Accounting rules

Determine the accounting period or periods in which the revenue distributions for an invoice line are recorded.

Invoicing rules determine the accounting period in which the receivable amount is recorded

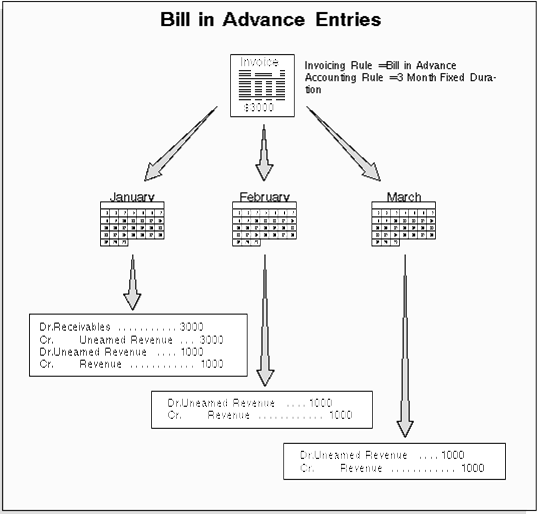

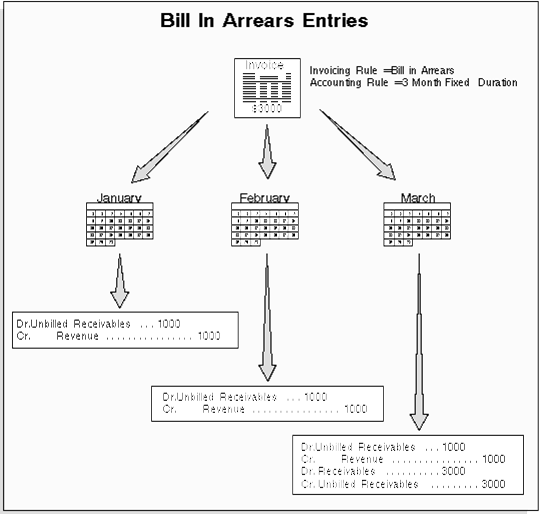

* Bill In Advance: Use this rule to recognize your receivable immediately (see Figure 1 - 19<http://docs.oracle.com/cd/A60725_05/html/comnls/us/ar/invrules.htm#biadvance> below).

* Bill In Arrears: Use this rule if you want to record the receivable at the end of the revenue recognition schedule

* Attention: With Cash Basis Accounting, you only recognize revenue when payment is received. Invoices with rules are therefore not applicable for this method of accounting, as they are designed to distribute revenue over several periods before receipt of payment. If you import invoices into a cash basis accounting system, lines with associated invoicing and accounting rules will be rejected by AutoInvoice.

* Account Sets

* Account sets are templates used to create revenue and offset accounting distributions for individual invoice lines with accounting rules. These account sets enable you to split revenue for a line over one or more revenue or offset accounts. You can change account sets from period to period to meet your business requirements. For example, you have an invoice with revenue that you want to recognize over a twelve month period, and the cost center of one of the accounts changes during the twelve months. You can update the account sets to the new cost center account for all of the revenue distributions still to be created. AutoAccounting creates the initial revenue and offset account sets for your invoice.

* Revenue Recognition

* The Revenue Recognition program identifies all transactions with rules within a given period or range of GL dates and creates the revenue distributions for those transactions. The distributions are created for the current period only, using the rules associated with the transactions

Receipt Class

Define receipt classes to determine the required processing steps for receipts to which you assign payment methods with this class. These steps include confirmation, remittance, and reconciliation.

If you checked the Require Confirmation check box, choose a Remittance Method. The remittance method determines the accounts that Receivables uses for automatic receipts that you create using payment methods to which you assign this receipt class. Choose one of the following methods:

* Standard: Use the remittance account for automatic receipts using a payment method with this receipt class.

* Factoring: Use the factoring account for automatic receipts using a payment method with this receipt class.

* Standard and Factoring: Choose this method if you want Receivables to select receipts assigned to this receipt class for remittance regardless of the batch remittance method. In this case, you can specify either of these remittance methods when creating your remittance batches. See: Creating Remittance Batches<http://docs.oracle.com/cd/A60725_05/html/comnls/us/ar/remit2.htm#t_rmtbat>.

* No Remittance: Choose this method if you do not require receipts assigned to this receipt class to be remitted.

. To require receipts created using a payment method assigned to this receipt class to be reconciled before posting them to your cash account in the general ledger, choose one of the following Clearance Methods:

* Directly: Choose this method if you do not expect the receipts to be remitted to the bank and subsequently cleared. These receipts will be assumed to be cleared at the time of receipt entry and will require no further processing.

* By Automatic Clearing: Choose this method to clear receipts using the Automatic Clearing program. See: Automatic Clearing for Receipts<http://docs.oracle.com/cd/A60725_05/html/comnls/us/ar/remit204.htm#t_clear>. (Receipts using this method can also be cleared in Oracle Cash Management.)

* By Matching: Choose this method if you want to clear your receipts manually in Oracle Cash Management.

Using AutoLockbox

AutoLockbox (or Lockbox) is a service that commercial banks offer corporate customers to enable them to outsource their accounts receivable payment processing. A lockbox operation can process millions of transactions a month.

AutoLockbox eliminates manual data entry by automatically processing receipts that are sent directly to your bank. You specify how you want this information transmitted and Receivables ensures that the data is valid before creating QuickCash receipt batches. You can automatically identify the customer who remitted the receipt and optionally use AutoCash rules to determine how to apply the receipts to your customer's outstanding debit items.

You can also use AutoLockbox for historical data conversion. For example, you can use AutoLockbox to transfer receipts from your previous accounting system into Receivables. AutoLockbox ensures that the receipts are accurate and valid before transferring them into Receivables.

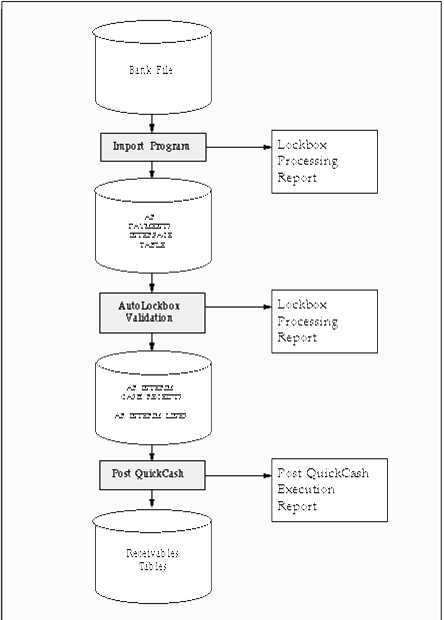

AutoLockbox is a three step process:

1. Submit Import: During this step, Lockbox reads and formats the data from your bank file into AutoLockbox tables using an SQL *Loader script.

2. Submit Validation: The validation program checks data in the AutoLockbox tables for compatibility with Receivables. Once validated, the data is transferred into QuickCash tables. At this point, you can optionally query your receipts in the QuickCash window and change how they will be applied before submitting the final step, Post QuickCash.

3. Submit Post QuickCash: This step applies the receipts and updates your customer's balances. See: Post QuickCash.<http://docs.oracle.com/cd/A60725_05/html/comnls/us/ar/quickc01.htm#n_pqukcsh>

These steps can be submitted individually or at the same time from the submit Lockbox Processing window. After you run Post QuickCash, Receivables treats the receipts like any other receipts; you can reverse and reapply them and apply any unapplied, unidentified, or on-account amounts.

The following diagram shows how receipt data from your bank file is imported into Receivables tables.

Remittances

* Standard Remittances: For automatic receipts, you remit receipts to your bank so the bank can transfer funds from the customer's account to your account on the receipt maturity date. For manual receipts, the bank credits your account when the customer's check clears.

* Factored Remittances: Remit receipts to your bank so the bank can lend you money against the receipts either before the maturity date (for automatic receipts) or before clearing (for manual receipts). After clearing factored receipts, Receivables creates a short term debt for the borrowed amount to track your liability in case of customer default.

Get Flower Effect

Get Flower Effect

No comments:

Post a Comment