EXECUTIVE OVERVIEW

Generating payment checks from

the E-Business Suite has traditionally required either a third party or

considerable customization of the delivered check print reports. The check

print format is very specific to each banking organization, requiring specific

fonts and pixel-perfect layout. The existing E-Business Suite reports generate

flat text output and do not support these features. Oracle XML Publisher now

offers an integrated, cost-effective method to generate the check output

directly from the E-Business Suite.

INTRODUCTION

Check printing from the

E-Business Suite has historically required a third-party solution that can

either query the necessary data and format the output or accept the existing

flat text output generated by the provided check print programs. To then

generate the checks, the format components had to be placed with pixel-perfect

precision onto the page using the necessary MICR font to format the bank

routing number and bank account of the payee. Alternatively customers could

take the existing check print program and customize it to format the output

correctly. These solutions are costly in terms of their implementation, their

ongoing maintenance and their complexity. This all adds to the total cost of

ownership for the E-Business Suite.

Oracle XML Publisher offers

integrated functionality that allows customers to design their own check format

using familiar desktop tools that can then be applied to a check print data

source, whether that is the seeded Oracle Report or a custom solution. This

format is easily maintainable and can include all the necessary components

required in the final output to be printed onto blank check stock.

Taking this approach reduces the complexity of the systems

surrounding the check generation and thereby reducing the total cost of

ownership of the E-Business Suite.

Pre-requisites:

Download

BI Publisher Template Builder for Word version 10.1.3.4.1 from

download.oracle.com

Basic

requirements to start creating checks are to have an RTF file (Template) and an

XML file (data definition).

There are 2 ways

that you can have an RTF file:

o Create your own, or

o (Recommended) Download standard oracle Template

Nav : Payables Manager > Setup > Payment > Payment Administrator > Formats > XML Publisher Format Templates

o Create your own, or

o (Recommended) Download standard oracle Template

Nav : Payables Manager > Setup > Payment > Payment Administrator > Formats > XML Publisher Format Templates

Query

and download the RTF file

‘Standard Check Format’ IBYDC_STD1.rtf or

Standard Check Format (Stub After Payment) IBYDC_STD1A.rtf

‘Standard Check Format’ IBYDC_STD1.rtf or

Standard Check Format (Stub After Payment) IBYDC_STD1A.rtf

àGo to Metalink and Check Oracle Note 457539.1. This note says that the Package IBY_FD_EXTRACT_EXT_PUB controls the XML extract used in check printing. The supplied version can be found in $IBY_TOP/patch/115/sql/ibyfdxeb.pls

àBetter way is to follow the instructions in Doc ID: 465389.1 R12 Create Or Modify A Payment Format Using XML Builder. This note explains the same steps that I have defined below

MICR

Fonts.

This is another important requirement which you will run into later on. So I

have decided to address it right away because you may end up spending a lot

more time if you start thinking about it later. One of the easiest way is to

buy the MICR font from a third party like IDAutomation (http://www.idautomation.com/) and use

MICRW1B.ttf. Typical cost is around $750.00 per user license – you may need to

purchase only one license. You may also download their Demo version which is

good for testing.

The good news is that Oracle also provides a MICR font which is available if you have downloaded the BI Template Builder. Some banks reject this font, but so far I did not have any problem with the bank that we used.

Download and install BI Publisher ver 10.1.3.4.1

Font File Location: C:\Program Files\Oracle\BI Publisher\BI Publisher Desktop\Template Builder for Word\fonts\ MICR____.TTF

In order to use this file in the RTF template, copy the font file MICR____.TTF to C:\WINDOWS\Fonts

The good news is that Oracle also provides a MICR font which is available if you have downloaded the BI Template Builder. Some banks reject this font, but so far I did not have any problem with the bank that we used.

Download and install BI Publisher ver 10.1.3.4.1

Font File Location: C:\Program Files\Oracle\BI Publisher\BI Publisher Desktop\Template Builder for Word\fonts\ MICR____.TTF

In order to use this file in the RTF template, copy the font file MICR____.TTF to C:\WINDOWS\Fonts

At this stage, you

may or may not have designed the Check template. But you can still use

IBYDC_STD1.rtf downloaded earlier.

Following steps are needed to create a check in AP from scratch. These steps may also be used to create the initial payment to get the XML file.

Following steps are needed to create a check in AP from scratch. These steps may also be used to create the initial payment to get the XML file.

Step

1: Create XML Template

Navigation : Payables Manager à Setup à Payment à Payment Administrator à Formats à XML Publisher Format Templates

Navigation : Payables Manager à Setup à Payment à Payment Administrator à Formats à XML Publisher Format Templates

Click

'Create Template'

Enter below details

Name

|

: XX_APPS88_CHECK

|

Code

|

: XX_APPS88_CHECK

|

Application

|

: Payments

|

Type

|

: RTF

|

Data Definition

|

: Oracle Payments Funds Disbursement Payment Instruction

Extract 1.0

|

Default File Language

|

: English

|

Default File Territory

|

: UNITED STATES

|

Upload your RTF File

Step

2: Create Payment Format

Navigation : Payables Manager > Setup > Payment > Payment Administrator > Formats > Formats

Navigation : Payables Manager > Setup > Payment > Payment Administrator > Formats > Formats

Select

Type = Disbursement Payment Instruction

Click

on Create

Enter below details

Enter below details

Name

|

: XX_APPS88_CHECK

|

Code

|

: XX_APPS88_CHECK

|

Data Extract

|

: Oracle Payments Funds Disbursement Payment Instruction

Extract 1.0

|

XML Publisher Extract

|

: XX_APPS88_CHECK (XML Template name created in Step 1)

|

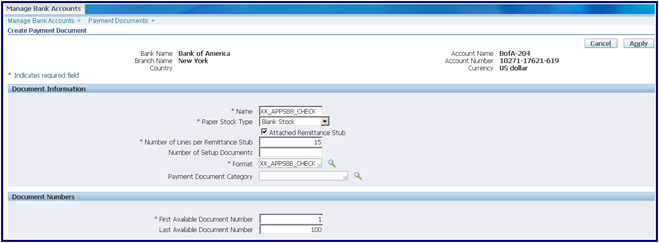

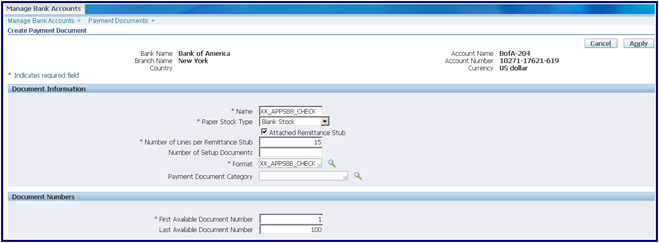

Step 3: Create

Payment Document

Navigation : Payables Manager > Setup > Payment > Bank Accounts

Navigation : Payables Manager > Setup > Payment > Bank Accounts

Account name

|

: BofA-204

|

Query

up your Bank Name. It is assumed that your Bank has already been setup in AP.

Select the Bank Account and click on Manage Payment Documents.

Click on Create

Select the Bank Account and click on Manage Payment Documents.

Click on Create

Enter:

Name

|

: XX_APPS88_CHECK

|

Paper Stock Type

|

: Blank Stock or Prenumbered Stock

|

Attached

Remittance Stub

|

: Yes

|

If you have remittance stub, check the box for Attached Remittance Stub

Important: If you check the

above box, a new field called ‘Number of Lines per Remittance Stub’ will show

up. This is number that you will have to find out by trial and error once you

start testing your template. Initially, set it to a lower number, say 15.

Format

: XX_APPS88_CHECK (Enter Format defined in step

2)

First Available Document Number:

Last Available Document Number

Enter any other information that you may need.

Click Apply

First Available Document Number:

Last Available Document Number

Enter any other information that you may need.

Click Apply

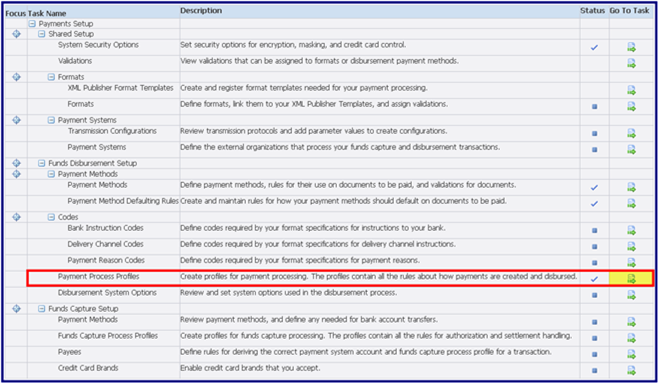

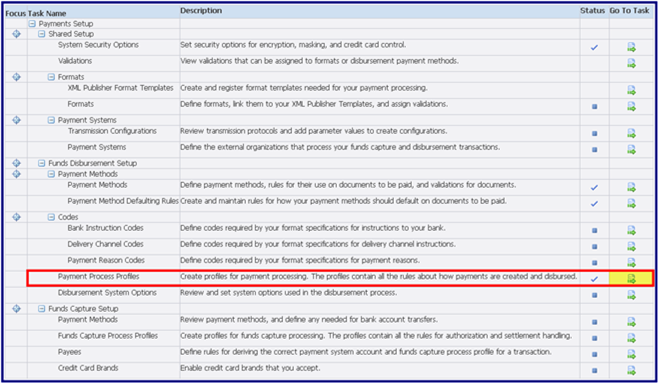

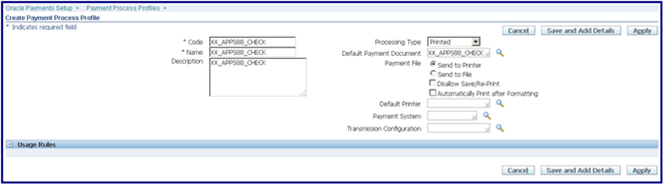

Step 4: Create

Payment Profile

Navigation : Payables Manager > Setup > Payment > Payment Administrator > Payment Process Profiles

Navigation : Payables Manager > Setup > Payment > Payment Administrator > Payment Process Profiles

Click

on Create

Enter

Enter

Code

|

XX_APPS88_CHECK

|

Name

|

XX_APPS88_CHECK

|

Payment Instruction Format

|

XX_APPS88_CHECK (As defined in Step 2)

|

Processing Type

|

Printed

|

Payment Completion Point

|

When the Payment Instruction is Formatted

|

Default Payment Document

|

Document created in Step 3

|

Payment File

|

Send to Printer

|

Check the box ‘Automatically Print After Formatting’ (Note: You may choose not to check this box initially – it will help in testing)

Default Printer: Valid oracle printer name

Click Apply

Now you are all set

to create checks. All you have to do is create an Invoice, or select any

existing validated invoice for a vendor.

There

is one more thing that you must check before creating the payment.

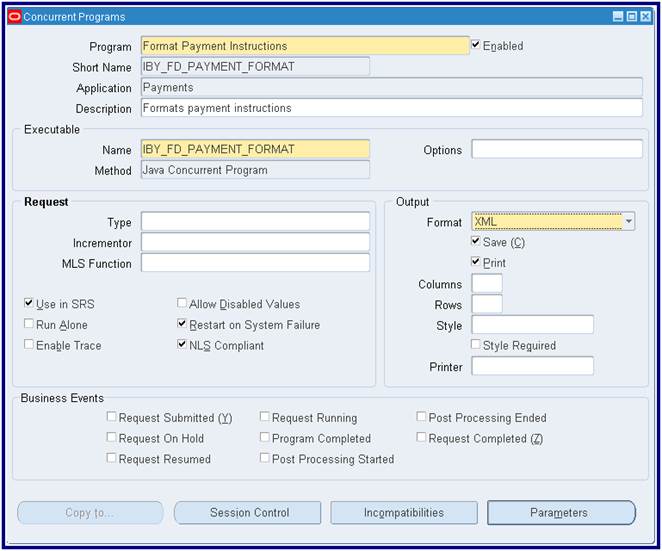

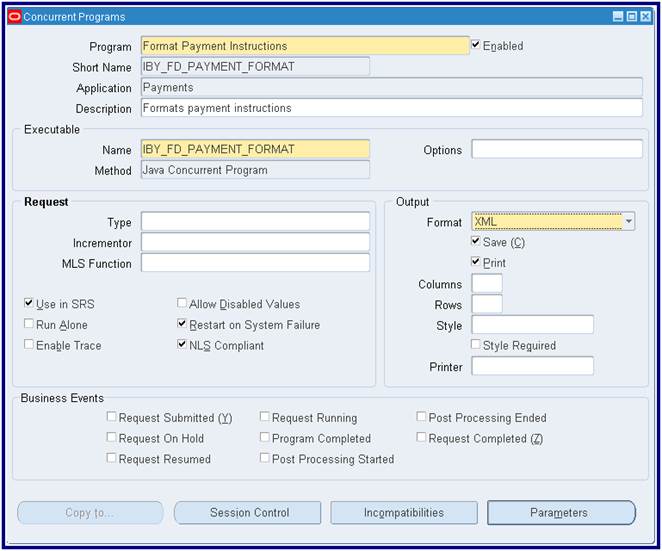

Verify Concurrent Program

Go to Application Developer or Sys Admin responsibility and bring up the concurrent program Format payment Instructions

Navigation : Concurrent > Program > Define > F11 > Format Payment Instructions > Ctrl-F11

(Short Name: IBY_FD_PAYMENT_FORMAT)

Set Output Format to XML: Use this option to first generate your XML (Data Definition) file

Set Output to PDF : This will create your check in PDF format once your check template is ready. Also, Set Style to PDF Publisher in this case

Verify Concurrent Program

Go to Application Developer or Sys Admin responsibility and bring up the concurrent program Format payment Instructions

Navigation : Concurrent > Program > Define > F11 > Format Payment Instructions > Ctrl-F11

(Short Name: IBY_FD_PAYMENT_FORMAT)

Set Output Format to XML: Use this option to first generate your XML (Data Definition) file

Set Output to PDF : This will create your check in PDF format once your check template is ready. Also, Set Style to PDF Publisher in this case

There

is one more way to get the XML, In the formats change xml publisher name to

“Extract Identity”

Navigation : Payables Manager > Setup > Payment > Payment

Administrator > Formats > Formats

Query with format name(XX_APPS88_CHECK) and change the XML Publisher Template value to “Extract Identity”.

Query with format name(XX_APPS88_CHECK) and change the XML Publisher Template value to “Extract Identity”.

How

to Submit a Request to create Payments

Submission process for AP Checks/Payments has also changed in R12. Most of the options are now available in HTML screens. The good news is that you can create templates (Not XML templates - these are different) so that you do not have to enter the same information every time you submit a request.

Submission process for AP Checks/Payments has also changed in R12. Most of the options are now available in HTML screens. The good news is that you can create templates (Not XML templates - these are different) so that you do not have to enter the same information every time you submit a request.

Submit

Request:

Navigation : Payables Manager > Payment Manager > Submit Single Payment Process Request

Following parameters are minimum required - you can enter others as necessary:

Navigation : Payables Manager > Payment Manager > Submit Single Payment Process Request

Following parameters are minimum required - you can enter others as necessary:

Payment Process Request name (Mandatory)

|

: Provide any useful Name

|

Use Template

|

: Leave Blank

|

Payee

|

: Vendor Name

|

Payment Method

|

: Check (Or any other name that has been setup is payment

method)

|

Click

on Payment Attributes Tab:

Payment Date

|

: Defaulted to today's date

|

Disbursement Bank Account

|

: BofA-204 (Enter your Bank Account Name associated with this

payment)

|

Payment Document

|

: XX_APPS88_CHECK (Enter payment document name created in Step

3 above)

|

Payment Process Profile

|

: XX_APPS88_CHECK (This value will get filled automatically

with the profile defined above in step 4)

|

Payment Exchange Rate Type

|

: Enter valid excahnge rate type (Ex: Corporate, Spot)

|

These

parameters are sufficient to create a payment. Click on Submit in order to

process. However, I do recommend following steps also in the begining.

Click on Processing Tabs:

Check following boxes

- Stop Process

for Review After Scheduled Payment Selection. This step

will stop after building the payments so that you can review the payments

selected, and cancel any of them, if necessary

- Stop Process

for Review After Creation of Proposed Payments

Click on Submit. Click on Home. Click on Monitor Requests.

How

to Create Template for Request Submission

Note: All of the fields in this process are the same as in 'Submit Single

Request'. Enter any fields that you repeat for request submission. In the above

example, usually leave the Payee field blank if you want to run for separate

vendors every time. Once the template has been created and saved, you may enter

the template name in the field 'Use Template' in the example above.

There are several other options which I haven't explored yet. I will add more once I get to try them out.

There are several other options which I haven't explored yet. I will add more once I get to try them out.

Navigation : Payables Manager > Payment Manager >

Create Template

Name

: XX_APPS88_CHECK

Scheduled

Payment Selection Criteria:

The

Scheduled Payment Selection Criteria tab allows you to specify invoice

selection criteria for the “AutoSelect” process to use when it selects eligible

invoices/memos for the batch, such as

The

Payment Attributes tab allows you to specify how the batch will be paid,

including:

•

what Payment Date you want to see on the payments (required)

•

which internal bank account you want to pay from (optional)

•

which set of Payment Documents you want to use (optional)

•

which Payment Process Profile you want to use (will default if Payment

Documents are specified)

•

which Payment Exchange Rate Type you want to use (required)

•

other items related to financial methods of paying this batch

The

Processing tab allows you to specify features you want to use during the PPR process,

and how they should work:

• Maximize Credits

|

: Check this if you want the system to apply any available memos

up to the point where the payment for the supplier will be zero (and you have

done setups to allow for zero payments)

|

• Stop Process for Review After Scheduled Payment Selection

|

: Check this if you want to stop the PPR process after the

initial batch of eligible invoices/memos has been selected so you can review

the batch and modify the batch, if needed

|

• Calculate Payment Withholding and Interest During the

Scheduled Payment Selection

|

: Check this if interest and/or WH tax was not previously

calculated (at the time of invoice validation). If checked, the system will

calculate it during the Build process

|

• Stop Process for Review After Creation of Proposed Payments

|

: Check this if you want to stop the PPR process after the

proposed payments have been created so you can review the proposed payments,

and modify the payments, if needed

|

• Create Payment Instructions

|

: Select whether you want the system to automatically kick off

the Create Payment Instructions program automatically, or if you would prefer

to kick off the program manually from the SRS form

|

The

Validation Failure Results tab allows you to specify what should happen if a

Document (an invoice/memo) or a Payment fails a pre-defined (or user-defined)

Validation:

•

If a DOCUMENT fails a validation, the system should:

•

Reject only those document(s) that failed, and proceed with the rest

•

Reject all of the supplier’s documents even if only one of their documents

fails validation

•

Reject all documents selected for the PPR if ANY document in the batch fails

validation

•

Stop the process for a review of the failed document(s)

•

If a PAYMENT fails validation, the system should:

•

Reject only those payment(s) that failed, and proceed with the rest

•

Reject all of the supplier’s payments even if only one of their payments fails

validation

•

Reject all payments selected for the PPR if ANY payment in the batch fails

validation

•

Stop the process for a review of the failed payment(s)

PPR

- Payment Process Profile

PPR Process:

DOCUMENT SELECTION ("AUTOSELECT")

|

(Code: AP_AUTOSELECT_PKG): The Selection process is handled by

Payables (AP), the calling product.

|

When a PPR is submitted, a record is created in

AP_INV_SELECTION_CRITERIA_ALL with a checkrun_name, which is the same as the

PPR Name.

|

Selection: Invoices are then selected based

on Due Date, Discount Date, Pay Group, and other criteria

provided by the user while completing the PPR header.

|

The table AP_SELECTED_INVOICES_ALL is populated with selected

invoices.

|

The table AP_UNSELECTED_INVOICES_ALL is populated with the

invoices that were not selected.

|

Locking:After selecting the documents, the

invoices are locked to prevent other check runs from selecting the same

invoices.

|

AP_PAYMENT_SCHEDULES_ALL.checkrun_id is populated on the

selected documents (invoices).

|

Review:If the PPR has been setup to Stop

Process for Review After Schedule Payment Selection (option

available on the header of the PPR), the process stops for user review after

the initial selection of payables documents has been completed. The status of

the PPR is set to "Invoices Pending Review". After the user

reviews and/or modifies the selected documents, and clicks on the Submit button,

AP calls the IBYBUILD program.

|

If the Stop Process for Review After Schedule Payment

Selection parameter was not enabled, then at the end of invoice

selection, the Build program is submitted automatically.

|

If no invoices met the selection criteria, the PPR is canceled

automatically and the status of the PPR is set to "Canceled - No

Invoices Selected"

|

BUILD PAYMENTS

|

(Code: IBY_DISBURSE_SUBMIT_PUB_PKG): The Build Payments process

is handled by Oracle Payments (IBY).

|

The Build Payments program first creates a record in

IBY_PAY_SERVICE_REQUESTS with call_app_pay_service_req_code = checkrun_name.

|

The Build Payments program goes on to populate the

IBY_DOCS_PAYABLE_ALL table with the proposed payments.

|

The link to the payment service request table is through the

PAYMENT_SERVICE_REQUEST_ID.

|

Internal Bank Account / Payment Process Profile Assignment(Code:

IBY_ASSIGN_PUB): If the PPR has a default internal bank account and Payment

Process Profile (PPP) assigned to it on the header of the PPR, the values are

assigned to all of the selected documents in the PPR.

|

If a default internal bank account and PPP were not provided by

the user on the header of the PPR, Oracle Payments attempts to default the

values. If it cannot find a default value for all of the selected documents,

the PPR status is set to "INFORMATION REQUIRED". The user display shows

it as "Information Required - Pending Action". The user will need

to use the Information Required window to provide the missing internal bank

account(s) and PPP(s) for each selected document.

|

Document Validation (Code:

IBY_VALIDATIONSETS_PUB): During this step, Oracle Payments validates all the

documents (selected invoices & memos) using Pre-Defined and User-Defined

Validations assigned to Payment Methods assigned to the selected documents.

Afterward, the program validates all the documents again, using the

Pre-Defined and User-Defined Validations assigned to Payment Formats

associated with the PPPs specified on the PPR.

|

If all the documents pass validation, all the documents are set

to a status of VALIDATED in the tables and the request status is displayed as

"Documents Validated".

|

If there any document validation failures, Oracle Payments uses

the parameter setting for "Documents" on the Validation Failure

Results tab on the PPR header (the DOCUMENT_REJECTION_LEVEL_CODE) to

determine the next action.

|

REQUEST: Reject all documents in this PPR

|

DOCUMENT: Reject only the document in error

|

PAYEE: Reject all the documents related to the supplier

|

NONE: Stop the PPR for review

|

Create Payments

|

(Code: IBY_PAYGROUP_PUB): The validated documents are then

grouped into "proposed" payments based on the grouping rules - both

User-Defined and hard-coded. It then numbers the proposed payments with an

internal identifier (not "the" check number) and validates the

payments.

|

Records are inserted into IBY_PAYMENTS_ALL that holds the payment

information for the selected documents (invoices). The Build Payments program

then updates the IBY_DOCS_PAYABLE_ALL table with the payment_id and

formatting_payment_id values of the payment associated with each document.

|

If there any payment validation failures, Oracle Payments uses

the parameter setting for "Payments" on the Validation Failure

Results tab on the PPR header (the PAYMENT_REJECTION_LEVEL_CODE) to determine

the next action.

|

§ REQUEST: Reject all documents in this PPR

|

§ DOCUMENT: Reject only the document in error

|

§ PAYEE: Reject all the documents related to the supplier

|

§ NONE: Stop the PPR for review

|

If the PPR setup Stop Process for Review After Creation of

Proposed Payments is enabled on the Process tab of the PPR header, the

displayed PPR status is set to "Pending Proposed Payment Review".

This status prevents further processing until user takes action.

|

If this option to stop for a review is not enabled, the

displayed status of the PPR is set to "Payments Created". In this

status, payment instructions can be created for the PPR.

|

FORMAT PAYMENTS

|

(Codes: IBY_PAYINTSR_PUB, IBY_CHECKNUMBER_PUB): The Format

Payments process is handled by Oracle Payments (IBY).

|

When a PPR is submitted, the program checks the setting for the

Create Payment Instructions parameter on the Process tab of the PPR header to

determine if the associated payment instruction(s) (PI) should be created

automatically after the payments are created (the

CREATE_PMT_INSTRUCTIONS_FLAG = Y), or if the program is to wait for a manual

kick-off of the Format Payment Instructions program through the Standard

Request Submission form (SRS) (the CREATE_PMT_INSTRUCTIONS_FLAG = N).

|

If the PPR is set up to automatically submit instruction(s), the

payment_service_request_id will be populated in IBY_PAYMENT_INSTRUCTIONS_ALL

because the instruction will be specific to the PPR. In this case, the

instruction(s) can be linked to the PPR using PAYMENT_SERVICE_REQUEST_ID.

|

If the PPR is set up for the user to submit the instruction

program manually on the SRS form, then when the instruction(s) is submitted,

the instruction(s) is linked to the PPR through the payments selected by the

instruction(s). The link in this case will be through the

payment_instruction_id in IBY_PAYMENTS_ALL.

|

Sort and number the payments (paper checks and possibly,

electronic payments)

|

Create XML extracted message

|

Pass the extract to Oracle XML Publisher (also known as "BI

Publisher")

|

XML Publisher applies the formatted template to the payments

|

XML Publisher formats and stores the output

|

Oracle Payments then updates the status of the Payment

Instruction(s) and the PPR. If successful, the displayed status of the PPR is

"Formatted", and the status of the Payment Instruction(s) will be

"Formatted" for electronic payments and "Formatted - Ready for

Printing" for check payments

|

Print checks:

|

Users can load stationery into the printer and print checks at

this stage by clicking on the Take Action icon for the related Payment

Instruction on the Search PPRs window.

|

Determine if the checks printed OK, and if so, click on the Take

Action icon again to be taken to the "Record Print Status" window,

and click on the Record Print Status button. If there were problems with the

printing process (paper jams, skipped checks, etc.) -- especially if you are

using pre-numbered check stock -- use the Reprint button to reprint the batch

and record any spoiled (ruined) and/or skipped check numbers.

|

Transmit electronic payments:

|

Electronic payments can be transmitted at this point.

|

CONFIRM PAYMENTS

|

(Code: AP_PMT_CALLOUT_PKG): The Selection process is handled by

Payables (AP).

|

In order to confirm the printing of paper checks, the user needs

to use the Record Print Status window to confirm which pre-numbered paper

stock printed OK, and which (if any) were skipped or were damaged beyond

repair ("spoiled").

|

Oracle Payments calls ap_pmt_callout_pkg.payment_completed to

confirm the payments. During this step, the program does the following:

|

Assigns sequence values for Document Sequencing (Vouchering).

|

Creates data in the AP_CHECKS_ALL table with the appropriate

data from the IBY tables.

|

Inserts data into the AP_INVOICE_PAYMENTS_ALL table for the

corresponding checks.

|

The documents (invoices) are updated in the

AP_PAYMENT_SCHEDULES_ALL table to indicate in the Invoices Workbench the

payment details and status.

|

The documents not paid in this PPR are released by setting the

checkrun_id on the Payment Schedules to NULL.

|

The AP_INVOICES_ALL table is updated to show the payment status

in the Invoices Workbench for those documents that were paid by the PPR.

|

Data for this PPR is deleted from the AP_SELECTED_INVOICES_ALL

table.

|

Data for this PPR is deleted from the AP_UNSELECTED_INVOICES_ALL

table.

|

"Completing" Electronic Payments: Electronic

payments are not "confirmed" in the same way that paper documents

are handled. The system will automatically mark electronic payments as

"completed" based on the setting you chose for the "Completion

Point" field on the header of the associated Payment Process Profile

(PPP):

|

"Built" = the payments will be marked as

"complete" when the Build process completes

|

"Payment Instruction is Created" = the payments will

be marked as "complete" when the PI is created

|

Payment Instruction is Formatted" = the payments will be

marked as "complete" when the PI has successfully completed the

Formatting process

|

"Payment Instruction is Transmitted" = the payments

will be marked as "complete" when they are transmitted"

|

PPR Status:

NEW:A1:A58

|

This status indicates that the PPR has been successfully

submitted for processing, and the AutoSelect program is digesting the

criteria provided by the user on the header of the PPR in preparation of the

automatic selection the invoices and memos related to that criteria.

|

SELECTING INVOICES:

|

This status indicates that the AutoSelect program is selecting

the eligible invoices/memos for the payment batch based on Due Date,

Discount Date, Pay Group, and other criteria provided by the user on the

header of the PPR.

|

CANCELLED - NO INVOICES SELECTED:

|

If no invoices or memos met the selection criteria provided by

the user on the header of the PPR, the PPR is automatically terminated and

the status changes to this status.

|

"MISSING..." STATUSES:

|

Other statuses may appear at this point in the process if the

user failed to included required information on the PPR header, such as

"Missing Exchange Rates", etc.

|

INVOICES SELECTED:

|

After selecting the documents (invoices/memos), they are locked

to prevent other checkruns from selecting the same documents.

|

INVOICES PENDING REVIEW:

|

This status will only appear if you selected the Stop

Process for Review After Scheduled Payment Selection option on

the Processing tab of the PPR header. This status means that

the PPR process has stopped, and is waiting for you to review the invoices

and memos that were selected for payment (and make any changes to the batch,

as needed). Click on the Take Action icon to be taken to

the Review Selected Scheduled Payments window.

|

CALCULATING SPECIAL AMOUNTS:

|

This status will only appear if you selected the Calculate

Payment Withholding and Interest During the Scheduled Payment Selection option

on the Processing tab of the PPR header. This status means

that interest and withholding tax are being calculated and applied, as

necessary, to the invoices and memos selected for this payment batch.

|

ASSEMBLING/ASSEMBLED PAYMENTS:

|

An "interim" status, it appears after the calculation

for interest and withholding has been completed, and the Build Payments

program is starting. It may appear again later after the user provides any

required bank account and PPP information for the invoices/memos

("documents") selected.

|

INFORMATION REQUIRED - PENDING ACTION:

|

This status appears if you did not provide a default Internal

(Disbursement) Bank Account and/or PPP on the header of the PPR. In that

case, you need to click on theTake Action icon to be taken to a

form where you can decide which internal bank account and PPP should be used

for each invoice and memo selected for payment.

|

PENDING PROPOSED PAYMENT REVIEW:

|

This status will only appear if you selected the Stop

Process for Review After Creation of Proposed Payments option on

the Processing tab of the PPR header. In this case, the

system is waiting for you to review (and modify, if needed) the proposed

payments for this batch. Click on the Take Action icon to be

taken to the Review Proposed Payments window.

|

FORMATTING:

|

This status indicates that the proposed payments have been

turned into payment instruction files. At this point, you will want to click

on the Show link to view the new associated payment

instruction file(s). Each payment instruction file with have their own PI Reference

Number. If you have both electronic and paper ("check")

payments involved in this payment batch, you will see a payment instruction

file for each type of payment method.

|

PAYMENT INSTRUCTION STATUSES:

|

An "electronic" type of payment instruction file will

usually be marked as FORMATTED at this stage, which means

the PI has been created, (and based on your setups) may also have been

transmitted, and even marked as "Complete".

|

A "check" type of payment instruction file will (based

on your setups) usually be marked as FORMATTED - READY FOR PRINTING,

which means the payment instruction file was created, and is waiting to be

sent to your printer. Click on the Take Action icon to send

the file to the printer.

|

Afterward, the Status will change to SUBMITTED

FOR PRINTING. Click on the Take Action icon again to

"confirm" the payments (Record Print Status). This is also

where the user will have an opportunity to "Reprint" the payment

instruction file, if there were problems during the first printing process.

Once the payment instruction file has been printed, an internal Payment

Reference Number is assigned to the payment, along with a Paper

Document (Check) Number.

|

Once the user clicks on the Record Print Status button

(and confirms it), the payment instruction file's Status changes

again, this time toPRINTED.

|

CONFIRMED PAYMENT:

|

Once the payment instructions have been transmitted/printed and

confirmed, the Status of the PPR changes to this status to

indicate a successfully completed payment batch (PPR).

|

TERMINATED:

|

If the user terminates a PPR anytime prior to confirmation of

the payments (using the Terminate icon), the status will

change to "Terminated", and the PPR is permanently closed.

|

PPR Reports:

Payment Process Request Status Report: The

Payment Process Request Status Report is a report that you can run that

displays proposed payment information. You can request the report to run automatically

after proposed payments have been created and validated or run the report by

standard report submission. The report provides parameters, such as the

Payment Process Request name/identifier and runs if the Payment Process

Request status is "Payments Created".

|

Payment Instruction Register: Once

a payment instruction has been formatted, payments within that payment

instruction can be reviewed in report format. The Payment Instruction

Register can be run at any time after payment instruction creation. The

report lists the various statuses of payments within the payment

instructions, such as Formatted or Transmitted.

|

Separate Remittance Advice:The

Separate Remittance Advice is a report sent to a payee that lists the

documents payable paid as part of each payment. You can specify the format

for the remittance advice document and the delivery method.

|

Positive Pay: A

positive pay file is a security measure in the form of a document that the

deploying company sends to its payment system or bank to inform it of

payments made by check. When you print checks, then you can electronically

transmit a list of payments to the bank or payment system that indicates the

checks you printed, so the bank or payment system knows what checks to pay.

This list prevents the payment system or bank from paying fraudulent checks,

since such checks are not listed on the positive pay file.

|

R12 Oracle Payments offers two versions of the Positive Pay

report:

|

the Positive Pay File program, and

|

the Positive Pay File with Additional Parameters program.These

programs replace the R11i report called the Positive Pay Report.

|

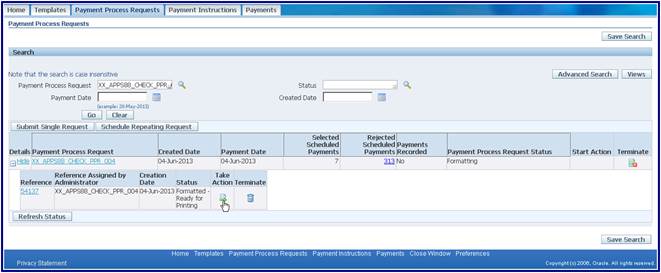

Submitting

PPR with Submit Single Format Payment Process Request

Search

with payment details

Navigation : Payable Manager à Payments à Entry à Query with below details

Operating Unit

|

: Vision Operations

|

Bank Account

|

: BofA-204

|

Payment Method

|

: Check

|

Status

|

: Negotiable

|

Or

Click

on the find button and enter the values and click on find

Void

the payments

Click

on Actions à Check the Void à Ok

Then

submit the PPR

Payment

Process Request Name : XX_APPS88_CHECK_PPR_004

Template

: XX_APPS88_CHECK (Use the above created

template to populate the values)

Click

on Submit.

Query

with PPR and then click on go

Click

on the “Record Print Status” button and click on “Continue” (Record Print

Status : Screen shot is missing )

Submitting

the PPR with Create Printed Payment Instructions

Navigation : Payable Manager à Payments à Entry àClick on find

Operating Unit

|

: Vision Operations

|

Bank Account

|

: BofA-204

|

Payment Method

|

: Check

|

Status

|

: Negotiable

|

Void

the payments

Click

on Actions à Check the Void à Ok

Then

submit the PPR

Payment

Process Request Name : XX_APPS88_CHECK_PPR_005

Template

: XX_APPS88_CHECK (Use the above created template

to populate the values)

Click

on Submit.

Payment Process Profile

|

: XX_APPS88_CHECK

|

Payment Currency

|

: USD

|

Internal Bank Account

|

: BofA-204

|

Payment Document

|

: XX_APPS88_CHECK (it will populate by default)

|

Select Payments from Source Product

|

: Payables

|

Select Payments from Payment Process Request

|

: XX_APPS88_CHECK_PPR_005(Above created PPR)

|

Select Payments from Legal Entity

|

:Vision Operations

|

Select Payments from Organization Type

|

: Operating Unit

|

Select Payments from Organization

|

: Vision Operations

|

Print Now

|

: No

|

Get Flower Effect

Get Flower Effect

6 comments:

amazing post thankyou so much !

Wow. That's very detailed and well put together. Well done and thanks for the post.

Hi, I am receiving the below error while processing the payment at the time of "Format Payment Instructions"... Please HELP!!! I'm new to this and not able to get a resolution...:-(

This request finished with an error and produced the following completion message: Internal Error to Payment Server: \tmp\xdoIPiwbAekKZ072618_0308233020.fo (The system cannot find the path specified) The processing began on 26-JUL-2018 15:08:07 and ended on 26-JUL-2018 15:08:23. You may find more information on the cause of the error in the request log or the concurrent manager log.

Please check with your DBA, It is temporary file path issue.

This is a lovely interpretation of Oracle Check Printing Using XML Publisher in Oracle Applications Release 12. However, it is confusing how your Net Amount total is 89,192.81, and the check amount is $223,740.90.

What brought me to your site was that I was looking for how to change the payment extract to include a missing address for checks. Can you help with modifying the payment extract?

How to encrypt final PPP file before sending to Bank ?

Post a Comment