation

1.

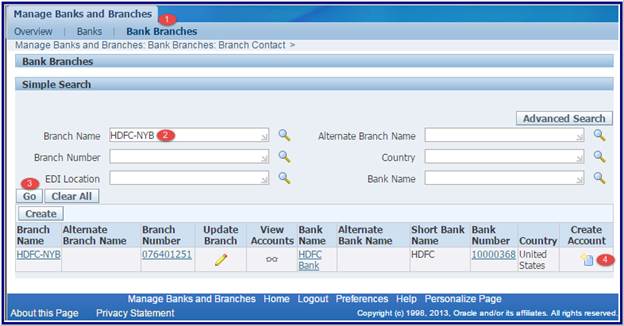

Search the newly created bank from Payables Manager àSetup

àPayment àBanks and Bank Branches and then

click “Create Branch”.

2.

Click on continue button and enter the Branch name,Branch number and select

Branch type.Then click on “Save and Next” button.

Branch

Types are:

·

ABA: American Bankers Association

·

CHIPS: Clearing House Interbank

Payment System

·

SWIFT: Society for Worldwide

Interbank Financial Telecommunication

·

OTHERS

1. Please note: The Bank Branch Number is called the Routing

Transit Number for US Banks. This number has to conform to a "check digit

validation" as required for US Banks as part of Federal Financial

Requirement #PMC-18. The branch using ABA will have to have Routing Transit Number.

2. Entered "Routing Transit Number" (Branch Number) did not conform to the check digit algorithm. Hence Errors as:

The Check Digit Validation for Routing Transit Number has failed. Please enter as correct value for the Routing Transit Number.

(2). Details of the algorithm are given in the Cash Management User Guide, Appendix F - Country Specific Bank Account Validations: United States

Validation Rules:

The fields are checked for validity by adopting the following rules:

Routing number here is our bank branch number. The following validations are performed for all US bank branches. The first 8 digits of the bank branch number must not be 0 -- so the valid range is 00000001 to 99999999. Valid Check digit, which is the 9th digit of the bank branch number, should be 0-9. The bank branch number field is optional.

Validation

A new validation is required for the Bank Branch Number for US Banks as part of federal financial requirement # PMC-18. The field is a nine-digit numeric-only field. The validation requires prohibiting fewer or more than nine characters, allow for only numeric characters, and prohibit the entry of all zeroes in this field. The purpose of the edit is to ensure the validity of the routing transit number (RTN) and prevent erroneous returns or payments. The ninth digit of the Number field will be used to represent the Check Digit. The authenticity of the Check Digit will be validated as well. The Check Digit is computed using

Modulus 10 as follows:

1. Multiply each digit in the Routing Number by a weighting factor. The weighting factors for each digit are:

Position 1 2 3 4 5 6 7 8

Weights 3 7 1 3 7 1 3 7

2. Add the results of the eight multiplications.

3. Subtract the sum from the next highest multiple of 10. The result is the

2. Entered "Routing Transit Number" (Branch Number) did not conform to the check digit algorithm. Hence Errors as:

The Check Digit Validation for Routing Transit Number has failed. Please enter as correct value for the Routing Transit Number.

(2). Details of the algorithm are given in the Cash Management User Guide, Appendix F - Country Specific Bank Account Validations: United States

Validation Rules:

The fields are checked for validity by adopting the following rules:

Routing number here is our bank branch number. The following validations are performed for all US bank branches. The first 8 digits of the bank branch number must not be 0 -- so the valid range is 00000001 to 99999999. Valid Check digit, which is the 9th digit of the bank branch number, should be 0-9. The bank branch number field is optional.

Validation

A new validation is required for the Bank Branch Number for US Banks as part of federal financial requirement # PMC-18. The field is a nine-digit numeric-only field. The validation requires prohibiting fewer or more than nine characters, allow for only numeric characters, and prohibit the entry of all zeroes in this field. The purpose of the edit is to ensure the validity of the routing transit number (RTN) and prevent erroneous returns or payments. The ninth digit of the Number field will be used to represent the Check Digit. The authenticity of the Check Digit will be validated as well. The Check Digit is computed using

Modulus 10 as follows:

1. Multiply each digit in the Routing Number by a weighting factor. The weighting factors for each digit are:

Position 1 2 3 4 5 6 7 8

Weights 3 7 1 3 7 1 3 7

2. Add the results of the eight multiplications.

3. Subtract the sum from the next highest multiple of 10. The result is the

Check

Digit.

Example:

Routing No.: 0 7 6 4 0 1 2 5

Multiply by: 3 7 1 3 7 1 3 7

Sum: 0 49 6 12 0 1 6 35 = 109

Check Digit = 1 (110 minus 109)

In this example, the routing transit number and check digit 076401251 will pass validation if this is the value entered into the Bank Branch Number field. If the Bank Branch Number passes validation, then the record is saved, otherwise an error message is returned.

Example:

Routing No.: 0 7 6 4 0 1 2 5

Multiply by: 3 7 1 3 7 1 3 7

Sum: 0 49 6 12 0 1 6 35 = 109

Check Digit = 1 (110 minus 109)

In this example, the routing transit number and check digit 076401251 will pass validation if this is the value entered into the Bank Branch Number field. If the Bank Branch Number passes validation, then the record is saved, otherwise an error message is returned.

3.

Click on “Create” button under Address tab and add branch address details.

Then click on “Save and Next”

button.

4.

Click on “Create Contact” button. Enter the details and click on “Apply”

button.

5.

Click on “Finish” button and the Branch is created.

Bank

Account

1.

Search the newly created Branch under Bank Branches tab and then click on

“Create Account”.

2.

Click on continue button and enter the Bank Account Owner.Also select the “Account Use” . Then click on

Next button.

3.

Enter the account Name and other account information’s. Then click on “Save and

Next” button.

4.

Enter the Account Control informations and click on “Save and Next”

button.

·

Multiple

Currency Payments: Enable

this option if you want to use this bank account to pay invoices entered in

multiple currencies. You can select this option only if the Use Multiple

Currencies Payables option is enabled and of the bank account is in your

functional currency.

·

Allow

Zero Payments: Enable

this option to allow zero-amount payments from this bank account.

·

Pooled

Account: Enable

this option if you use Automatic Offsets and you want to associate multiple

companies with this bank account. Oracle Payables creates one corresponding

cash accounting entry for each liability distribution. Oracle Payables builds

the cash account based on the cash account defined for the bank account, and on

the account segments of the liability lines.

·

Maximum

Outlay: Enter

the largest currency outlay that you allow for a payment batch for this bank

account. The system displays a warning if the payment batch exceeds this

amount. However, you can continue to process the payment batch. You can

override this default amount when initiating a payment batch.

·

Minimum

Payment: Enter

the lowest payment amount that you allow in a payment batch. You can override

this default amount when initiating a payment batch. Maximum Payment. Enter the

largest payment amount that you allow in a payment batch. You can override this

default amount when initiating a payment batch.

5.

Click on “Add Organization Access button” and enter the Organization and select

Account Use options.Then click on Continue button.

5.

Enter the Payables and GL options and click on “Save and Next” button.

6. Click

on “Create Contact” button if you want to create contact.

Then click on Finish button and the

Bank account will be created.

Payment

Document

1.

Select the Account and click on “Manage Payment Documents” button.

2.

Click on Create button and enter the Document Name.Then select

the Paper Stock Type and Payment Format.Alsoenter First

and Last(Last not mandatory) Document number.

Select Paper

Stock Type as Blank Stock for Electronic Payment

format and Prenumbered Stock for Paper payment

format.

3.

Then click apply and the Payment Document will be created.

Get Flower Effect

Get Flower Effect

2 comments:

Hi Raju,

Please confirm if we need to attach the payment document for ACH what should be the Format and first available and last available document number should be what?

Regards,

Aanchal

Hi Aanchal,

It is not mandatory to create a payment document for ACH for checks it is mandatory and client will provide the document numbers.

Thanks,

Raju

Post a Comment