Expenditure Categories:

An expenditure category describes the source of your organization’s costs. For

example, an expenditure category with a name such as Labor refers to the cost

of labor. An expenditure category with a name such as Supplier refers to the

cost incurred on supplier invoices.

In addition, you can use expenditure categories in your AutoAccounting rules

and in your reporting. Expenditure categories are used for grouping expenditure

types for costing.

Defining Expenditure Categories

N èSetup è

ExpendituresèExpenditure Categories

To Define expenditure categories:

In

the Expenditure Categories window, enter a unique name for the expenditure

category and enter its description and also the Effective Dates.

Save

your work.

Some

of the Examples of commonly Used Expenditure Categories

Expenditure Category Name

|

Description

|

Labor

|

Labor

costs

|

Travel

|

Travel

expenditures

|

In-House

Recoverable

|

Use

of corporate assets

|

Outside

Services

|

Outside

services

|

Material

|

Materials

|

Other

Expenses

|

Expenses,

excluding travel

|

Units

N èSetup è SystemsèUnits

N èSetup è SystemsèUnits

A

unit of measure records quantities or amounts of an expenditure item. You

assign a unit to each expenditure type. Oracle Projects predefines the units

Currency and Hours.

To

define a unit of measure:

1. Navigate

to the Unit Lookups window.

2.

Enter Type as UNIT, Meaning as UNIT, Application-Projects, and Description as

UNIT.

3.

Enter the following information-Code, Meaning, Description, Tag Value (optional

–– tag value is not used by Oracle Projects), Effective dates & Enabled

Checkbox checked.

Save

your work.

Define Expenditure Types

An expenditure type is a classification of cost

that you assign to each expenditure item you enter in Oracle Projects.

N èSetup è

ExpendituresèExpenditure Types

1.

Name: Enter a unique name for the expenditure type.

2.

Expenditure

Category and Revenue Category: Enter

the expenditure category and revenue category you want to associate with this

expenditure type.

3.

Unit of

Measure: Enter the unit of Measure

you want Oracle Projects to use when calculating the cost for this expenditure

type. You must enter Hours for labor expenditure types.

4.

Tax

Classification Code: This is a new

feature in R12. You need to click Tax Classification Code and select the tax

classification code for customer invoice lines for this expenditure type and

operating unit. Oracle Projects uses this code as the default tax

classification code based on the Application Tax Options hierarchy that you

define in Oracle E-Business Tax for Oracle Projects and the specified operating

unit.

5.

Rate Required: If this expenditure type requires a cost rate, check

the Rate required check box, then choose Cost Rate to navigate to the

Expenditure Cost Rates window and enter a cost rate and its effective date(s).

6.

Description

and Dates: In the Description, Dates

region, enter a description for the expenditure type. You can optionally enter

effective dates for the expenditure type.

7. Expenditure

Type Classes: In the Expenditure Type Classes region, enter the

Expenditure Type Class or classes you want Oracle Projects to associate with

This expenditure type, to determine how to process the expenditure item.

Expenditure

Type Classes

An expenditure type class tells Oracle Projects how to process an expenditure

item. Oracle Projects predefines all expenditure type classes.

Oracle

Projects uses the following expenditure type classes to process labor costs for

interfacing to Oracle General Ledger:

1.

Straight Time – Payroll straight time

2.

Overtime – Overtime premium on a project

Oracle

Projects uses the following expenditure type classes to process non–labor

project costs:

1.

Expense Reports – Oracle Projects expense reports are interfaced to

Oracle Payables for employee reimbursement.

2.

Usages – Asset usage costs are interfaced to Oracle General Ledger.

3.

Supplier Invoices – Oracle Payables supplier invoices are interfaced

from Oracle Payables to Oracle Projects.

4.

Miscellaneous Transaction – Miscellaneous Transactions are used to track

miscellaneous project costs.

5.

Inventory – This expenditure type class is used for the following

transactions:

–

Project Manufacturing transactions that are interfaced from Manufacturing or Inventory

to Oracle Projects.

-Oracle

Inventory Issues and Receipts that are interfaced from Oracle Inventory to

Oracle Projects in a manufacturing or non–manufacturing installation

For

Example: Expenditure Category is Labor; Expenditure Type is Administrative

& Expenditure Type Class is Straight Time.

Define Event Types

An implementation-defined classification of events

that determines the revenue and invoice effect of an event. Typical event types

include Milestones, Scheduled Payments, and Write-Offs.

N èSetup è Billing è Event Types

1. Enter a unique, descriptive name for this event

type.

2. Revenue Category: Enter the revenue category

that you want to associate with this event type.

3. Class: Enter a classification for this event type

Automatic. An Automatic classification generates an automatic

event for revenue or invoice amounts that

may be positive or negative, depending on your implementation of billing

extensions.

Manual. A Manual classification allows you to enter both a

revenue amount and a bill amount. These two amounts can be different. Classify

an event type as manual when you need to indicate different

revenue and bill amounts.

4. Enter the effective start and end dates.

5. Tax Classification Code. This is a new feature in

R12 .Optionally; click Tax Classification Code to select the tax classification

code for customer invoice lines created for this event type and operating unit.

Oracle Projects uses this as the default tax classification code based on the

Application Tax Options hierarchy that you define in Oracle E-Business Tax for

the Oracle Projects application and the project's operating unit. For more

information on setting up tax classification codes and the hierarchy of

application tax options, see the Oracle E-Business Tax User Guide.

Define Budget Entry Method

Budget entry methods

specify and control how you enter a budget or forecast. You use budget entry

methods when you create budgets and forecasts that use budgetary controls and

budget integration features.

N èSetup è Budgetsè Entry Methods

Oracle Projects predefines three budget entry

methods:

You can define additional budget entry methods

during implementation.

Defining Budget Entry Methods

1. Navigate

to the Budget Entry Methods window.

2. Enter a

name and description for the budget entry method.

3. Select an

entry level. The entry level can be Project, Top Tasks, Lowest Tasks, or Top

and Lowest Tasks.

4. Select

Categorized by Resources if you want to categorize amounts by resources.

5. Select a

time phased type. The choices are Date Range, GL Period, PA Period, or None.

6. Select

the enterable fields for cost and revenue using the displayed check boxes.

7. Save your

work.

Define Resource List

Define the resource list as a hierarchy of

resources up to two levels. The top level is restricted to resource types, such

as organization, expenditure category, and revenue category. Use the resource

types Event Type, Expenditure Type, Revenue Category, and Expenditure Category

to define the second level of the hierarchy:

N èSetup è Budgetsè Resource Lists

1.

Enter the Resource List name and Description.

2.

Group Resources By: Choose how you want to group the resource list. If

you choose to group the resource list, and then you enter resource groups.

Select the resource group, and override the alias and order if necessary.

3.

If the resource list is job-based, then you must enter a job group to be

used for summarization. The Resources region then displays jobs that belong to

the job group you entered.

4.

In the Resources region, enter the resources for each resource group. If

you do not use grouping for the resource list, then use the Resources region to

enter resources for the resource list.

5.

Select the resource type and resource .Resource type could be

Expenditure type, Event etc

6.

Alias and the Order number defaults automatically .Override the values

if required.

Define Rate Schedules.

Oracle Projects determines rates from a combination

of rate schedules or rate overrides and uses these rates to calculate cost,

revenue, and bill amounts. We can define four types of rate

schedules:

·

Employee

·

Job

·

Non-Labor

·

Resource Class

Define Billing and Non

Billing rate schedules

N èSetup è

ExpendituresèRate Schedules

First Define Employee Bill Rate Schedule

To define a rate schedule:

1. Specify the Operating Unit. This is a new

feature in Release 12. Specify the operating unit to which your organization

and rate schedule belong. When you have access to only one operating unit, that

operating unit appears as a default value in this field.

2. Specify the organization that maintains the

schedule.

The organization you enter can be any organization

from your organization hierarchy, regardless of whether the organization has

the Expenditure Organization classification, and regardless of the start and

end dates for the organization.

3. Enter a schedule name and a description of the

schedule.

4. Specify a currency for the schedule.

Note: You can specify a different currency for your

Bill Rate Schedule if the Enable Multi Currency Billing option is enabled for

the operating unit. See: Enable Multi Currency Billing, Billing Implementation

Options, and Oracle Projects Implementation Guide.

4. Check the Share across Operating Units check box

to allow other operating units to use this schedule.

Note: To share bill rate schedules, you must also

enable the Share Bill Rate Schedules across Operating Units options in the

Billing tab of the Implementation Options window. See: Share Bill Rate Schedule

Across Operating Units, Billing Implementation Options, and Oracle Projects

Implementation Guide.

5. Select a schedule type.

6. Rates can be

defined employee wise or Job wise. Incase of job wise rate Click on the Job Tab

and Select Job group.

7. Select Employee name against whom the rate need

to be defined.

8. Employee Number and UOM defaults.

9. Enter the Rate or Markup percent.

10. Enter the effective start and end date for the

rate.

Now, define Job Bill

Rate Schedule

Just update the

Organization, Schedule Name and Currency and save your work.

Now, define Non

Labor Bill Rate Schedule

Just update the

Organization, Schedule Name and Currency and save your work.

Define Transaction Sources

N èSetup è

ExpendituresèTransaction Sources

Transaction sources identify the source of external

transactions you import into Oracle Projects using Transaction Import The

transaction source determines how Transaction Import processes transactions.

Some transaction sources are system–defined, and you can create others to fit

your business needs. When you create a transaction source, you control the

Transaction Import processing by the options that you select.

Predefined Transaction Sources

Oracle

Projects predefines several transaction sources. The following table lists some

of the predefined transaction sources:

Transaction Source Used to Import Records From:

AP

INVOICE Oracle Payables (supplier

invoices)

WARNING:

Do not use this transaction source when you run the PRC: Transaction Import

program. It is intended only for use by the Oracle Projects processes to import

Oracle Payables invoices.

ORACLE

PAYABLES Oracle Self–Service Expense.

Oracle

Self–Service Time Oracle Self–Service

Time

Time

Management Oracle Time Management

Oracle

Time and Labor Oracle Time and Labor

Predefined

Transaction Sources for Manufacturing and Inventory Costs:

Oracle

Projects predefines three transaction sources for importing expenditures from

Oracle Manufacturing and Oracle Inventory:

Transaction

Source Used to Import:

Inventory- Manufacturing material costs Inventory

Misc

Inventory- issues and receipts

entered in the Miscellaneous Transactions window in Oracle Inventory

Work In Process- Manufacturing resource costs

Implementation

Option Set Ups

Costing Implementation Options

Navigate to the Implementation Options

Screen.

N èSetup è System è Implementation Options

1.

Operating Unit: It’s a new feature in R12. You can define your

Implementation options based on your Operating Units. It means that from a

single responsibility you can Define/Query Multiple Operating Unit based

Implementation Options Set Ups. The same feature was not available in previous

releases.

2.

Ledger: In R10.5.10 the same information was defined under

Set of Books Tab. In R12 the name has been changed to Ledger. If you are

implementing Oracle Projects for a single organization, then you must specify a

set of books to tell Oracle Projects which set of general ledger books to use.

If your implementation of Oracle Projects is for multiple organizations, Set of

Books is a display-only field. Its value defaults from the Legal Entity for the

operating unit.

3.

Summarization

Period Type: summarization period

type is used when updating project summary amounts.

4.

Calendar Name: When you implement Oracle Projects, you can select

the calendar used to maintain PA periods.

5.

PA Period

Type: Specify a Period Type, which is

used to copy Project Accounting Periods from the calendar associated with the

GL Set of Books.

6.

Maintain

Common PA and GL Periods: When this

option is enabled, the system automatically maintains PA period statuses as you

maintain the GL period statuses.

7.

Default Asset

Book: Optionally, select a

default asset book from the list of values. The value that you select for this

field will be the default value for all project assets that you create. You can

override the default value at the asset level.

8.

Default

Reporting Organization Hierarchy: You

specify an organization hierarchy and version to indicate which organization

hierarchy you want Oracle Projects to use as the default reporting organization

hierarchy.

1.

Functional

Currency: This display-only field

shows the functional currency of your company’s set of books.

2.

Exchange

Rate Date Type: Specify a default

exchange rate date type for converting foreign currency transactions from the

transaction currency to the functional and project currencies.

3.

Exchange Rate

Type: Select the GL Rate Type to

determine the rate. The system-defined rate types, such as Corporate, User, or

Spot, are defined in Oracle General Ledger.

1.

Project

Numbering: Specify whether you

want Oracle Projects to number projects automatically, or whether you plan to

enter project numbers manually.

2.

Project/Task

Owning Organization Hierarchy: You

assign a project/task owning organization hierarchy to the operating unit to

control which organizations can own projects and

tasks.

3.

Version: Enter the version number.

1.

Expenditure Cycle Start Day- You

specifies an Expenditure Cycle Start Day to indicate the day your seven–day

expenditure week begins. If you specify Monday as the expenditure cycle start

day, the week ending date on all expenditures, including timecards and expense

reports, is the following Sunday. You can choose any day of the week as your

expenditure cycle start day.

2.

Interface Cost to GL: If you want to interface costs with Oracle General

Ledger, you must enable the system options for labor and usage costs interface.

Interface

Employee Labor Cost- Enabled

Interface

Usage, Inventory, and WIP, Miscellaneous and Burden Costs-Enabled.

3.

Expenditure/Event Organization: You assign

an expenditure/event organization hierarchy to the operating unit to control

which organizations have the following capabilities:

–

incur

expenditures

–

own project

events

–

be assigned

to a resource list as a resource

4. Version:

Enter the version number.

Auto Accounting

N èSetup è Auto

AccountingèAssign Rules

Oracle Projects creates many different accounting

transactions throughout its business cycle (when posting labor cost debits and

labor revenue credits, for example). You can use AutoAccounting to specify how

to determine the correct general ledger account for each transaction.

When you implement AutoAccounting, you define the

rules and circumstances that determine which general ledger accounts Oracle

Projects uses. Oracle Projects then uses the rules when performing accounting

transactions.

Define AutoAccounting rules to generate account

combinations, and then assign a set of rules to each AutoAccounting transaction

you want to use for your company.

Costing

|

|

Expense Report Cost Account

|

Determined

cost account for expense report items.

|

Expense Report Liability Account

|

Determines

liability account for expense report costs

|

Labor Cost Account

|

Determines

cost account for all labor items, including straight time and overtime

|

Labor Cost Clearing Account

|

Determines

clearing account for labor costs

|

Supplier Invoice Cost Account

|

Determines

cost account for adjusted supplier invoice items.

|

Total Burdened Cost Credit

|

Determines

credit account for total burdened costs for all items on burdened projects

|

Total Burdened Cost Debit

|

Determines

debit account for total burdened costs for all items on burdened projects

|

Usage Cost Account

|

Determines

cost account for usage items

|

Usage Cost Clearing Account

|

Determines

clearing account for usage costs

|

Labor Cost Account Function

When you

run the PRC: Distribute Labor Costs process, Oracle Projects calculates labor

cost amounts based upon employee labor cost overrides and labor costing rules.

After calculating labor costs, Oracle Projects uses the Labor Cost Account

transactions to debit an expense account for raw labor costs.

The Labor Cost Account function consists of the

following transactions:

• Indirect Private Labor

• Indirect Public Labor

• Private Billable Labor

• Private Non–Billable Labor

• Public Billable Labor

• Public Non–Billable Labor

• All Labor

• Capital, All

• Contract, All

• Indirect, All

• Capital, Private, Capital

• Capital, Private, non–Capital

• Capital, Public, Capital

• Capital, Public, non–Capital

Dening a Lookup Set

In lookup sets you specify pairs of values. For

each intermediate value, you specify a corresponding account segment value. One

or more related pairs of intermediate values and segment values form a lookup

set. Use the Segment Value Lookup Region zone to specify an intermediate value,

and then map that intermediate value to a specific segment value of your

Accounting Flexfield.

To implement the Labor Cost Account function,

Implementation team defines three lookup sets:

• One lookup set to map organizations to companies

• One lookup set to map organizations to cost

centers

• One lookup set to map service types to each

Fremont’s six expense accounts for indirect labor

Segment Value Lookups

You

may need several lookup sets to map organizations to cost centers, expenditure

types to account codes, event types to account codes, or for other situations

where the segment value depends upon a particular predefined parameter.

You

can use a lookup set more than once; several AutoAccounting rules can use the

same lookup set.

You

define and modify lookup sets using the AutoAccounting Lookup Sets window.

AutoAccounting Lookup

Sets Window Reference

Use

this form to define, view, and maintain AutoAccounting lookup sets.

Name.

Enter a unique,

descriptive name for this lookup set.

Segment Value Lookup

Region

Use

this zone to specify an intermediate value, and then map that intermediate

value to a specific segment value of your Accounting Flexfield.

AutoAccounting

matches an intermediate value derived from an AutoAccounting rule with an

intermediate value in the lookup set and determines the corresponding segment

value you specify to derive an account code from your chart of accounts.

Intermediate

Value. Enter the

intermediate value that you want to map to an Accounting Flexfield segment

value.

Ensure

that you have entered a valid intermediate value. Valid intermediate values are

those that match intermediate values that may be derived from AutoAccounting

rules. Specify the values in the base language and ensure that the case and spelling

match exactly. (For more information about the base language, see: Multilingual

Support in Oracle Projects, Oracle Projects Fundamentals.) For example, if you

are mapping organization intermediate values to cost center segment values, you

cannot enter 'RISK ANALYSIS' for an organization with the name of 'Risk

Analysis'.

If

AutoAccounting does not find a matching intermediate value in the lookup set,

AutoAccounting provides an error message (Incomplete AutoAccounting Rules)

notifying you that it could not build an Accounting Flexfield combination. You

must correct your AutoAccounting setup and resubmit the process that triggered

the AutoAccounting error.

Selecting

an Intermediate Value Source

To define an AutoAccounting

rule, you first specify an intermediate value (an "input" for the

rule). You can draw an intermediate value from one of three intermediate value

sources:

Constant

|

Always supply a particular

intermediate value (usually an Accounting Flexfield segment code)

|

Parameter

|

Use a predefined parameter

as an intermediate value; make the rule context-sensitive based on one value

|

SQL Select Statement

|

Execute a SQL select

statement to retrieve an intermediate value; make the rule dependent on

multiple values and/or conditional statements

|

Segment

Value. Enter the

Accounting Flexfield segment value that you want to map to with this

intermediate value.

Ensure

that you have entered a valid segment value. Valid segment values are those

that are defined for your Accounting Flexfield segments. Values must match

exactly numerically.

If

AutoAccounting does not find a matching segment value in the lookup set,

AutoAccounting provides an error message (Invalid Accounting Flexfield)

notifying you that it could not build a valid Accounting Flexfield combination.

You must correct your AutoAccounting setup and resubmit the process that

triggered the AutoAccounting error.

Dening AutoAccounting Rules

AutoAccounting rule you define supplies one

Accounting Flexfield segment value at a time. Thus, you need to specify one

AutoAccounting rule for each segment in your Accounting Flexfield for each

AutoAccounting transaction you want to use. Some of the AutoAccounting rules

you define can be quite simple, such as always supplying a constant company

code or natural account. Others can draw upon context information (parameters),

such as the revenue category for a particular posting or the organization that

owns a particular asset. You can even use multiple parameters to provide a

segment value. You can reuse the same AutoAccounting rules for many different

functions and their transactions.

- One rule supplies the

appropriate value for the Company segment of Organization’s Accounting

Flexfield; Organization uses a lookup set to define this rule.

- One rule supplies the

appropriate value for the Department segment; Organization uses

a lookup set to define this rule.

- Rules supply the appropriate

account code for the Account segment; the indirect, private labor rule

uses a lookup set, and the other five use constant values.

- Rules supply the appropriate

account code for the Sub Account segment; the indirect, private labor rule

uses a lookup set, and the other five use constant values.

- Rules supply the appropriate

account code for the Product segment; the indirect, private labor rule

uses a lookup set, and the other five use constant values.

Assigning Rules to Transactions

AutoAccounting function consists of several distinct

transactions; you assign rules to each transaction you want to use. These rule

assignments then determine which general ledger account AutoAccounting uses to

process that transaction. After you enable a transaction, you match each

segment in your Accounting Flexfield with the appropriate AutoAccounting rule.

For example, if you have a two-segment Accounting Flexfield containing a

Company segment and an Account segment, you assign one rule to the Company

segment and one rule to the Account segment.

Function Transaction’s Enabled

All

Labor- All Labor Items Enabled Checkbox Ticked

Capital,

ALL – All Labor Items on Capital Projects.

In

the same manner you will need to define other Auto Accounting Rules

Non Labor Resources

You specify a name and a description of an asset,

or pool of assets, to define a non–labor resource. For example, you can define

a non–labor resource with a name such as Earth Mover to represent one earth

mover your business owns.

Every usage item you charge to a project must

specify the non–labor resource utilized and the non–labor resource organization

that owns the resource.

When defining your non–labor resources, you can

choose only expenditure types with the Usage expenditure type class.

You can use the non–labor resource organization in

your AutoAccounting rules for Usage & Miscellaneous cost and

revenue.

Defining Non-Labor Resources

N èSetup è ExpendituresèNon Labor Resource

To define non-labor resources:

1.

In

the Non-Labor Resources window enter a name, description, effective date(s),

and a usage expenditure type for each non-labor resource your organization

owns.

2.

For

each non-labor resource you define, enter the organization(s) to which the

resource is assigned in the Organizations region. Enter the effective dates

during which the resource is owned by each organization.

The

organizations you enter can include any organization from your organization

hierarchy, regardless of whether the organization has the Expenditure

Organization classification, and regardless of the start and end dates for the

organization.

3.

If

you want to override the cost rate of the expenditure type by the resource and

organization combination, choose Cost Rates and enter the cost rate for the

operating unit in question and the effective date in the Cost Rates Overrides

window.

4.

Save

your work.

Non Labor Cost Rates - Defining Cost Rates

for Expenditure Types

An expenditure type cost rate is a currency amount

that Oracle Projects multiplies by the expenditure type unit to calculate cost.

You define a cost rate in the Expenditure Types

window by selecting an expenditure type and entering a cost rate for it. You

can select only a non–labor expenditure type that requires a cost rate. You

cannot define a cost rate for a non–labor expenditure type that does not

require a cost rate. Instead, you must disable the expenditure type and create

a new one that requires a cost rate and has a unique name.

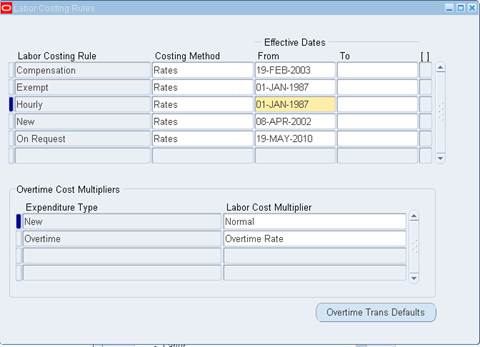

Labor Costing Rules

N èSetup è Costingè LaborèLabor Costing Rules

A labor costing rule determines how an employee is

paid. You define a labor costing rule for each pay type your business uses.

For example, you can define a labor costing rule

for pay types such as exempt, non–exempt, uncompensated, compensated, or

hourly.

When an employee charges time to a project, Oracle

Projects processes the labor hours according to the employee’s labor costing

rule.

For example, if an employee’s labor costing rule is

Hourly, the employee is eligible for overtime pay; if the employee’s labor

costing rule is Exempt, the employee is not eligible for overtime pay.

1.

In

the Labor Costing Rules window, enter a unique rule name and select a costing

method.

Costing

methods determine how labor costs are calculated. The available options are:

Rates: When you select Rates, Oracle

Projects calculates the labor costs for entered hours using hourly cost rates.

Extension: When you select Extension, labor

costs are calculated by the labor costing extension. When using this option you

are not required to maintain hourly cost rates in Oracle Projects.

2.

If

overtime hours are created by the overtime calculation extension, you can select

Overtime Trans Defaults and specify a default project and task by operating

unit for system generated expenditure items.

3.

Enter

the Effective Dates during which the labor costing rule is valid.

4.

If

your employees enter overtime hours manually, use the Overtime Cost Multipliers

region to assign cost multipliers to overtime expenditure types. When a costing

method of Rates is selected and a transaction is charged to an expenditure type

that has an assigned multiplier, the multiplier is applied as labor costs are

calculated.

Note:

If the transaction is charged to an overtime task and a cost multiplier is

assigned to the task, the task multiplier takes precedence over the expenditure

type multiplier.

If

overtime hours are derived using the overtime calculation extension, you can

use the Overtime Cost Multipliers region to default expenditure types for

system generated expenditure items.

5.

Save

your work.

Define Labor Costing Overrides

N èSetup è

CostingèLaborèLabor Costing Overrides

1. To

override labor costing:

2. In the

Labor Costing Overrides window, enter either the Employee Name or Employee

Number for the operating unit under question. Then select Find.

3. The

current overrides for the selected employee are displayed.

4. Specify

whether you wish to override the assigned rate schedule or enter an overriding

cost rate by choosing an override type:

5. Schedule:

Enter the overriding rate schedule in the Cost Rate Schedule field.

6. Rate:

Enter an overriding rate. Optionally, select a new currency code and define

currency conversion attributes.

7. Enter the

Effective Dates during which the labor costing override is valid for this

employee.

8. Save your

work.

Get Flower Effect

Get Flower Effect

2 comments:

thanks

Unique information that is not available on internet

Post a Comment