Introduction

This document is a

supplement to the GL

Configuration Checklist

and serves to provide more detail regarding setting up Chart of Accounts (COA)

in the PwC Approach for Oracle. If you are

setting up a new install from scratch or modifying the PwC Approach for Oracle, use this document as a guide and modify it as needed

to meet Client requirements. Note that this document only contains the steps

that warrant explanation; refer to the GL Configuration Checklist for an explanation

of all the setup steps in the recommended order of execution.

1.1.1. Accounting Flexfield structure

In Oracle Applications, the accounting

flexfield is the account structure used to classify revenues, expenses, assets,

liabilities, and owners’ equity across different business entities. The

accounting flexfield can have multiple segments of multiple lengths and is

usually represented as strings of numbers separated by a segment separator

(e.g. ‘-’). The accounting flexfield is usually less than or equal to

twenty-five (25) characters in length due to the fixed length of the accounting

flexfield field displayed in Oracle Applications forms.

You can assign segment qualifiers to your

accounting flexfield segments. The required segment qualifiers are balancing

segment and natural account. The balancing segment is typically the legal

entity or company segment. For each value of the balancing segment, the

transaction amounts for that segment need to balance. The “natural” account

segment is used to classify each transaction amount or balance as an asset,

liability, owners’ equity, revenue, or expense. The other segment qualifiers

include the following:

• Cost Center Segment

– indicate functional areas, such as Accounting, Sales, Shipping, others.

Oracle Assets and Oracle Projects require you to qualify a segment as cost

center in your account.

• Management Segment

– used to perform management reporting and secure read and write access to the

segment value. This can be any segment other than the balancing segment,

natural segment and cost center segment.

• Intercompany

Segment – used to track intercompany transactions within a single ledger and

among multiple ledgers. Usually is a mirror of the balancing segment.

• Secondary Tracking

Segment – allows tracking of retained earnings, cumulative translation

adjustment, and revaluation unrealized gain/loss specific to balancing and

secondary segment value pair. This gives you an option of displaying unique

combination of both primary and secondary segment as a separate account when

querying

t-accounts/activity summaries, and for some standard reports. (Note that this cannot be used with average balances option. Also, once you enable tracking by secondary ledger, you can not disable the same. Refer to the Oracle GL User Guide for more details).

t-accounts/activity summaries, and for some standard reports. (Note that this cannot be used with average balances option. Also, once you enable tracking by secondary ledger, you can not disable the same. Refer to the Oracle GL User Guide for more details).

In addition to company, cost center, and

account, the most common segment types include:

• Product line –

includes services and service lines as well as products; allows for a quick

summation of product or service revenue and expense amounts and isolates the

account segment from product or service line changes

• Sales channel –

usually utilized by consumer products manufacturers who sell material amounts

of goods via direct, distributor, and retail channels

• Project – support

basic project reporting for management decision-making purposes

• Geographical entity

– usually used by firms competing in geographically specific markets (e.g.,

cellular phone companies may use metropolitan statistical areas to track

revenues against a regions’ potential cellular subscribers.

• Fund – A segment

that indicates a fiscal and accounting entity with a self-balancing set of

accounts for governmental or not-for-profit organizations.

• Program – segment

that indicates programs, such as, for a university, scholarship program, and

endowment program.

endowment program.

• Intercompany –

segment indicates intercompany entities, which usually mirrors your company

segment.

Each segment should only represent a single

dimension (e.g., ‘Western,’ a geographical dimension) versus

multiple-dimensions (e.g., ‘Western Region Service Revenue,’ incorporates

‘Western,’ a geographical dimension, ‘Service,’ a product line dimension, and

‘Revenue,’ an account dimension). Multiple-dimension values increase

maintenance costs and do not fully utilize the system’s capabilities.

1.1.2. Structure maintenance

It is difficult to modify the accounting

flexfield once transactions have been entered. However, it is easier to add a

segment than to remove one. Similarly, it is easier to expand segment size than

to reduce it. The principal difficulty of adding or expanding segments is determining

how to convert the data associated with transactions entered before the change.

Defaults can be specified, but if historical categorization against the added

segment or segment characters is needed, extensive reclassification is

required.

Navigation: Setup> Financials> Flexfield> Segments

1.2. Segment values

Segment values can be set to a pre-defined

list by specifying an independent or table validated value set for the segment.

These value sets can be shared between different Ledgers and different Oracle

Applications.

Segment values can be numeric or alphanumeric.

However, segment values should preferably be numeric because alphanumeric

values prevent effective use of FSG and other reporting tools.

Segment values should be grouped by ranges

to facilitate reporting (e.g., all checking accounts are five digits, beginning

with 100 and ending with two digits used to distinguish accounts - 10002

(corporate checking account at Bank of America) and 10003 (corporate checking

account at Wells Fargo)).

System-wide default values can be assigned

to each account segment, although the system frequently defaults to the last

value entered. Specify an account type of asset, liability, owners’ equity,

revenue, expense, budgetary (DR) or budgetary (CR) when entering segment values

for the account segment.

1.2.1 Navigation: Setup> Financials> Flexfields>

Validation> Sets

1.2.2. Define Company Segment Value Set

1.2.3. Define Account Segment Value Set

1.2.4 Define Accounting Unit Segment Value Set

1.2.5. Define Subaccounting Segment Value Set

1.2.6. Define Future Segment Value Set

1.3. Define accounting Flexfield structure

1.3.1.

Navigation: Setup >

Financials > Flexfields > Key > Segments

|

|

|

1.3.2.

Accounting Key Flexfield Segments summary screen

1.3.3. Company segment Accounting Flexfield

Company Flexfield Qualifiers

1.3.4. Account segment Accounting Flexfield

Account Segments Qualifiers:

1.3.5. Accounting Unit Segments Accounting Flexfield

Accounting Unit Segment Qualifiers:

1.3.6. Subaccounting Segments Accounting Flexfield

1.3.7. Future Segments Accounting Flexfield

1.4.

Define segment default

values

Define values that will be assigned as

default values for segments in the accounting flexfield. Typically, the Company

segment is not assigned a default value because unless the client has only one

Company code, it is preferable to control the Company segment default value

using security rules. You can optionally assign default values of 0s to your

Product, Project, and Intercompany Segments.

1.4.1

Navigation

|

Navigate

to:

|

Setup >

Financials > Flexfields > Key > Segments

|

1.4.2. Define Company Segment default values

1.4.3. Accounting Unit Segment default value

1.4.4. Subaccount Segment default value

1.4.5. Future Segment default value

2.1. Freeze Flexfield definition:

Navigation:

Setup> Financials> Flexfield> Key> Segments

2.1.2. Key Flexfield segment screen

2.1.3. Find key flexfield segment screen print

2.1.4. Navigation: Navigation: Setup> Financials>

Flexfield> Key> Values

2.1.5. Segment Values screen print

2.1.6. Define Accounting Flexfield segment values

2.1.7. Account Segment values:

Navigation:

Setup> Financials> Flexfield> Key> Values

2.1.8.Find Key Flexfield

Segment screen details

|

Field/button

name

|

Description

|

R/O/C

|

User

action and values

|

Comments

|

|

Find Values By

|

Defaults to Key

Flexfield.

|

R

|

|

|

|

Application

|

Application Name

|

|

General Ledger

|

|

|

Title

|

Accounting

Flexfield

|

R

|

Accounting

Flexfield

|

|

|

Structure

|

Accounting

Flexfield

Structure Name |

R

|

Indicate your

structure name |

|

Calendar

1.5.

Define accounting period

types

General Ledger has predefined calendar

period types that support the accounting calendar: Month, Quarter, and Year.

This is a pre-requisite to the Accounting Setup Manager, but may not need any

updates as these period types are typically sufficient, even when even when a

fiscal accounting calendar (i.e., April to March) is required.

You can define your own period types to use

in addition to the General Ledger standard period types Month, Quarter and

Year. You use these period types when you define the accounting calendar for

your organization.

Note:

Do not change the number of accounting periods per year for a period type.

Doing so will cause data corruption.

1.5.1.

Navigation: (General

ledger responsibility)

|

Navigate

to:

|

Setup >

Financials > Calendars > Types

|

1.5.2.

Period types screen print

1.5.3.

Period types screen

print fields

|

Field

name

|

Description

|

R/O/C/D/E

|

User

action and values

|

Comments

|

|

Period Type

|

Unique name for

accounting period type

|

R

|

|

|

|

Periods Per Year

|

Number of periods

per year. You can define a ‘Week’ period type and specify 52 periods per

year. You can assign up to 366 accounting periods per year.

|

R

|

|

Budgets can only

use the first 60 periods

|

|

Year Type

|

Fiscal or

Calendar Year

|

R

|

|

|

|

Description

|

Description of

year type

|

O

|

|

|

1.6.

Define accounting

calendar

The accounting calendar periods for each

year must be defined on an ongoing basis as part of the year-end procedures.

When defining the accounting calendar for a new year always include JAN of the

following year to ensure that DEC of the new year can be closed without error.

To close the last period of a year, the first period of the next year must

exist and be set to Future Entry before expense and revenue account balances

can be written off to

retained earnings.

retained earnings.

You can define multiple calendars and

assign a different calendar to each ledger. For example, you can use a

quarterly calendar for ledger, and a monthly calendar for another.

Calendars you create are validated online.

Full calendar validation is launched whenever you exit the Accounting Calendar

window. Carefully consider the type of calendar you need for your organization,

as it can be difficult to change your calendar (e.g., from a fiscal year to a

calendar year) once you've used it to enter accounting data.

This is a pre-requisite to the Accounting

Setup Manager.

1.6.1.

Navigation: (General

ledger responsibility)

|

Navigate

to:

|

Setup >

Financials > Calendars > Accounting

|

Accounting

Calendar Screen:

1.6.2.

Accounting

calendars screen print fields

|

Field

name

|

Description

|

R/O/C/D/E

|

User

action and values

|

Comments

|

|

Calendar

|

Accounting

Calendar Name

|

R

|

|

|

|

Description

|

Accounting

Calendar Description

|

O

|

|

|

|

Enable Security

|

Enable Security

check box

to apply definition access set security to the Calendar definition.

If you do not

enable security, all users who have access to this calendar definition will

be able to view and modify the calendar definition.

|

O

|

|

|

|

Periods Prefix

|

Period Prefix

Name

|

O

|

|

|

|

Type

|

Calendar Type

|

O

|

|

|

Full calendar validation is launched when

you exit the Accounting Calendar window. Validate the calendar by viewing or

printing the Calendar Validation Report. This report helps you identify any

errors in your calendar that might interfere with the proper operation of

General Ledger.

1.7.

Define transaction calendar

If you enable average balance processing

enabled, you must assign a transaction calendar, which is used to control

transaction posting in Oracle General Ledger and Oracle Sub ledger accounting.

When you define the transaction calendar, you choose which days of the week

will be business days. You can also specify other non-business days, such as

holidays, by maintaining the transaction calendar.

Transaction calendars ensure that journals

created in Oracle General Ledger and Oracle Sub ledger Accounting are only

posted on valid business days.

1.7.1.

Transaction Calendar

Currencies:

2.1.1. Navigation: Setup> Currencies> Define

2.1.2. Rate Type

2.1.3. Rate Conversion.

Accounting Setup Manager:

Oracle

General Ledger R12 uses the Accounting Setup Manager to define accounting

setups. The Accounting Setup Manager centralizes the setup steps for common setup

components that are shared across the Oracle Financial Applications.

This includes the following:

• Legal Entities

• Ledgers (primary

and secondary ledgers)

• Reporting

Currencies

• Oracle Sub ledger

Accounting (SLA)

• Intercompany

Accounts

• Intercompany balancing

rules

• Sequencing Options

The basic accounting setup process consists

of the following:

1. Create an

Accounting Setup Structure – creates the framework of the accounting setup and

identifies legal entities, if any, the type of accounting setup, and ledgers.

2. Complete Accounting

Options – complete different accounting options to specify how to perform

accounting and process transactions. These include the following:

• Ledger Options

• Reporting Currency

Options

• Sub ledger

Accounting Options

• Intercompany

Accounts

• Intercompany

balancing rules

• Sequencing Options

3. Complete Accounting

Setup – Completing the accounting setup marks the accounting setup complete and

launches the General Ledger Accounting Setup program. The GL Accounting Setup

program performs the necessary validations to make the setup components of an

accounting setup ready for transaction processing and journal entry

To create accounting setups, complete

General Ledger prerequisites used to create ledgers and other setup components in

Accounting Setup Manager.

Accounting Setup Manager

|

Value

|

Details

|

|

Application:

|

General

Ledger/Oracle HRMS/System Administrator

|

|

Configuration

Task:

|

Accounting Setup

Manager

|

|

Configuration

Step(s):

|

|

|

Prerequisite(s):

|

Define Accounting

Flexfield (for your Chart of Accounts)

|

|

|

Define Accounting

Calendar

|

|

|

Define or Assign

Currencies

|

The following setup steps are presumed to

occur using the General Ledger Responsibility unless otherwise noted.

1.7.2.

Navigation:

(General Ledger responsibility)

Navigate to: Setup > Financials > Accounting Manager Setup

> Accounting Se

1.8.

Define primary ledger

Define Accounting Representations screen is

where you define your primary and secondary ledgers. Ledgers determine the

currency, chart of accounts, accounting calendars, ledger processing option and

Subledger accounting method.

Each accounting setup requires a primary

ledger and optionally one or more secondary ledgers and reporting currencies.

Note that the definition of the primary

ledger can only be completed after you complete attributes (including ledger

options) you enable for the primary ledger. For example, during the initial

definition of the primary ledger, you chose to add reporting currency and add a

secondary ledger. For ledger options, you also choose to assign balancing

segment values. You then need to complete these attributes before you can

complete definition of the primary ledger. The ‘Complete’ button used to create

and validate your ledger will only be available once all attributes for your

primary ledger are completed. Alternatively, you can choose not to add a

reporting currency and a secondary ledger during initial definition of the

primary ledger, and tag all ledger options as complete. This would facilitate

completion of the primary ledger. You can then add the reporting currency,

secondary ledger and other ledger options at a later point

in time.

in time.

1.8.1.

Define accounting

representations screen

1.8.2.

Define accounting

representations screen print fields

|

Field

name

|

Description

|

R/O/C/D/E

|

User

action and values

|

Comments

|

|

Name

|

Primary Ledger

Name

|

R

|

|

|

|

Chart of Accounts

|

Accounting

Flexfield Name

|

R

|

|

Pre-defined in GL. See GL COA Setup document

|

|

Accounting

Calendar

|

Accounting

Calendar

|

R

|

|

*

|

|

Currency

|

Functional

Currency

|

R

|

|

Pre-defined in

GL. See GL Reporting Currencies

Setup document |

|

Sub ledger

Accounting Method |

Integrates data

from Oracle Financial Subledger and non-Oracle systems with Oracle General

Ledger. Two seeded methods are available. Standard Accrual and

Standard Cash. |

O

|

|

|

1.8.3.

Complete accounting structure

1.8.4.

Save

accounting structure screen

Defined Ledgers (Primary and Secondary) and

Reporting Currencies are displayed once you’ve completed defining the same.

Review the accounting structure, and make changes if necessary. Once you’ve

saved the form, you cannot modify major attributes of the Primary Ledger (such

as COA, Calendar, and Currency).

1.8.5.

Update ledger options

When you assign a Subledger accounting

method to the ledger, this option displays with a complete status. If you did

not assign a Subledger accounting method to your ledger, then this step will not

be displayed. Update this at anytime from the Accounting Option stage.

1.8.6.

Define accounting

options screen

The Define Ledger Options screen enables

updates and revisions to the available options for your Legal Entity, Primary

Ledger and Secondary Ledger.

1.8.7. Update

ledger: Ledger definition screen

1.8.8.

Update ledger: Ledger

definition screen print fields

|

Field

name

|

Description

|

R/O/C/D/E

|

User

action and values

|

Comments

|

|

Standard

Information Region

Ledger

|

Primary Ledger

Name. Defaults from previous entry.

|

R

|

|

|

|

Short Name

|

Ledger short

name; appears in the title bar of windows and in some lists of values

|

R

|

|

Can be changed

anytime

|

|

Description

|

Primary Ledger

Description

|

O

|

|

|

|

Currency

|

Main transaction

currency for the ledger

|

O

|

|

Cannot be changed

|

|

Chart of Accounts

|

Accounting

Flexfield

Previously defined. |

D

|

|

Cannot be changed

|

|

Accounting

Calendar Region

Accounting

Calendar

|

Accounting

Calendar

Previously defined. |

D

|

|

Cannot be changed

|

|

Period Month

|

Defaults from the

accounting calendar |

D

|

Cannot be changed

|

|

First Ever Opened

Period

|

First period that

can be opened for this ledger.

|

R

|

This cannot be

changed after you open the first period.

|

|

Number of Future

Enterable Periods |

Number of future

periods to allow for journal entry within

this ledger |

R

|

|

|

Sub

ledger Accounting Region

Sub ledger

Accounting Method

|

Defaults from Sub

ledger Accounting Method

Previously defined |

R

|

|

|

Sub ledger

Accounting

Method Owner |

If owner is

Oracle, definition of this method cannot be updated.

|

D

|

|

|

Journal Entry

Language

|

Journal Entry

Language

|

R

|

|

|

Entered Currency

Balancing Account |

Posts differences

from out-of-balance foreign currency journals in subledgers.

|

O

|

|

|

Use Cash Basis

Accounting

|

Used by Oracle

Payables for its Mass Additions Create program for determining expense

account information.

|

O

|

|

|

Balance Sub

ledger

Entries by Ledger Currency |

Enables balancing

of Subledger journal entries by ledger currency and balancing segment value.

|

O

|

|

1.8.9.

Update ledger: Ledger options screen

1.8.10.

Update ledger: Ledger

options screen print values

|

Field

name

|

Description

|

R/O/C/D/E

|

User

action and values

|

Comments

|

|

Year

End Processing Region

Retained Earnings

Account

|

Prior Year’s net

balance of all income and expense accounts are posted against the retained

earnings account when the first period of a fiscal year is opened in General

Ledger.

|

R

|

|

|

|

Journal

Processing Region

Suspense Account

|

Allows suspense

posting of out-of-balance journal entries.

If you have

multiple companies or balancing entities within a ledger, General Ledger

automatically creates a suspense account for each balancing entity.

You can also

define additional suspense accounts to balance journal entries from specific

sources and categories

using the Suspense Accounts window.

Only balanced

entries can be posted if you do not enter a suspense account.

|

O

|

|

|

|

Allows suspense

posting of out-of-balance journal entries.

If you have

multiple companies or balancing entities within a ledger, General Ledger

automatically creates a suspense account for each balancing entity.

You can also

define additional suspense accounts to balance journal entries from specific

sources and categories

using the Suspense Accounts window.

Only balanced

entries can be posted if you do not enter a suspense account.

|

O

|

|

Tracks rounding

differences during currency conversions.

If you do not enter an account, General Ledger will post rounding differences to the journal line with the largest amount.

In Sub ledger

Accounting, this account tracks currency conversion rounding differences that

cause unbalanced journal entries. Sub ledger Accounting will issue an error

if it encounters a Subledger journal entry that is unbalanced because of

rounding differences and an account is not specified.

|

O

|

|

Posts

out-of-balance intracompany journals (debits do not equal credits for a

particular company or balancing segment value within the same ledger). If you

enable this option, you must define Intracompany Balancing Rules when you

complete your Accounting Options to provide instructions on how to

automatically balance intracompany journals against balancing accounts you

specify.

If you do not

choose to enable intracompany balancing, you can only post intracompany

journals that balance by balancing segment

|

O

|

|

Requires journal

to be approved by the appropriate level of management before any further

action can be taken, such as posting, when enabled for the journal source. If

Journal Approval is not enabled, approval is not required, even

if the journal source requires approval |

O

|

|

Requires journal

to be approved by the appropriate level of management before any further

action can be taken, such as posting, when enabled for the journal source. If

Journal Approval is not enabled, approval is not required, even

if the journal source requires approval |

O

|

|

Used to calculate

tax if

Oracle Payables or Oracle Receivables is not implemented. |

O

|

|

Automatically

reverses this ledger's journals based on the Journal Reversal Criteria

Set assigned. |

O

|

|

Used to translate

actual account balances.

You can override

the default rate types for each balance level reporting currency

|

O

|

|

Used to translate

actual account balances.

You can override

the default rate types for each balance level reporting currency

|

O

|

|

This account is

needed to translate the ledger's currency balances into a balance level

reporting currency. For journal level reporting currencies, this account is

used when revaluing foreign currency denominated balances. General Ledger

automatically posts any net adjustments resulting from currency translation

to this account, in accordance with FAS 52 (U.S.) and IAS 21. If you have

multiple companies or balancing entities within a ledger, General Ledger

automatically creates a translation adjustment account for each company or

balancing entity. The difference in revaluation adjustments between the

ledger and its journal level reporting currencies are recorded to the

cumulative translation adjustment account.

|

O

|

1.8.11.

Update ledger:

Advanced options screen

1.8.12.

Update ledger:

Advanced options screen print fields

|

Field

name

|

Description

|

R/O/C/D/E

|

User

action and values

|

Comments

|

|

Journal Reconciliation Region

Enable Journal Reconciliation

|

Allows you to

reconcile transactions in accounts that should balance to zero.

|

O

|

|

|

|

Budgetary Control

Region

Enable Budgetary

Control

|

Requires you to

create budget journals for funding budget.

|

O

|

|

|

|

Requires you to

create budget journals for funding budget.

|

O

|

|

Allows you to

require budget journals for all budgets when budgetary control is enabled.

|

O

|

|

In an average

balances ledger, your standard and average balances are tightly linked. Each

time you post a journal entry, Oracle General Ledger updates both the

standard (period-based) balances and corresponding average balances for your

balance

sheet accounts.

Note:

You can only enable average balance processing for those ledgers that require

it. This ensures that you incur no additional overhead unless you need

average balance processing enabled.

Note:

You can only enable average balances for a secondary ledger if its primary

ledger has average balances or average balance

consolidation enabled.

Note:

You cannot enable average balances if your ledger is enabled for secondary

segment tracking.

|

O

|

1.8.13.

Update ledger: Review ledger screen

Review your Ledger Definition. If you need

to make any changes, click on the Back button and go to

the appropriate screens.

Once your review is completed, click on the

Finish button.

1.8.14.

Accounting

options screen

After completing initial setup of the

Primary Ledger, the Accounting Options screen is displayed. Aside from updating

your Primary Ledger as previously discussed, you can also update the following:

|

Entity/Ledger

|

Setup

Step

|

|

Legal Entity

|

Update Balancing

Segment Values

|

|

Primary Ledger

|

Update Primary

Ledger – Ledger Options

|

|

Primary Ledger

|

Reporting

Currencies

|

|

Primary Ledger

|

Balancing Segment

Value Assignments

|

|

Primary Ledger

|

Operating Units

|

|

Primary Ledger

|

Intercompany

Accounts Sequencing

|

|

Secondary Ledger

|

(same as Primary

Ledger except Operating Units)

|

1.9.

Update balancing segment values

Assigning Balancing Segment Values to Legal

Entities enable you to readily identify transactions and balances for a

specific legal entity. This also enables certain Oracle Applications Legal

Entity Features, such as Intercompany Accounting, and granting access to

specific ledger/balancing segment value combinations. Note that Balancing

Segments can be removed from Ledgers before completing accounting setup. Once

complete, you can only disable balancing segment by entering an end date.

1.9.1.

Update balancing

segment value assignments screen

You assign a balancing segment value to

your legal entity in this screen. (Note that this screen is very similar to the

balancing segment value assignments update screen available for both Primary

and Secondary Ledgers). Optionally enter a Start date for the balancing

segment.

1.9.2. Balancing

segment is assigned to the LE in the Accounting Options screen

1.9.3.

Update operating units

Operating Units partition subledger

transaction data when multiple operating units perform accounting in the

context of one or more legal entities. You can update the operating units at

anytime from the Accounting Options screen. You do not have to complete this

step in order to complete your accounting step (though you need to tag it as

completed for your Primary Ledger). You can alternatively create the Operating

Unit by going to the HR Responsibility. See OA Multiple Organizations Setup for

more details.

Note:

The HR User Type Profile option should be assigned to the Responsibility you

are using to access the Organization Form.

Click on the Update icon for Operating

Units from the Accounting Options Screen (See Step 2.69).

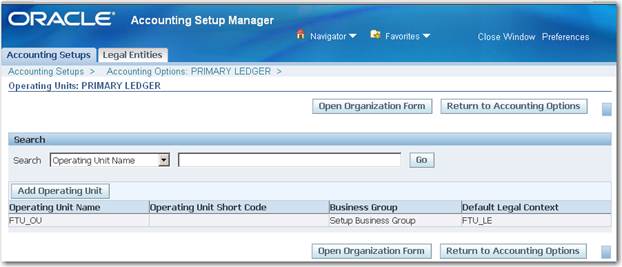

1.9.4.

Operating units screen

print

Operating Unit is displayed.

Open Organization Form is an alternate way

to create Operating Units, Business Groups, and other organizations. This is

similar to accessing the Organizations from HR Responsibility (Work Structures

> Organization > Description). Please refer to the OA Multiple

Organizations Setup document for details on entering/creating organizations

using

this form.

this form.

Click on Return to Accounting

Options

button.

1.9.5.

Update intercompany accounts

If you have legal entities assigned, and

balancing segment values have been assigned to the legal entities, the

Intercompany accounts steps are available for update. Update Intercompany

Accounts step to account for transactions across legal entities.

You do not have to complete this step in

order to complete your accounting setup (although you have to tag this as

complete for your Primary Ledger). You can update this step at any time from

the Accounting Options page.

Click

on the Update icon for Intercompany Accounts

from the Accounting Options Screen

To complete accounting setup without

updating this form, change the status to Complete, then click on the

Done button.

1.9.6.

Complete accounting setup

Review the Accounting Setup. Check the

status of Setup Steps for your Primary Ledger. These should all be with a

complete status (Check Mark). Likewise, Legal Entity should be updated, and

Setup Step for Secondary Ledger, if applicable, should be complete. The Complete button for your

Accounting setups will only be available if you have completed the required

setups. If you do not see the Complete button, review setup steps that are in

progress. Complete these to be able to access the Complete button.

1.9.7. Accounting

setup screen print

The Complete button is available when all

required setup steps are complete.

A warning message is displayed. You will

not be able to delete some of the components of your Accounting setups,

including legal entities, balancing segment values, and reporting currencies,

once you complete the accounting setup.

Click on the Yes button.

Message confirms completion of the

Accounting Setup.

Completing the accounting setup marks the

accounting setup complete and launches the General Ledger Accounting Setup

program. This program performs the necessary validations to make the setup components

of an accounting setup ready for processing of transaction processing and

journal entry.

You can likewise return to Accounting Setup

and update and/or complete other setup steps for your Primary Ledger and your

Secondary Ledger.

2.1.1.

Create Legal Entity

Define Legal Entity (Entities) if you plan

to record accounting transactions against legal entities (requires legal entity

context for transaction processing). Legal Entities are likewise required for

using legal entity specific features, such as intercompany accounting. Also, to

enable multiple organizations, define an accounting setup with at least one

legal entity, a primary ledger that will record the accounting for the legal

entity, and an operating unit that is assigned to the primary ledger and a default

legal context.

Legal Entities are setup in Accounting

Setup Manager or, alternatively, using Oracle Legal Entity Configurator.

2.1.2.

Create Legal Entity –

Identification information region screen print fields

|

Field

name

|

Description

|

R/O/C/D/E

|

User

action and values

|

|

Territory

|

The territory

where the legal entity is registered, displayed at the country level, and

shows only territories for which the identifying jurisdiction has

been defined. |

R

|

|

|

Legal Entity Name

|

Legal Entity Name

|

R

|

|

|

Organization Name

|

Organization Name

|

R

|

|

|

Legal Entity

Identifier

|

The

identification number used to uniquely identify the legal entity. It is

displayed only when the LE: Generate Legal Entity Identifier profile option

set to No and you must enter it manually. If this option is set to Yes, the

legal entity identifier is generated automatically based on the International

Organization for Standardization (ISO) code of the country of registration,

plus the registration number of the identifying jurisdiction, which qualifies

an entity to be a legal entity in that particular territory

|

R

|

|

|

|

|

|

|

|

EIN/TIN

|

EIN/TIN Number

|

R

|

|

|

Transaction

Entity

|

Yes or No

|

R

|

|

See Table Legend at

end of this section for an explanation of R/O/C/D/E abbreviations.

To enter Legal Address, Select Existing

Address or Create a New Address.

To Select Existing Address, use the Legal

Address query screen.

If no existing address is available, click

on Create New Address.

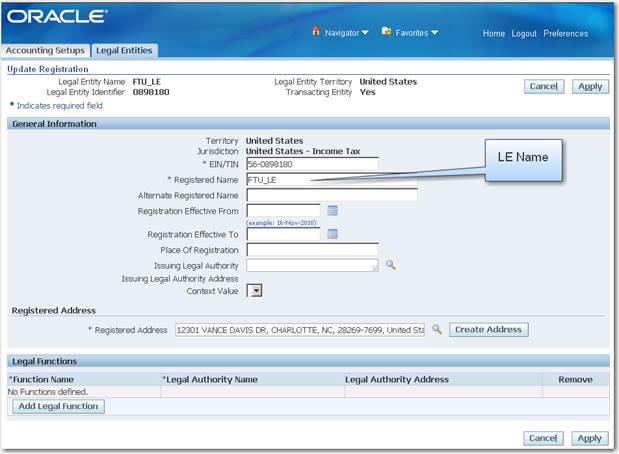

2.1.3.

Create Legal Entity –

Legal Address region screen

2.1.4.

Legal Entity Name

After creating legal entity, the Assign

Legal Entities Screen is displayed.

Get Flower Effect

Get Flower Effect

1 comment:

Hai,,

thanks for your efforts making easy to understand things,I have some doubt when we make standalone PO for a contract agreement

at line level we give reference number our agreement number,there is another tab with name contract no,Can u tell for what this field is

Regards,

Irfan.M.

Post a Comment