Introduction

Usage

of Credit Card for any purchases has become common. End Customers use credit

cards to make their payment for any purchases made. Client implementing Oracle

EBS now has the facility to integrate Oracle EBS modules like iPayments,

iReceivables, iProcurement etc with Credit Card payment functionality. Oracle

EBS is now compatible to support either Gateway or Processor model of Credit

Card Payment integration.

Scope

of the Document:

This

document gives the basic mandatory setups that are to be done in Oracle

Payments and Account Receivables module for credit card payment integration

with iReceivables module.

Non

Scope of the Document:

Credit

Card payments shall also be setup and integrated for use in other EBS modules

like Advanced Collections, iProcurement etc. The setups for integration with

those modules are not shown in this document.

Setup Overview

The first part of the document will

walk through all the setup stages required in Cash Management (CE), Receivables

(AR), and Payments (IBY) in detail.

Setup

Detail Flow

A Brief intro to

the steps:

1. Pre-Requisite

mandatory Receivables setups

2. Oracle Payments

Setups

3. Profile Options

setups

4. Test Customer

setups

5. Testing Snapshots

PRE-REQUISITE

MANDATORY RECEIVABLES SETUPS:-

1. Bank and Bank

account creation:

Create Internal Bank

The

first step in the bank account creation is the bank definition. This form

allows you to search for existing banks, view and update them or create new

banks.

Note: Internal

banks are also known as 'Remittance Banks'

Create

Bank Information:

Navigation: Receivables Manager

à Setup à Receipts à Banks

1. Navigate to the

Manage Banks and Branches window, select the Banks tab, and select the Create

button.

2. Select one of the

two radio buttons in the Bank Options region. When creating a new bank, you can

either create a new bank or add bank details to an existing party defined in

your Trading Community.

3. Enter a country

name or select a country from the list of values. This is a mandatory field.

4. Enter the Bank

Name. This is a mandatory field.

5. (Optional) Enter an

Alternative Bank name, Short Bank Name, Bank Number, Description, Taxpayer ID,

Tax Registration Number, Inactive Date.

6. Select Finish to

save your bank or select Save and Next to enter Bank Address information.

Bank

Information Region

Click on Create button

Create

Bank Address:

You

can maintain several addresses for the bank in case, for example, when the bank

has different mailing and physical locations. One of the addresses has to be

marked as a primary or identifying.

1. Navigate to the

Create Bank Address window and select the Create button.

2. Enter a country, or

select one from the list of values.

3. Enter the remaining

country specific address details.

4. Select Apply to

save the address.

5. Select Finish to

complete the bank creation or select Save and Next to enter Bank Contact

Information.

· Address: The

mailing address for the bank.

· Country: The name

of the country where the bank is located.

· Identifying: In

many countries a fiscal code is the principal means of identifying and querying

suppliers. The fiscal code is unique across all entities and appears on all

official documentation.

Update: Select this button to change any

information as needed

Create Bank Contact Information:

1. Navigate

to the Create Bank Contact window and select the Create button.

2. Enter

Contact Information. You need only enter a first or last (Family) name, a

Registry ID, and Start Date.

3. Optionally

enter Email, Phone, and Address information for the contact.

4. Select

Apply to save the contact.

5. Select

Finish to complete the bank creation.

Name: Name of your contact person.

·

Phone: Direct number to your bank contact.

·

Email: Email address for your contact at the bank.

·

Address: The mailing address for your contact.

Update: Select this button to change any information as needed.

Create Bank Branch: Create Bank Branch

Information

Navigation

:

Receivables Manager à Setup à Receipts à Banks

Navigate to the Manage Banks and Branches

window, then select the Bank Branches tab. Bank branch creation is the next

step after the bank creation. This page allows you to search for existing bank

branches, view and update them or create new bank branches. You may conduct a

Simple Search by filling in information in one of the following fields, and

then clicking the search icon: Branch Name, Branch Number, EDI Location,

Alternate Branch Name, Country, or Bank Name.

1. Navigate to the Manage Banks and

Branches window, select the Bank Branches tab, and select the Create button.

2. Enter the Country and Bank Name for

which you are creating the branch or select from the list of values and select

the Continue button.

3. Select one of the two radio buttons in

the Branch Options region to indicate if you are creating a new branch or

adding branch details to an existing party defined in your Trading Community.

4. Enter the Branch Name (required).

5. Optionally, enter the remaining branch

information, such as Alternate Branch Name, Branch Number, BIC, Bank Code

6. Select a Branch Type. The options are:

ABA: American Bankers Association

CHIPS: Clearing House Interbank Payment

System

SWIFT: Society for Worldwide Interbank Financial

Telecommunication

OTHERS

7. Optionally, enter the remaining branch

information, such as Alternate Branch Name, Branch Number, BIC, Bank Code

8. Select Finish to save your branch or

select Save and Next to enter Branch Address and/or Branch Contact information.

Entering Branch Address Details, and

supplying Contact Information are the same processes as described when entering

this information for banks.

Branch Name: The name of the bank branch.

Alternate Branch Name: You can enter an

alternate name for your bank branch. This is particularly useful if you do

business in Japan, which allows you to enter both Kanji and Kana values for

your bank branch name.

The system does not use the value. It is

for your reference only.

Branch Number(Also Known as ‘Transit

Routing Number’): The bank branch number. Payables used this information to

identify the bank branch in payment formats that use electronic payment

methods, in creating positive pay files, and when printing the MICR line on

checks.

Note: For banks based in the United

States, enter the American Banking Association ninedigit transit routing

number in this field. Also, if you use the National Automated Clearing House

Association (NACHA) electronic payment format, then include the bank branch

number on both internal and supplier banks. The combination of Branch Number,

Bank Account Number, and Country must be unique within a bank.

BIC:The Bank Identification Code (BIC)

(formerly called SWIFT Code) is entered at bank branch level. BIC consists of

either 8 or 11 characters. The BIC consists of the following elements:

4 characters for the bank code

2 characters for the country code (ISO31661)

2 characters for the location code

3 characters for the branch code (optional)

The length of the BIC will be validated at

entry time. If the bank branch is used for SEPA payments, BIC is mandatory.

EDI Location: The Electronic Data

Interchange (EDI) location code for this bank.

EFT Number: Your enterprise's EFT

(electronic funds transfer) user number. This number is used to identify your

company on any EFT transmissions with the bank.

Disable the 'CE: Disable Bank Validations' profile option to

enter the branch number.

R12

Bank Branch Validation USA, CANADA : Profile Option 'CE: Disable Bank Validations', Bank Branch Information: Error: Check Digit

Validation for Routing Transit Number has failed (Doc ID 1287647.1)

Issue 1: In R12, the mandatory feature of

bank account validation is causing issues for customers. A means is needed to

be able to "turn-off” the validations.

Impact of: profile option 'CE: Disable

Bank Validations' Yes or No.

Issue 2: Validation Rule Error -

"Routing Transit Number" does not accept any number of digits in

"Create Bank Branch : Bank Branch Information"

Validation rule error - "Routing

Transit Number" would not accept any number of digits in "Create Bank

Branch : Bank Branch Information" setup. When 10+ digits were entered,

received error that less than 10 digits is required; however, the field does not

accept less than 10 digits either in the field either.

Issue 3: Error: The Check Digit validation

for Routing Transit Number has failed. Please Enter a Correct value for the

Rounting Transait Number.

Create Bank Branch Information

Create Bank Branch Address

Create Bank Branch Contact

Note: PARTY_ID/PARTY_NUMBER are unique for

bank and branch

Also, when checking the data be mindful of

the PARTY_USAGE_CODE 'Bank' or 'Bank Branch' When you create the Bank Account

the Cash Management (CE) tables are used:

CE_BANK_ACCOUNTS

CE_BANK_ACCT_USES_ALL

CE_GL_ACCOUNTS_CCID

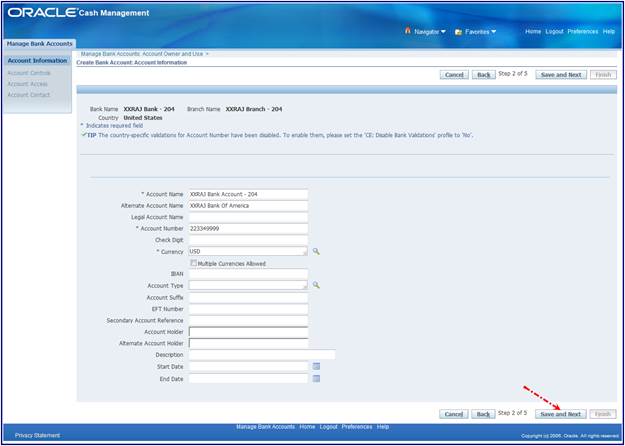

Create Bank Account

Once you are done with the bank branch

creation, you can proceed to the bank account setup. This page allows you to

search for existing bank accounts, view and update them or create new bank

account.

Select the bank branch to which your bank

account belongs and proceed to the bank account setup. In the first step you

will have to select the owner of the bank account; the legal entity that opened

this account at the bank. In the following steps you will be able to define

which organizations within your company will be able to use this bank account:

1. Navigate to the Manage Bank Accounts

window and select Create.

2. Enter the Country, Bank Name and Branch

Name for which you are creating this account and select Continue.

Assign Account Owner and Use

3. Enter the Bank Account Owner; the legal

entity that owns the account.

4. Select the types of functions that this

bank account is going to be used for: Payables, Payroll, Receivables, or

Treasury or all. If the Treasury option is disabled, you have not linked this

bank branch to the counterparty in Treasury.

5. Assign Account Information.

Enter information in the Account

Information tab. For details of the fields, see Bank Account Window reference.

Account Name: The name you use to refer to

the bank account. You may want to use a name that indicates the usage of the

bank account.

Alternate Account Name: The alternate name

for your bank account. You can enter an alternate name for your bank account.

This is particularly useful if you do business in Japan, which allows you to

enter both Kanji and Kana values for your bank account name. The system does

not use the value you enter here unless you enable the Sort by Alternate Fields

Payables option. If you enable that option, then Payables uses the alternate

name when it sorts reports by bank account name.

Short Account Name: This may be an alpha or

a numeric reference.

Account Number: The bank account identification

number. The combination of Bank Account Number, Bank Branch Number, Account

Use, and Currency must be unique for each bank. Refer to your country specific

documentation on validation that the system performs on the bank account number

for specific countries.

Check Digit: The value used to validate the

authenticity of your bank account number according to country specific bank

account validation requirements. This value is provided by your financial

institution.

Currency: Currency for a bank account. The

default value is your ledger currency.

Multiple Currencies Allowed: If you do not

enable the Use Multiple Currencies Payables option, then Payables does not

allow you to change this value. If you select your ledger currency as your bank

currency, then you can enable the Use Multiple Currencies Payables option and

use this bank account to pay foreign currency invoices. If you select a

different currency than your ledger currency in this field when you define

Payables Payment Documents, then you will only be able to select payment

formats that you define in that currency. Also, you will only be able to pay

invoices that you enter in this foreign currency.

IBAN (International Bank Account Number):

The IBAN is an international standard that uniquely identifies the account

number of a bank's customer. It is used in eurozone countries to help ensure

errorfree crossborder payments. The IBAN is validated upon entry. If you

provide the IBAN on your supplier's bank account, then we recommend that you

also provide the BIC for that supplier's bank branch.

Account Type: Bank account type. The seeded

values are SAVING, CHECKING and OTHER.You can define additional bank account

types in the Oracle Cash Management Lookups window. For example, you could add

Controlled Disbursement for your internal bank account. Checking would be used

for a supplier or customer bank account.

Account Suffix: An identifier for your

bank.

EFT Number: Your enterprise's EFT

(electronic funds transfer) user number. This number is used to identify your

company on any EFT transmissions with the bank.

Secondary Account Reference: Additional

account reference. For your reference only.

Account Holder: Name of the person or

organization within your organization who is responsible for this account

(optional).

Description: Description of the Bank

Account. For your reference only.

Alternate Account Holder: The alternate

name for your bank account holder. If you are using this internal bank account

to process NACHAformatted electronic payments, then enter the name of the tax

reporting entity that will be referenced by the payment files, exactly as it

appears in the Reporting Entity window. If you do not use this bank account for

NACHAformatted payments, then this value is not used by the system and is for

your reference only.

Start Date: Enter the start date if you

want to limit the time during which this supplier site uses this bank account

as the primary bank account for receiving electronic payments in the bank

account currency.

End Date: Enter the end date if you want to

limit the time during which this supplier site uses this bank account as the

primary bank account for receiving electronic payments in the bank account

currency.

Account Controls Window References

General Controls Region

Cash: Enter the cash account number. If the

cash account number is in 5 segmental format, such as Company DepartmentAccountSubAccountProduct.

enter the number as 0100011100000000.

Cash Clearing: Enter the cash clearing

account number. If the cash clearing account number is in 5 segmental format,

such as CompanyDepartmentAccountSubAccountProduct. enter the number as 0100011100000000.

Bank Charges: Enter the bank charges

account number. If the bank charges account number is in 5 segmental format,

such as CompanyDepartmentAccountSubAccountProduct. enter the number as 0100011100000000.

Bank Errors: Enter the bank errors account

number. If the bank errors account number is in 5 segmental format, such as

CompanyDepartmentAccountSubAccountProduct. enter the number as 0100011100000000.

Foreign Exchange Charges: Enter the foreign

exchange charges account number. If the foreign exchange charges account number

is in 5 segmental format, such as CompanyDepartmentAccount SubAccountProduct.

enter the number as 0100011100000000.

Agency Location Code: If your enterprise is

a United States federal agency, then you might need to enter an Agency Location

Code. This code is assigned by the United States Department of the Treasury to

identify the source of financial transactions.

Netting Account: Select Yes or No. When

netting receipts, both receipts must be in the same currency.

Cash Management Controls Region

Minimum Target Balance: You can define a

minimum target balance for bank accounts. The target balances help you

determine the minimum balance for bank accounts that you include in your cash

position.

Maximum Target Balance: You can define a

maximum target balance for bank accounts. The target balances help you

determine the maximum balance for bank accounts that you include in your cash

position.

Minimum Payment Amount: You can opt to pay

the minimum payment available.

Minimum Receipt Amount: This is the minimum

amount in this currency that must be specified when you create automatic

receipts with this payment method.

Rounding Factor: Select the method the

factor in amounts are displayed.

Rounding Rule: Select the rounding rule.

The options are Round Up, Round Down, or Nearest. Cash Flow Display Order: Cash

receipts minus cash disbursements from a given operation or asset for a given

period.

Payables Controls Region

Multiple Currency Payments: Enable this

option if you want to use this bank account to pay invoices entered in multiple

currencies. You can select this option only if the Use Multiple Currencies

Payables option is enabled and if the bank account is in your ledger currency.

Allow Zero Payments: Enable this option to

allow zeroamount payments from this bank account.

Pooled Account: If you use Automatic

Offsets and you want to associate multiple companies with this bank account,

then enable this option. When you enable the Automatic Offsets Payables option,

Payables creates one offsetting liability distribution for each invoice

distribution. If you then pay the invoice from a pooled bank account, then

which Payables accounts for the invoice payment, Payables creates one

corresponding cash accounting entry for each liability distribution. In

addition, Payables builds the cash account based on the Cash Account defined

for the bank account, and on the account segments of the liability lines. If

you do not use a pooled account, then when Payables accounts for the payment,

it creates a single accounting entry for the Cash Account, and uses the Cash

Account that is defined for the bank account without modifying any account

segments.

Maximum Outlay: The largest currency outlay

that you allow for a payment batch for this bank account. If the total outlay

of a payment batch exceeds the maximum outlay for the payment batch, then

Payables displays a warning, but allows you to continue processing the payment

batch. The Maximum Outlay for a bank account defaults from the Payables Options

window. When you initiate a payment batch using the bank account, Payables uses

the bank account's Maximum Outlay as a default. You can override this default.

Minimum Payment: The lowest payment amount

that you allow in a payment batch. Maximum Payment: The largest payment amount

that you allow in a payment batch.

Receipt Controls Region

Multiple Currency Receipts: Check this

check box to define the bank account as a multiple currency bank account. A

multiple currency bank account is an account that accepts payments in more than

one currency.

Reconciliation Controls Region

Payables Matching Order: Select Transaction

or Batch.

Float Handling: Select Error or Ignore.

Receivables Matching Order: Select

Transaction or Batch.

Foreign Currency Bank Region

Exchange Rate Type: AutoReconciliation

selects the exchange rates for the transaction currency using the Exchange Rate

Type that you specify. You can choose any Exchange Rate Type.

Exchange Rate Date: AutoReconciliation

selects the exchange rates for the transaction currency using the date source

you specify. You can choose any of the following exchange rate dates:

Bank Statement GL Date: The accounting date

used to clear the statement. Bank Statement Date: The closing date of the

statement.

Statement Line Date: The date the

transaction cleared the bank. Transaction Creation Date: The date the

transaction was created.

Transaction Creation GL Date: The

accounting date used to create the transaction. Transaction Exchange Rate Date:

The date associated with the exchange rate that was used to create the

transaction.

Open Interface Controls Region

Use Reconciliation Open Interfaces: Enable

the checkbox if you use this feature.

Open Interface Matching Criteria: This

parameter specifies the matching criteria for open interface transactions. The

default is Transaction Number. If you want to reconcile bank statement lines to

Treasury settlements, then select the Date and Amount option.

Float Status: Status of open interface

transactions that are available for clearing and reconciliation. If you

reconcile only Treasury settlements in the Reconciliation Open Interface, then

enter the Reconciled status code.

Clear Status: Status of open interface

transactions that have cleared or reconciled. If you reconcile only Treasury

settlements in the Reconciliation Open Interface, then enter the Available

status code.

Manual Reconciliation Tolerances Region

Tolerance Amount: You enter reconciliation

tolerances as an amount.

Tolerance Percentage: You enter

reconciliation tolerances as a percentage.

Assign Account Access

Enter information in the Account Access

tab. In this step you will define for which organizations and in which

functional areas such as Payables, Payroll,

Receivables, or Treasury, or all, that this bank account can be used. For

example, you can let Operating Unit # 1 use this bank account in Payables and

Receivables, but limit

Operating Unit # 2 to use this bank account

only in Payables. If you choose a particular functional area for you bank

account, you will be taken to the page where you may be required to enter

certain bank account attributes that are unique for this particular functional

area. It is also important to note that if you grant Operating Unit # 1 access

to this bank account in Payables and Receivables, then all users who have been

granted access to Operating Unit #1 will be able to use this bank account in Payables

and Receivables (provided that the functional access has been granted to these

uses as well).

Assign Account Contact

Enter information in the Account Contact

tab.

2. Creation of Receipt

Class and Receipt Method:

Navigation: Receivables Manager

à Setup à Receipts à Receipt Classes

Receivables uses receipt methods to account

for your receipt entries and applications. Receipt methods also determine a

customer's remittance bank information.

Note: You define receipt methods in the

Receipt Classes window.

You can assign multiple remittance banks to

each receipt method, but only one bank account can be the primary account for

each currency. For each remittance bank branch account assigned to a receipt

method, you must define all of your receipt accounts. You can then assign your

receipt methods to your receipt sources to use with your AutoLockbox and

manually entered receipts.

If you remit receipts in several currencies

for a single receipt method, then you must enter at least one remittance

bank per currency. At least one of these

remittance banks must be primary.

The receipt class you assign to each of

your receipt methods determines the processing steps that Receivables requires

for receipts that you create using this receipt method. These steps include

whether to require confirmation, remittance, and bank clearance for receipts

that you create with a specific receipt class. See: Receipt Classes.

Receivables requires that you specify a

receipt method when you create your automatic receipts through the Receipt

Batches window. You also assign receipt methods to invoices when you manually

enter them in the Transactions window. If an invoice will be automatically paid

by credit card, direct debit, or bills receivable, then you must assign an

automatic receipt method to the invoice.

Note: Enable automatic correction of funds

transfer errors by mapping error codes to corrective actions, for each

automatic receipt method. See: Enabling Automatic Funds Transfer Error

Corrections.

You can assign all receipt methods to

transactions in the Transactions window, except for bills receivable remittance

receipt methods. You enter bills receivable remittance receipt methods in the

Remittances window.

This example will demonstrate setting up

for creation method automatic and payment method credit card

1. Navigate to the Receipt Classes window.

2. Enter a unique Name for your Receipt

Class.

3. If you are creating a Notes Receivable

receipt class, check the Notes Receivable box. You cannot change this attribute

after you assign a receipt method and then save this receipt class. See: Notes

Receivable, Oracle Receivables User Guide.

4. Creation Method.

If you choose Automatic, you

can create receipts with this receipt class using the Automatic Receipt

program.

See: Creating Automatic Receipts, Oracle

Receivables User Guide. In addition, for these receipts, Oracle Payments is

responsible for the funds capture process. See: Enabling the Funds Capture

Process.

5. To require automatic receipts assigned

to this receipt class to be confirmed before they can be remitted, check the

Require Confirmation box. Check this box to confirm automatic receipts using

this receipt class in the Confirm Automatic Receipts window. (This will not be

used in this example) If you are defining a receipt class for use with ACH bank

account transfers, then you should not check this box.

6. Choose a Remittance Method. The

remittance method determines the accounts that Receivables uses for automatic

receipts that you create using the receipt method assigned to this receipt

class. Choose one of the following methods:

Standard: Use the remittance account

for automatic receipts or for standard bills receivable assigned to a receipt

method with this receipt class.

Note: If the creation method is Automatic,

then you cannot select No Remittance as the Remittance Method.

To require receipts created using a receipt

method assigned to this receipt class to be reconciled before posting them to

your cash account in the general ledger, choose one of the following Clearance

Methods:

1. Directly: Choose this method

if you do not expect the receipts to be remitted to the bank and subsequently

cleared. These receipts will be assumed to be cleared at the time of receipt

entry and will require no further processing. Choosing this method is the same

as setting Require Bank Clearance to No in previous releases of Receivables.

By Automatic Clearing: Choose this

method to clear receipts using the Automatic Clearing program. See: Automatic

Clearing for Receipts, Oracle Receivables User Guide. (Receipts using this

method can also be cleared in Oracle Cash Management.)

By Matching: Choose this method if

you want to clear your receipts manually in Oracle Cash Management.

2. Enter the receipt method to assign to

this receipt class. See: Receipt Methods.

1. Enter a unique Name for your receipt

method, then enter how you want this receipt method to be printed on your

statements in the Printed Name field. The default Printed Name is the receipt

method name.

Note: Oracle Receivables lets you create a

receipt method only if there is no transaction type, adjustment, or receivable

activity with the same name.

2. Enter the range of Effective Dates for

this receipt method. The default start date is the current date, but you can

change it. If you do not enter an end date, this receipt method will be active

indefinitely.

3. To assign the same transaction number to

the debit memo generated when you create a debit memo reversal, check the Debit

Memo Inherit Receipt Numbers box. Do not check this box if you want Receivables

to generate unique debit memo numbers automatically. See: Reversing Receipts,

Oracle Receivables User Guide.

4. If the receipt class associated with

this receipt method has a Manual or AP/AR Netting creation method, then skip to

the last step.

5. To ensure that the receipt number is

always the same as the transaction number to which it is applied, check the

Receipts Inherit Transaction Numbers box. This option helps you track Automatic

Receipts. Do not check this box if you want Receivables to generate document

numbers for Automatic Receipts assigned to this receipt class and receipt

method.

6. If the receipt class associated with

this receipt method has an Automatic creation method, enter a Number of

Receipts Rule (see Number of Receipts Rules above).

7. Enter a Receipt Maturity Date Rule.

Receivables uses this rule to pay invoices that have different due dates with a

single receipt using this receipt method. Enter Earliest if you want the

receipt maturity date to be the earliest due date of all of the invoices that

your receipt covers. Enter Latest if you want the maturity date to be the

latest due date of all of the invoices that your receipt covers.

8. Enter the Automatic Print Program for

transmissions using this receipt method. Receivables provides one standard

receipt print program to format the output of your payment selection and

creation programs when you physically create the receipt document. If you need

a different receipt print program format, you must copy this standard receipt

print program, and modify it accordingly.

9. Specify a number of Lead Days. Lead days

indicate the number of days before the invoice due date that an invoice can be

selected for application by the Automatic Receipts program using this receipt

method.

10.

Select a funds capture payment method. A funds capture payment method is a

payment medium by which your customer chooses to remit payment to you. Oracle

Payments predefines funds capture payment methods, but you can define your own.

See: Setting Up Funds Capture Payment Methods,

Oracle Payments Implementation Guide.

Select Credit Card for transactions to be

paid by credit card.

Select Bank Account Transfer for

transactions to be paid by ACH (Automated Clearing House) transfer.

For transactions to be paid by direct

debit, create a new receipt method or use an existing receipt method, and

assign or define a new EFTspecific payment method.

11.

Select Funds Transfer Error Handling to enable the automatic correction of

funds transfer errors. See: Enabling Automatic Funds Transfer Error

Corrections.

12.

Save your work. To assign a remittance bank to this receipt method, see:

Assigning Remittance Banks.

Assign Bank Accounts (Also known as

'remittance bank')

1. Choose Bank Accounts.

2. Enter general Remittance Bank

information, such as Bank, Branch, Account Name, and range of Effective Dates.

You can only select active banks and bank branches.

3. If the creation method of the receipt

class is Automatic, enter a Minimum Receipt Amount. This is the minimum amount

in this currency that must be specified when you create automatic receipts with

this receipt method.

Note: You can also define a minimum receipt

amount at the customer profile level. Receivables uses the larger of the two minimum

receipt amounts when creating automatic receipts.

4. If the remittance method for this

receipt class is either Factoring or Standard and Factoring, specify the number

of Risk Elimination Days for receipts created with this receipt class

(optional). When you factor receipts, Receivables creates a short term debt to

account for your risk in case of customer default. When you run the Automatic

Clearing program to clear or risk eliminate these receipts, the debt is cleared

y days after each receipt's maturity date, where y is the number of risk

elimination days that you enter here.

5. If the remittance method is not No

Remittance, enter the number of Clearing Days for receipts created with this

receipt class (optional). Remitted receipts are cleared x days after their

maturity date, where x is the number of clearing days that you enter here.

Factored receipts are cleared immediately on the remittance date.

6. To be able to override this bank during

the remittance process, check the Override Bank box.

7. If you do not want this to be the

primary remittance bank account in this currency for this receipt method,

uncheck the Primary check box. You can only assign one primary remittance

account per currency to your receipt method. Receivables ensures that at least

one remittance account per currency is primary.

8. In the GL Accounts tabbed region, enter

GL Account information for this remittance bank.

Note: Cash Account, Receipt Confirmation

Account and Remittance Account cannot be updated once the record has been

saved. Therefore if incorrect data is entered it will require a new receipt

method.

9. In the Unearned Discounts and Earned

Discounts fields, select an unearned discount activity type and an earned

discount activity type from the lists of values.

10.

If using Oracle Trade Management, then in the Claim Investigations field,

select a claim investigation activity type.

Ensure the Receipt Method Name mentioned in

the receipt class is linked correctly in Payee Routing Rules.

11.

If the creation method of the associated receipt class is Automatic, open the

Formatting Programs tabbed region, then enter formatting program information.

To run a printing program when you

format remittance batches for receipts remitted to you using this receipt

method, enter a Remittance Print program. When you factor your remittances,

Receivables notifies your print program so that it functions accordingly. You

can use this program to create and send remittance advice to customers to whom

you assign this receipt method.

To run a factoring print program

when you format your batches of remitted receipts for this receipt method,

enter a Factoring Print program. When you factor your remittances, Receivables

notifies your factoring print program so that it behaves accordingly. You

cannot enter a factoring transmission program for this receipt method if your

bank branch account's factoring creation medium is magnetic medium.

Oracle

Payments Minimum/Dummy Setup For Credit Card/Purchase Card Funds Capture

Processing (Doc ID 553614.1)

Oracle

Payments Minimum/Dummy Setup For Direct Debit Funds Capture Processing (Doc ID

471418.1)

Note: This document is for customers NOT using

real time bank account processing by integrating with a backend

payment system. Setups in the document can be used to process dummy

authorization and settlement requests in order to successfully create and remit

bank account receipts.

11i

Oracle iPayment is replaced with a brand new product called Oracle Payments in

Release 12. This new product has extended functionality for funds capture

(inbound payments) and funds disbursement (outbound payments) processing. In

Release 12, both Oracle Receivables and Payables have dependency on Oracle

Payments implementation. For funds capture processing, minimum implementation

of Oracle Payments is mandatory even if realtime payment processing

functionality is not used. If real time payment processing functionality

is used, extensive setups as outlined in Oracle Payments implementation guide

are needed. This note will document the setup's needed in Oracle Payments for

merchants implementing Receivables (funds capture) without using real time

payment processing. If these setups are not performed, receipt and remittance

batches will fail with error "INVALID_PAYEE: Invalid payee

identifier".

Existing

11i customer had the ability to configure receipt class/method in such a way

that realtime payment processsing can be turned off. This was done by setting

payment type and merchant_ref to null. In Release 12, merchant_ref was

obsoleted and replaced with Payment Method, created in Oracle Payments. This

payment method is mandatory and for merchants upgrading from 11i, it will

default to 'Bank Account Transfer'. Therefore merchants upgrading to Release 12

will need to perform following dummy setups in Payments to successfully process

receipt and remittance batches.

II.

Create Payment System

a. From

Oracle Payments Setup dashboard, click on Go To Task icon for Payment

System--> Payment System.

b.

Click on Create button and enter following details to create new payment

system.

Code

= dps (or any other code)

Name = Dummy Payment System (or name of your choice)

Processing Model = Processor

Bank: Optional, can be set to remittance bank used in receipt class

Supported Capabilities : Check Bank Account Transfer under Fund Capture

Name = Dummy Payment System (or name of your choice)

Processing Model = Processor

Bank: Optional, can be set to remittance bank used in receipt class

Supported Capabilities : Check Bank Account Transfer under Fund Capture

Format

: Electronic Bank Remittances Format

Transmission

Protocol : Select File_Dump with protocol

name = Local File System Directory

Funds

Capture Processing: Bank Account Lead Days = number of days desired

Click on Save and Add Accounts.

Payment

System Accounts:

Click

on Add a row and enter details

Name:

XXRAJ CC Account

Save

Create

Funds Capture Process Profile

a.

From Oracle Payments Setup dashboard, click on Go To Task icon for Funds

Capture Setup--> Funds Capture Process Profiles

b. In

Funds Capture Process Profiles (FCPP) page, select the payment system created

in step II (imprtant) and click on Create button. Enter following detais for

FCPP.

Code

: XXRAJ DPS

Name

: XXRAJ_FCPP

Processing

Type: Bank Account

Settlement:

Outbound

Format =

Electronic Bank Remittances Format

Transmission

Protocol = Local File System Directory

Settlement

Grouping:

First

Party Organization

No

First

Party Legal Entity

Yes

Internal

Bank Account

Yes

Settlement

Currency

Yes

Settlement

Date

No

Payment

System Accounts:

Tranmission

Configuration Settlement = Select protocol name Local File Directory

Check

Enabled

Click

Apply to save

This

completes creation of funds capture process profile. Next step is to associate

FCPP with payee to be used when creating settlements.

Create

Payee

a. Go

back to payments setup screen and click on Tasks for Payee to create a new

payee with following details

Code:

XXRAJ_DPS

Name:

XXRAJ_Payee

Payment

System Accounts:

Click

on add another row and select Payment system and account created in step II

above.

Assign

operating unit of your choice. Note: Assignment of operating unit will decide

whether or not this payee will be used.

Supported

Processing Types:

Check

Bank Account Transfer

Default

Payment Systems:

For

Bank Account Transfer, goto funds capture proccess profile and attach FCPP

created in step III. Once FCPP is selected, payment system account will also be

populated automatically

Save the payee setup. This completes basic

payee creation. However, if your business requires using multiple payment

system with different settlement file formats (for example country specific

formats), then you need to setup multiple payment systems and FCPP and setup

routing rules to route authorizations and settlements to proper payment system.

The following details creation of routing rules for the payee.

Click on + to expand routing rules and

create a new routing rule using the following steps.

Rule Name

= XXRAJ Credit Card

Payment Method

= Credit Card

Criterion

= Receipt Method

Operator

= Equal To

Value

= Receipt method used for creating remittances

Payment System Account

=

Account created in step II

Funds Capture Process Profile

= FCPP created in step III

Rule Name

= XXRAJ BAT

Payment Method

= Bank Account Transfer

Criterion

= AR Receipt Method

Operator

= Equal To

Value

= Receipt method used for creating remittances

Payment System Account

=

Account created in step II

Funds Capture Process Profile

= FCPP created in step III

Click Apply to save.

3. Create and

Assign Document Sequence:

Navigation: System Administrator à Application à Sequential Numbering à Define

Name: XXRAJ Credit Card

Assigning the Document Sequence with the

receipt class

Navigation: System Administrator à Application à Sequential Numbering à Assign

4. Customer setups:

Identified

customers are to be assigned/linked with the following:-

a. Receipt Method

b. Credit Card

c. Bank

Navigation: Receivables Manager à Customers à Customers

Query for the customer

Customer Account Details à Payment Details

Assign Payment

Method (optional)

To assign receipt methods:

1. Navigate to the Payment Details

subtab of the Account Overview page.

2. Click Add Receipt Method.

3. Search and select an appropriate

receipt method.

4. Specify the start and end dates

for the method.

5. Select Primary, if this receipt

method is the primary one for this customer account

Note: You define receipt methods in

the Receipt Classes window.

Create Credit Card

(optional)

To assign credit cards:

You can assign a credit card either

by adding a predefined credit card or by creating a new credit card.

To add a credit

card

1. On the Payment Details subtab of

the Account Overview page, click Add.

2. Search and select an appropriate

credit card.

To create a credit

card

1. On the Payment Details subtab of

the Account Overview page, click Create.

2. Enter credit card details such as

number, expiration date, and statement billing address.

Note: You can also create a billing

address.

For testing purpose, Oracle provided test

credit card numbers. The available credit card numbers for testing shall be

found from the Metalink Note: 395462.1

Card Provider

Name

|

Credit Card

Number

|

American

Express

|

378282246310005

|

Create bank CC Account

5. System Options

Setups:

Navigation: Receivables

Manager à Setup à System à System Options

PROFILE

OPTION SETTINGS:-

The following profile options are to be

setup at the given levels.

Profile Option

Name

|

Level

|

Value

|

Comments and

Usage

|

ICX: Oracle

Payment Server URL

|

Site

|

Required to

establish successful internal secured HTTP/https connection. Both values are

supposed to be same and are not supposed to be modified.

|

|

IBY: ECAPP URL

|

Site

|

CREDIT

CARD INTEGRATION INFORMATION:-

Integration between

Oracle Payments and any third party happens via the following which is usually

taken care by a DBA Team:-

1. Transmission

Servlet Base URL which points to the secured connection URL of the third party

system

2. A Servlet file

which has other connection details

3. Oracle Payments

seeded API looks for a properties file called Zone.properties for the location

of the servlet file

4. The servlet file

ideally resides in $IAS_ORACLE_HOME/Apache/Jserv/etc.

5. The Zone.properties

file will be edited to link the Servlet and the Payment System created.

CREDIT

CARD TESTING:-

Create AR invoice :

Enter the source and Bill To customer

details and click on Select Instrument

Enter the Line Details:

Query the invoice in iReceivables

Click on the link

Select the credit card information and

click on Pay

View Payment

Query for the Receipt

Receipt# 1

Status of the receipt is confirmed

Navigation: - Receivables Manager à Receipts à Remittances

Click on Auto Create

Enter Receipt Number and select checkboxes

Create and Approve

Remittance batch number created

View Requests

Get Flower Effect

Get Flower Effect

2 comments:

Do you know why does it not automatically authorize at the time of 'Pay Invoice', it simply creating receipt with dummy PSON and only 'Automatic Remittance' is submitting the card for authorization? we are facing same issue and some setup seem missing.

We have a requirement in R12.1.3. Is it possible to Reverse an Credit Card Authorisation and Re-authorise it using Any API in Offline Mode/ batch Mode. The Credit Card Company has come up with a new Policy to6 penalise the Companies if we exceed the Authorisation days limit for Example if we have a Order which is paid through Credit card , the Authorisation is for say 7 days, if we donot fulfill the order due to some delay which will cross 7 days then there will be penalty for the excess days until the order is fulfilled and payment is settled.

Post a Comment